Review Article - (2024) Volume 13, Issue 6

Received: 20-Jul-2022, Manuscript No. JAMK-22-69742;

Editor assigned: 25-Jul-2022, Pre QC No. JAMK-22-69742(PQ);

Reviewed: 09-Aug-2022, QC No. JAMK-22-69742;

Revised: 19-Sep-2022, Manuscript No. JAMK-22-69742(R);

Published:

29-Nov-2022

, DOI: 10.37421/2168-9601.2022.11.389

Citation: Dress, Tilahun Simegnew. "The Determinants of

Financial Stability of Commercial Banks: Empirical Evidence from Ethiopia." J

Acc Mark 11 (2022): 389.

Copyright: © 2024 Dress TS. This is an open-access article distributed under the terms of the creative commons attribution license which permits unrestricted

use, distribution and reproduction in any medium, provided the original author and source are credited.

This study was conducted to investigate the determinants of commercial banks’ financial stability in Ethiopia for ten consecutive years (2009-2018). The target population of this study was the total number of commercial banks in Ethiopia, of which one is a state-owned bank and the rest are private banks. Data were collected from the audited financial statements of nine sample commercial banks selected by using purposive sampling. The balanced panel data and quantitative research approach were used for data analysis. Results are estimated by using multiple regression models. The empirical results revealed that there is a statistically significant and positive relationship between the financial stability of banks and bank size, capital adequacy ratio, and liquidity. On the other hand, operating cost was found to have a statistically significant and negative relationship with the financial stability of banks. The study also revealed that inflation had a negative and statistically insignificant relationship with the financial stability of banks. Finally, the deposit interest rate was found to have a positive and statistically insignificant relationship with the financial stability of commercial banks in Ethiopia. Therefore, this study recommended that banks, investors, regulators, and policymakers should give more attention to bank size, capital adequacy ratio, liquidity, and operating costs to maintain the financial stability of commercial banks in Ethiopia.

Financial stability • Commercial banks • Determinants • Ethiopia

A stable and sound banking system is essential to achieve efficiency in financial intermediation of channeling surplus funds for investments through the provision of credits by banks and other financial institutions [1]. To maintain stability, banks and other financial institutions must strike a balance between having adequate capital and the creation of credit assets [2]. However, the activity of credit creation by banks exposes them to liquidity problems and default risks that could affect profitability and the stability of the entire banking system. To tackle the liquidity and credit risk, strict regulatory standards such as higher capital adequacy requirements were introduced in a bid to achieve a more stable banking system following the 2007-2009 world financial crisis [3]. Higher bank capital is required as a result of the belief that banks with stronger capital bases are more capable of withstanding financial distress and invariably boost the financial system's stability [4].

Currently, bank stability has been getting a serious attention by central banks and international financial institutions. The International Monetary Fund (IMF) issues international reports on financial stability and intensified efforts to define a clear concept of the term that goes beyond the simple concept of no crisis. The financial system is considered as stable if it facilitates the efficiency of economic resources along with other financial operations such as savings, investment, lending, borrowing, liquidity creation, distribution, financial risk assessment, pricing, identification and management, and the ability to perform these basic functions. Moreover, the analysis of financial stability should not be limited to considering only possible disturbances, but also the degree to which the financial system is absorbed [5]. Various factors that can mitigate or absorb the shock must be taken into account. These include the size of capital reserves, the reliability of insurance facilities, the adequacy of firewalls, safety nets, and alternative systems.

A safe and sound banking system avoids banking system crises and their associated adverse feedback effects on the real economy [6]. A dysfunctional financial industry puts pressure on businesses and households thereby adversely affecting the real economy as capital may be prevented from flowing to worthy investments and may lead to credit crunches. To ensure that the financial industry remains sound to perform its financial intermediation role, individual financial institutions in the industry must implement relevant strategies that would ensure their financial stability [7].

To promote a safe and stable banking system, the National Bank of Ethiopia (NBE) has increased the minimum capital requirement for commercial banks to five billion Birr. Commercial banks in business have four years to increase their paid-up capital to five billion Birr.

