Research Article - (2023) Volume 14, Issue 6

Received: 05-Nov-2023, Manuscript No. bej-23-32433;

Editor assigned: 07-Nov-2023, Pre QC No. P-32433;

Reviewed: 20-Nov-2023, QC No. Q-32433;

Revised: 25-Nov-2023, Manuscript No. R-32433;

Published:

30-Nov-2023

, DOI: 10.37421/2151-6219.2023.14.468

Citation: Cookey, Boma. "Globalization and the

Manufacturing Sector in Nigeria." Bus Econ J 14 (2023): 468.

Copyright: © 2023 Cookey B. This is an open-access article distributed under the terms of the creative commons attribution license which permits unrestricted

use, distribution and reproduction in any medium, provided the original author and source are credited.

One of the arguments for the globalization is that it will efficient allocate resources in the world scale and especially make available capital and technology to the developing economies for industrialization and ultimately socio-economic development in the developing countries. Hence, the study took as its objective to examines the relationship between globalization and manufacturing sector development in Nigerian economy. To achieve this, the study adopted the ex-post experimental research design approach and annual time series data from 19986 to 2019. Overall globalization index, economic globalization index, trade openness and foreign direct investment were used as globalization variables, while Nigerian manufacturing sector output contribution to GDP served as proxy and indicator of manufacturing sector development. The analytical method followed the Paseran, Shin and Smith ARDL approach. The unit root test shows that all the variables, apart from FDI are integrated of order 1, that is, I(1) series, while FDI is I(0). Bound cointegration test revealed that there is a stable long run relationship among the variables. Estimate of the ARDL model shows that overall globalization, economic globalization, trade openness and exchange rate variations had negative and significant impact on manufacturing output growth in the long run. FDI had positive, but insignificant effect on manufacturing sector development in Nigerian economy during the period under review. Based on these findings, the study, therefore recommended that, the government should adopt proactive trade policies to protect and give competitive advantage to the domestic manufacturers in the domestic regional and markets.

Exchange rate • Development globalization • Manufacturing sector • Trade openness

The concept globalization has attracted the attention of many scholars from diverse fields and has been explained differently by these scholars. The globalization phenomenon is a multi-dimensional process which include political, economic, social and cultural dimensions that have been variously explained in different terms and context [1]. Although the political, cultural, social and environmental aspects of globalization are no doubt important, the economic aspect is perceived to be the heart of globalization process and most discussed.

Globalization is the intensification of cross border trade, increased financial flows across border and Foreign Direct Investment (FDI) flows among nations, promoted by rapid advances in trade liberalization and in communication and information technology. It is the process of integrating economic decision making across the world and creating a global market place in which all nations participate. Thus, globalization entails a borderless world or global village with attendant increase in international trade and capital flows among countries of the world. Globalization is therefore the integration of the world economy and it involves the interdependence of nations around the world through borderless transactions and increased financial flows.

Globalization phenomenon, over the years, has been a contentious issue. It has been widely criticized by some and also widely praised by many others, because of its experiences and consequences which varies from country to country. Globalization has influence on industrialization, especially, in developing economies where there is shortage of capital and technology for production of goods and services. Today, as part of the moving trend of globalization Nigeria is a member of and signatory to many multilateral and regional trade agreements such as International Monetary Fund (IMF), World Trade Organization (WTO), Economic Community of West African States (ECOWAS), just to mention a few [2].

Despite all her efforts to meet up with the demands to these economic partnerships in terms of opening up her border, industrialization of the Nigerian economy is still a mirage. Manufacturing sector output contribution to GDP continues to fall annually, as employment share of the sector. It therefore creates doubt as to the contribution globalization to industrialization and the development of the manufacturing sector in Nigeria. Hence the following question quickly comes to mind: Does globalization have any significant impact on manufacturing sector development in Nigeria? This work therefore seeks to investigate the effect of globalization on manufacturing development with special attention to Nigerian economy.

This study will be of immense benefit to all research students and the Nigerian Government. To the government, it will enable them to know globalization is affecting economy is and what policy to implement in other to reap the benefit of globalization. The remaining part of the paper is structure into four sections as follows: Section two (2) is the literature review. Section three (3) presents the empirical methodology, while section four (4) is the presentation of empirical results and discussion of findings. Section five (5) is devoted to the summary and conclusion from the study.

The theoretical and empirical literature reviews of the study are presented in this section. First, we present the theoretical literature followed by the empirical literature.

Theoretical literature

Theoretically, there are two main schools of thought on the argument about the role of globalization and economic growth. The classical economists from Smith to Ricardo advocated the need for free trade and removal of all trade barriers to allow for free flow of goods and services across international geographical boundaries. Their main proposition is that free trade will institutionalize economies of scale, division of labour, along the line of absolute advantage or along the line of comparative advantage and increase output level. In other words, globalization, according to the classical economists, will stimulate productivity and overall growth in the economy and the world at large [3]. The classical economists were mainly concerned with economic growth, the role of the three primary factors of production and their shares in the national income. They came to the conclusion that apart from the important role of these factor of production, the size of the market matters for division of labour, productivity and output growth. Hence, they advocate for free trade encourage growth. Within the context of the globalization, the classical economists are in support of globalization.