Banks under formation that have already raised equity of over 500 million Birr from the public are required to comply in seven years. The cut date for the minimum capital requirement is set for June 30, 2026 (NBE Directive No. SBB/78/2021). Despite the existence of various challenges in recent years, such as the COVID 19 pandemic, conflicts, and high inflation, which have been affecting the Ethiopian economy, the National bank of Ethiopia's policy reduced the impact of these challenges on the financial stability of banks.

The Ethiopian financial system is shallow and less developed than those of its peer countries in the region. For example, relative to GDP, Kenya’s financial sector is almost twice the size of that of Ethiopia. This difference is mainly due to the virtual absence of nonbank financial institutions in Ethiopia. Also, the role of government in the banking sector is completely different. While in Kenya less than 5 percent of all banking assets are controlled by government ownership, in Ethiopia state owned banks comprise 2/3 of the banking system's total assets (WB, 2019). Competition is limited, as shown by the high concentration ratio, spread between lending and deposit rates, barriers to entry and exit, and lack of a non-banking financial sector. According to the National Bank of Ethiopia's (2018) annual report, Ethiopian banks' were faced with liquidity risk and operational risks more severely than other types of risks.

In recent years, central banks and researchers have been giving more attention to monitoring the risks of global financial instability.

Some central banks rely on macroeconomic data, while others rely on a wide range of financial institutions [8]. Numerous prior empirical studies have identified various factors that affect the financial stability of commercial banks. The factors that are identified to affect financial stability are political instability, exchange rate, non-performing loan, capital adequacy ratio, inflation, low GDP growth, liquidity risk, return on asset, high unemployment rates, and return on equity [9-12].

However, most of these empirical studies were conducted in developed countries. Furthermore, there are no unanimous findings among these studies.

In Ethiopia, many empirical studies have been conducted on determinants of bank profitability, liquidity non-performance loan and financial structure [13]. However, previous empirical studies ignored bank stability and soundness in Ethiopia. Determinants of banks' financial stability in Ethiopia are still an unexplored area.

Therefore, the overall objective of this study is to fill both the theoretical and practical gap by examining important determinants of the financial stability of commercial banks in Ethiopia. Specifically, the study examined the effects of selected explanatory variables (bank size, capital adequacy ratio, deposit interest rate, inflation, liquidity, and operating costs) on the dependent variable (financial stability of banks).

The study investigated the determinants of financial stability of Commercial banks in Ethiopia. Therefore, this study is expected to have a great benefits for bank regulators (such as NBE), policymakers, standard setters, investors, and researchers. It enables regulators, standard setters, and policymakers to strengthen and evaluate the financial system's stability and soundness. It will also help investors to assess and evaluate the stability of the banking system before they make an investment decision. Finally, it will also provide additional scientific studies and provide new research ideas about bank stability for researchers.

In the existing financial system, central banks and monetary authorities focused on financial stability and maintaining financial system safety. The problem of bank financial stability has become a key to global social and economic development [14]. Numerous prior empirical studies investigated the determinants of the financial stability of commercial banks. Geršl and Hermanek examined the different indicators of financial stability suggested by the International Monetary Fund. They argue in favour of developing an aggregate financial stability indicator and argued that an aggregate financial stability indicator could help frame a more appropriate framework for measuring financial stability and better operationalization of the concept of financial stability.

Klomp and de Haan examined the relationship between the independence of the central bank and the financial stability for 60 developed and developing countries during the period (1985-2005).

The results show a strong correlation between monetary policy and financial stability. There is an inverse relationship between financial stability, inflation rate, deposit interest rate, money supply growth rate of the previous year, and the annual change in the value of the national currency. Nevertheless, there is a strong positive correlation between financial stability and government instability, targeted exchange rate strategy, target inflation strategy, and the independence of the central bank. The study also shows that with the independence of the central bank, its ability to prepare quickly to prevent disturbances in the financial system is increasing.

Kasri and Azzahra analyzed the determinant of banks’ stability in Indonesia during September 2015-June 2019 period. The data is subsequently analyzed by employing a dynamic panel data model.

The results show that the main factors that positively influenced banks' stability in Indonesia are exchange rate, financial inclusion, asset returns, and credit/financing growth. However, interest rates are found to be negatively influenced stability.

Singh investigated bank-specific, industry-specific, macroeconomic, and institutional determinants of bank stability for the Nepalese banking industry covering the period from 2004-to 2018. The results suggested that credit growth has a negative impact whereas income diversification appears to have a positive impact on the stability of the banks. The results of the study support the concentration stability hypothesis. Findings disclose that inflation is playing a crucial role in impacting the stability of the banks. The study reveals that the GFC had no significant impact on the stability of the Nepalese banking industry.

Pham, Dao, and Nguyen conducted a study to investigate the determinants of commercial banks' stability listed in Vietnam’s Stock Exchanges by using the Generalized Method of Moments (GMM) regression technique. Results demonstrate that the equity to asset ratio, bank size, loans to assets ratio, revenue diversification, and macroeconomic factors have a positive effect on the stability of the bank. Total assets-based foreign investment also correlates positively with a bank's stability. Finally, the market share of mobilized capital, loan loss provisions, and market structure was found to harm banks' stability. Alshubiri examined the factors that affect financial banking stability measured by Z-score in MSM of Oman over the period 2008 to 2014. The study found that income diversity, size of the bank, P/E ratio, inflation, gross demotic product growth, size of government, and regulation have a significant effect on bank stability.

Sifrain investigated the factors of the banking stability in Haiti, from 1996 to 2017, using macroeconomic, government and institutions, banking system, and economic freedom factors measured respectively by GDP growth and exchange rate, political stability index and regulatory quality index, bank lending-deposit interest rate spread, property rights index and investment freedom index. The study found that GDP growth, exchange rate, political stability index, regulatory quality index, bank lending deposit interest rate spread, property rights index, and investment freedom index have significant effects on Haitian banking stability.

Ozili investigated the determinants of banking stability in Africa by using four measures of banking stability (embedding banks’ loan loss coverage ratio, insolvency risk, asset quality ratio, and level of financial development). The findings indicate that banking efficiency, foreign bank presence, banking concentration, size of the banking sector, government effectiveness, political stability, regulatory quality, investor protection, corruption control, and unemployment levels are significant determinants of banking stability in Africa and the significance of each determinant depends on

• The banking stability proxy employed.

• Depends on the period of analysis: Pre-crisis, during-crisis or post-crisis.

Ozili also investigated the determinants of banking stability in nigeria. Banking stability is crucial for economic growth and financial development. The findings reveal that bank efficiency, the size of nonperforming loans, regulatory capital ratios, greater financial depth, and banking concentration are significant determinants of banking stability in nigeria.

Al Salamat and Al-Kharouf examined the determinants of financial stability for 13 commercial banks listed on the Amman Stock Exchange (ASE) over the period (2007-2016) by using panel data statistical approach and multiple regression models. The empirical results suggested that there is a statistically significant negative effect of the inflation rate and debt ratio on capital adequacy while there is a statistically significant positive effect of growth in the gross domestic product on capital adequacy. In contrast, there is a statistically significant negative effect of return on equity and growth in the gross domestic product on the non-performing loans while there is a statistically significant positive effect of inflation rate on nonperforming loans. Finally, there is a statistically significant negative effect of growth in the gross domestic product on the number of returned checks while there is a statistically significant positive effect of inflation rate on the number of returned checks.

Githinji investigated internal and external factors that influence the financial stability of commercial banks in Kenya. The finding showed that commercial banks operating costs, the size of the bank, board size, capital size, Sound Interest rate policy, inflation rates, interest rate spread, exchange rates, and GDP growth influenced commercial bank financial stability. Similarly, Ngaira and Miroga conducted a study to establish the determinants of financial stability of listed commercial banks in kenya by using a descriptive survey research design. The study found that bank size, liquidity, and interest rate had a significant positive influence and operational cost had a significant negative influence on the financial stability of listed commercial banks in kenya.

Research approach and design

To conform to the objective of this research, an explanatory research design was used to examine the relationship between banks’ financial stability and selected explanatory variables. The explanatory type of research design helps to identify and evaluate the causal relationships between the different variables under consideration. In addition, a quantitative research approach was used to test objective theories by examining the relationship among variables. These variables, in turn, can be measured, typically on instruments, so that numbered data can be analyzed using statistical procedures.

Nature and sources of data

Data required for undertaking the study has been collected from secondary sources. The secondary data have been collected from the audited financial statements of sample commercial banks in Ethiopia for ten consecutive years (2009-2018).

Sampling design

The population of this study is the total number of commercial banks registered by the National Bank of Ethiopia (NBE). There are 17 commercial banks in Ethiopia. Out of the seventeen commercial banks, the researcher selected nine banks that conforms to the criteria set by the researcher (age and audited financial statements) as a sample; these are; commercial bank of ethiopia, awash international bank, bank of abyssinia, buna international bank, dashen bank, nib international bank, oromia cooperative bank, united bank, and wegagen bank.

Data analysis and presentation

This study utilized both descriptive and inferential statistics based on panel data from 2009-2018 to examine the relationship between financial stability and its determinant factors in commercial banks of Ethiopia. The financial statements of sampled private banks were analyzed using a panel data model. Regression analysis and correlation analysis were used to test research hypotheses and to examine the nature and the strength of the relationship among the variables. A linear multivariate regression model was used to measure the relationship between the independent variables and the dependent variable which are explained in the model. Quantitative data obtained from the audited financial statements of sample commercial banks were analyzed using STATA 14.

Variables and hypothesis

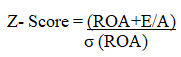

Dependent variable: This study used bank stability as a dependent variable. The Z-score is the most commonly used in the empirical banking literature to estimate a bank’s probability of insolvency. This is one of the indicators used by the World Bank in the global finance development database to measure financial stability. Bank Z-scores captures the probability of default of a country's baking system. The z-score compares the buffer of a country’s banking system, i.e. capitalization and returns, with the volatility of those returns. A high value of Z-Score indicates a low probability of banking sector failure and a high degree of banking stability/soundness while a low value implies otherwise. It is defined as:

Where: ROA is the rate of return on assets, E/A is the ratio of equity to assets, and σ (ROA) is an estimate of the standard deviation of the rate of return on assets. The basic principle of the Z-score measure indicates how much variability in returns can be absorbed by capital without the banking system becoming insolvent.

Independent variables

Bank size: Firm size is considered as one of the key factors that affect the financial stability of banks. This study used the natural logarithm of total assets as a proxy for bank size. Large firms have more negotiating powers leading to lower financing costs on average which in turn improves their overall stability in the market [15]. In principle, large firms can hedge and diversify risks more in comparison to smaller firms. This, in turn, influences the company's ability to exploit varied methods of diversifying that in turn influence long-term survival. Hence, the effect of bank size on bank stability is expected as follows:

Hypothesis 1: Bank size has a significant and positive effect on the financial stability of commercial banks.

Capital adequacy ratio

Capital Adequacy Ratio (CAR) of commercial banks is a measure of capital adequacy based on the ratio between equity capital and total risk weighted assets of a bank. It reflects the amount of risk capital that banks have to keep for the risks they take. Higher capital requirements ensure that banks have sufficient capital to absorb unexpected losses when losses materialize [16]. Thus, the higher the capital requirement the higher the risk capital banks are required to set aside to meet losses that arise from their excessive risk taking activities, which subsequently improves bank stability [17]. Higher regulatory capital ratios lead to greater safety and lead to greater banking stability for the banking sector. Hence, the researcher formulated the following hypothesis.

Hypothesis 2: The capital adequacy ratio has a significant and positive effect on the financial stability of commercial banks.

Deposit interest rate

Deposit rate refers to the amount of money paid out in interest by a bank or financial institution on cash deposits. Banks pay deposit rates on savings and other investment accounts. The deposit interest rate is paid by financial institutions to deposit account holders.

Charging a high deposit rate has multiple impacts on credit risk and bank stability [18]. Offering a high deposit rate encourages depositors or improves the level of deposit mobilization directly influences the lending rate. A higher lending rate in turn creates an excess loanable fund. The deposited money should not be kept idle since the deposit is not free of cost. As a result, it enforces the bank to increase its lending volume and thus credit risk and bank instability [19]. Thus, the following hypothesis is formulated.

Hypothesis 3: Deposit interest rate has a significant and negative effect on a bank’s financial stability.

Inflation rate

Annual inflation rate is considered as one of the macroeconomic factors influencing banking sector stability. High inflation rates lead to a situation where consumers find themselves in a position of low purchasing power [20]. During periods of high inflation, consumers tend to use most of their money for consumption. This diverts the amount of money to be invested to consumption. Such a situation, therefore, reduces the amount of money being deposited in commercial banks as savings by the consumers and this, in turn, reduces their cash reserves as well as their ability to issue loans to borrowers. This in turn negatively affects commercial banks' profitability and financial stability.

Hypothesis 4: Inflation rate has a negative and significant effect on banking sector stability.

Liquidity

Liquidity is another factor that determines the level of bank financial stability. Liquidity refers to the ability of the bank to pay its current liabilities by using current assets. Liquidity risk is the possibility that over a specific period, the bank will become unable to settle obligations with immediacy. Dang found that an adequate level of liquidity is positively related to bank profitability This risk can adversely affect both banks’ earnings and the capital and therefore, it becomes the top priority of a bank’s management to ensure the availability of sufficient funds to meet future demands of providers and borrowers, at reasonable costs. The vulnerability of banks to liquidity risk is determined by the funding risk and the market risk. Thus, it is hypothesized as follows:

Hypothesis 5: Liquidity has a significant and positive effect on bank stability.

Operating costs

Higher operating costs reduces bank’s operating income. It is important to note that due to competition and market regulations, a bank that is faced with the high cost of operations cannot pass the whole burden to the customers through increasing the bank charges and therefore this means that the bank has to shoulder it. Increased costs affect the left side of the profit and loss statement and this means that the profits realized will be lower than in a case where the costs of operations are lower. The operating costs of a bank are normally expressed as a percentage of the profits and they are normally expected to influence the financial performance of the bank in a negative manner.

Hypothesis 6: Operating cost has a significant and negative effect on bank stability.

Model specification

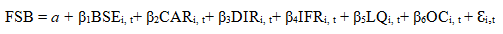

This study aimed to investigate the determinants of bank stability in commercial banks of Ethiopia. The study used the financial stability of banks as the dependent variable and bank size, capital adequacy ratio, deposit interest rate, inflation rate, liquidity, and operating costs as independent variables. A linear multivariate regression model was used to measure the relationship between the dependent variable and the independent variables. The regression model helped to explain the magnitude and direction of the relationship between the variables of the study through the use of coefficients like the correlation, coefficient of determination, and the level of significance. The regression model was developed as follows:

Where:

FSB=Financial stability of banks

BSE=Bank size

CAR=Capital adequacy ratio D

IR=Deposit interest rate

IFR=Annual inflation rate

LQ=Liquidity

OC=Operating cost

a=constant term while the coefficienβt1s toβ 8 are used to measure the sensitivity of the dependent variable (bank stability) to a unit change in the explanatory variableℇs.i is the error term that captures the unexplained variations in the model.

This section presents the empirical results about determinants of financial stability in commercial banks of Ethiopia. It presents and discusses descriptive analysis, correlation analysis, and the results of the random effect regression analysis.

Descriptive analysis

Table 1 below shows the descriptive statistics of the research variables. In this research, nine commercial banks were selected as a sample of which one is a state owned commercial bank, and eight are private commercial banks in Ethiopia. The results indicate that during the study period, commercial banks in Ethiopia had a mean Zscore index of 26.26 with 199.77 maximum values and 0.3786 minimum values. Based on the Altman’s zones of discrimination (Z>2.6, “Safe” zone, 1.1<Z<2.6, “grey” zone, Z<1.1, “financial instability” zone. In this case, commercial banks in Ethiopia are in the 'save zone’, as indicated by a mean Z-score of 8.31 indicating that there is less probability that the bank will face financial instability shortly. The corresponding standard deviation of 50.24 indicates a higher variability of financial stability levels of the commercial banks under study.

| Variable | Obs | Mean Std. | Dev. | Min | Max |

|---|---|---|---|---|---|

| FSB | 90 | 26.25873 | 50.23767 | 0.378616 | 199.7731 |

| BSE | 90 | 23.3944 | 1.649806 | 19.71266 | 32.70808 |

| CAR | 90 | 1.000652 | 2.716504 | 4.58 E-05 | 15.55492 |

| DIR | 90 | 7.144444 | 0.227893 | 7 | 7.5 |

| IFR | 90 | 0.12706 | 0.080375 | 0.0663 | 0.3201 |

| LQ | 90 | 1.476001 | 0.295429 | 1.099559 | 2.929858 |

| OC | 90 | 1380.423 | 3347.428 | 3.601 | 21680.16 |

Source: Own computation using STATA 14 (2022)

Pearson correlation analysis

Correlation measures the strength and degree of linear association between variables. In this study, the dependent variable is the financial stability of commercial banks and the explanatory variables are bank size, capital adequacy ratio, deposit interest rate, annual inflation rate, liquidity, and operating costs. Table 2 presented the results of the Pearson correlations matrix between variables.

| FSB | BSE | CAR | DIR | IFR | LQ | OC | |

|---|---|---|---|---|---|---|---|

| FSB | 1 | ||||||

| BSE | 0.7201 | 1 | |||||

| CAR | 0.9173 | 0.6845 | 1 | ||||

| DIR | 0.2747 | 0.3698 | 0.2393 | 1 | |||

| IFR | -0.0449 | -0.0991 | -0.03 | -0.1323 | 1 | ||

| LQ | 0.1847 | -0.1679 | 0.1046 | -0.1778 | 0.0572 | 1 | |

| OC | 0.7201 | 0.6532 | 0.437 | 0.3554 | -0.0754 | -0.0345 | 1 |

The correlation matrix shows that bank size, capital adequacy ratio, deposit interest rate, liquidity, and operating costs have a positive relationship with bank stability/soundness while the annual inflation rate has a negative relationship with the financial stability of banks. This means that the financial stability of banks moves in the same direction with bank size, capital adequacy ratio, deposit interest rate, liquidity, and operating costs However, it moves in the opposite direction with the annual inflation rate. As shown in Table 2 above, the highest correlation (0.9173) was obtained between the capital adequacy ratio and bank stability. The annual inflation rate (-0.0449) has the lowest correlation with the financial stability of banks.

Regression analysis

Final data for regression were run using the random effect panel regression model, and a summary of the result of this model is presented below in Table 3. The regression result of the random effect model revealed that the coefficient of determination (Rsquared) has 0.885 which implies that around 88% change in bank stability is explained by the joint change in the selected explanatory variables. The remaining 12% changes in bank stability were caused by other factors that were not included in the model. This indicates that the model is almost more than an average fit the data from sampled companies. Pro (F-statistics) of 0.000 indicates that the model fits the sample data well and the explanatory variables are jointly significant. Therefore, the model is good and can be used to draw significant suggestions (Table 3).

| FSB | Coef. | St.Err. | t-value | p-value | 95% Conf | Interval | Sig |

|---|---|---|---|---|---|---|---|

| BSE | 7.256 | 1.709 | 4.24 | 0 | 3.856 | 10.655 | *** |

| CAR | 15.759 | 1.383 | 11.4 | 0 | 13.009 | 18.509 | *** |

| DIR | 13.686 | 9.175 | 1.49 | 0.14 | -4.562 | 31.934 | |

| IFR | -4.558 | 23.56 | -0.19 | 0.847 | -51.417 | 42.302 | |

| LQ | 24.089 | 6.854 | 3.51 | 0.001 | 10.456 | 37.722 | *** |

| OC | -0.002 | 0.001 | -2.22 | 0.029 | -0.004 | 0 | ** |

| Constant | -288.794 | 72.499 | -3.98 | 0 | -432.991 | -144.597 | *** |

| Mean dependent var | 26.259 | SD dependent var | 50.238 | ||||

| R-squared | 0.885 | Number of obs | 90 | ||||

| F-test | 106.478 | Prob>F | 0 | ||||

| Akaike crit. (AIC) | 778.751 | Bayesian crit. (BIC) | 796.25 | ||||

*** p<0.01, ** p<0.05, * p<0.1; Source: Own computation using STATA 14 (2022).

According to the random effect regression result, bank size had a positive and significant relationship (β=7.256 and p value=0.000) with bank financial stability. This implies that large banks may correlate with greater banking stability. Large firms have more negotiating powers leading to lower financing costs on average which in turn improves their overall stability in the market. In essence, large firms can hedge and diversify risks more in comparison to smaller firms. The result is in line with the researcher's prior expectations.

The regression result revealed that the capital adequacy ratio had a positive and significant relationship (β=15.759 and p value=0.000) with bank stability. This indicates that a higher capital adequacy ratio leads to greater safety and banking stability. The finding is consistent with prior expectations and prior empirical studies.

The study also found that the deposit interest rate had a positive but insignificant effect on banks ‘financial stability (with β=13.686 and p value=0.14). Offering a high deposit rate encourage depositors or improve the level of deposit mobilization which increases the amount of loanable fund and hence more interest income. But, in this study, the deposit interest rate was found not to be a major factor in the financial stability of commercial banks in Ethiopia. This result is not in line with the suggested hypothesis.

The annual inflation rate was found to have a negative but insignificant relationship with bank stability at a 5% significance level (with β=-4.558 and p value=0.847). Higher inflation negatively affects bank stability in Ethiopia. But, its effect is not significant. Low inflation will increase the purchasing power of money and bank customers will increase spending which would generate additional cash flow for banks and improve banks' liquidity and their ability to absorb future losses; thus, banks would be more stable during periods of low inflation. However, the finding is not in line with the suggested hypothesis.

The result in Table 3 above revealed that liquidity had a positive (β=24.089) and significant (p value=0.001) relationship with bank financial stability. Banks that have an adequate level of liquidity are more stable financially. On the other hand, liquidity risk adversely affects both banks’ earnings and stability. Hence, liquidity becomes the top priority of a bank’s management to ensure the availability of sufficient funds to meet future demands of providers and borrowers, at reasonable costs. This finding is in line with the suggested hypothesis.

The random effect regression result indicates that operating costs had a negative and significant relationship (β=-0.002 and pvalue= 0.029) with the financial stability of commercial banks in Ethiopia. Firms that can minimize their costs of operations are considered to be more effective, and it is additionally anticipated that they uncover higher benefit edges than their accomplices that have higher costs of operations. This finding is in line with the suggested hypothesis.

The main objective of this study is to investigate the determinants of financial stability in commercial banks of Ethiopia for ten consecutive years (2009-2018). The study examined the relationship between the dependent variable (financial stability of banks) and the selected explanatory variables (bank size, capital adequacy ratio, deposit interest rate, inflation rate, liquidity, and operating costs). This study adopted an explanatory research design and random effect regression results to analyze the relationship between bank stability and its determinants. The population of this study included 17 commercial banks in Ethiopia. Nine commercial banks were selected as a sample by using purposive sampling.

The study found that bank size, capital adequacy ratio, and liquidity had a positive and significant relationship with bank stability in Ethiopia. On the other hand, the operating cost had a negative and significant relationship with bank stability. Inflation was found to have a negative but insignificant relationship with bank stability. The deposit interest rate was found to have a positive and insignificant relationship with the financial stability of commercial banks.

Therefore, it can be concluded that bank size, capital adequacy ratio, liquidity, and operating costs were the major determinants of financial stability in commercial banks of Ethiopia. However, deposit interest rates and inflation were not important factors that affect the financial stability of commercial banks in Ethiopia.

The findings of the study are deemed to benefit different bodies such as commercial banks, investors, regulators, academicians, and policymakers in the country. Therefore, based on the major findings of the study, this research suggests the following recommendations to commercial banks, investors, regulators, policymakers, and academicians.

The study found that bank size, capital adequacy ratio, liquidity, and operating costs were the major determinants of bank stability.

Therefore, commercial banks are recommended to provide a special emphasis on these factors to maintain their financial stability.

Commercial banks should improve their liquidity position, capital adequacy ratio and reduce operating costs.

The regulators and policymakers, such as NBE, are recommended to formulate sound policies regarding capital adequacy to assist commercial banks to maintain financial stability. The study also recommended that future academicians further investigate the determinants of bank stability in Ethiopia.

First of all, I would like to express my deepest gratitude to the Almighty God for his endless help in giving me health, strength, good spirit and help in all situations for the success of my life, my career and accomplishment of this research. Next, I would like to express my deepest gratitude to Beza Damtie (PhD), Nestanet Belay (MSC) and Minibel Endeshaw (MSC) for their expert guidance, encouragement, valuable suggestions and professional and constructive comments from the beginning to the completion of this research paper.

I would also like to extend my gratitude to officials of the National Bank of Ethiopia and private banks for providing me the relevant data for my study. Special thanks go to all my parents and friends for their moral and spiritual support.

Accounting & Marketing received 487 citations as per Google Scholar report