The neoclassical economists examined the concept of economic growth from a different perspective. For the neoclassical economists, economic growth results from three main sources. The first source is the increase in quantity and quality of labor. The second source is the increase in accumulation of capital stock and the third is technological. In the long run, increasing capital cannot grow the economy. Any increase in saving rate results in temporary economic growth during the transition period. However, because of the diminishing return, the per capita income grows until the steady state [4]. Once steady state is reached, economic growth becomes zero. To have growth, there must be technological progress.

The sources of the technological progress are the main argument between the exogenous and endogenous strands of the neoclassical growth theorist. The endogenous growth theory, proposed by Romer exerts that technological progress is endogenous. It comes from within, it results from investment and knowledge accumulated in the economy. Technological progress does not suffer from diminishing returns and it has zero marginal cost once it has been produced. What this implies is that it is costless to multiply and more application yield more output. With respect to globalization, the theory emphasis domestic investment in capital goods and R and D to engender technological progress and economic growth beyond the steady state. So, globalization is not important. What matters is investment to drive growth. The theory failed to address the case where there is insufficient domestic savings for invest. In this case, capital and capital goods would have to be imported. The free movement of goods and services and financial assets is now important [5].

The Solow-Swan exogenous model contradicts the Romer model. The argument of the Solow-Swan model is that technological progress arises from research and development activities around the world. Economies that are open will grow faster through interaction with outside world; while closed economy will grow slowly. Thus, close economies impede FDI flows, R and D, technological diffusion and adoption. This will retard growth and underdeveloped economy. Therefore, opening up the economy for the flow of FDI, good and services will accelerate growth and development in the developing countries. The theory gives significant importance trade liberalization and the globalization mantra as a strategy for development of the less developed countries [6].

Empirical literature

There is a plethora of empirical literature on the effect of globalization on manufacturing sector output at the national level using time series data, at the sectoral level and using panel data in cross sections studies. The results of the studies vary in methods and findings. Some of the studies and their findings are summarized in Table 1.

| Author(s)/Year | Unit of analysis | Period | Method | globalization variables used | Results |

|---|---|---|---|---|---|

| Offori-Atta (2017) | Ghana | 1985-2013 | Ordinary Least Squares (OLS) regression | FDI | Globalization had negative effect on ghanaian manufacturing sector |

| Erumebor (2018) | Nigeria | 1986-2010 | Ordinary Least Squares (OLS) regression | Trade openness and exchange rat | Globalization has also had negative effects on Nigeria’s industrial sector development |

| Odebode and Aras (2019) | Nigeria | 2010Q1- 2018Q4 | Structural Vector Autoregressive (SVAR | Trade openness and exchange rate | Manufacturing output reacted negatively to trade openness and exchange rate fluctuations |

| Giray et al. (2019) | 92 developing economies | 2000-2016 | Panel data approach | FDI, Trade openness, exchange rate | Globalization had a negative impact on economic growth in developing countries. |

| Olaniyi, Sakariyahu, and Ariyo (2016) | Nigeria | 1980-2014 | OLS method | Exchange rate and trade openness | Globalization has a positive impact on the performance of the Nigerian capital market |

| Nyeche and Ekine (2018) | Nigeria | 1985-2016 | ARDL | Trade openness exchange rate and FDI | Trade openness and exchange rates had negative effect on GDP while FDI and exert insignificant influence on GDP |

| Bakare et al. (2020) | Nigeria | 1981-2017 | Vector Error Correction Model (VECM) regression techniques | Trade openness index | Trade openness caused increase in the manufacturing output in Nigeria |

| Odebodeeta (2019) | Nigeria | 2010-2018 | Structural Vector Autoregressive (SVAR | Exchange rate and FDI | Manufacturing output reacted negatively to exchange rate fluctuations. |

| Ali, Obayori and Obayori (2018) | Nigeria | 1980-2016 | Error Correction Model (ECM) analysis techniques | Trade openness index and exchange rate | The result shows that there is a short-run and long-run casual effect between globalization and manufacturing growth in Nigeria |

| Jonathan et al. (2015) | Nigeria | 1980-2013 | Vector Auto Regression (VAR) model | Trade openness, foreign direct investment, exchange rate | The result shows that globalization had positive and significant impact on manufacturing sector output |

| Chibuzo (2015) | Nigeria | 1982-2015 | ECM | Trade openness, foreign direct investment, exchange rate | Trade had openness had positive impact on manufacturing output growth. While exchange rate had negative impact |

| Oscar and Simon (1994) | Spain | 1975-1993 | ARDL | FDI | FDI positively affect GDP |

Table 1. Empirical literature review summary.

It is noteworthy that the results from the empirical literature are, however, mixed. There is no consensus of the effect of globalization on manufacturing sector, both for Nigeria and other countries.

This section of the study explains the method employed for the collection and analysis of the study data. It lays out the plan of the study and the empirical strategy [7]. Specifically, the section is divided into three sub headings as follows.

Model specification

The analytical framework of the study is based on the Solow-Swan model in which economic growth results from factors outside the economy. It proposes that economic growth is primarily determined external and independent forces. Therefore, playing on the world stage would afford a country the growth factors. The model is derived from conventional Cobb-Douglass production function in which foreign resources is introduced as an input in addition to labor and domestic capital. In the usual notation the production function can be written as follow:

Where, K is capital formation, L is labour force and A is the solow residual or Total Factor Productivity (TFP). α and β are output elasticity with respect to capital and labour and α+β=1. According to Keller and Yeaple the TFP is a separately additive function of several variables including level of technology, institutional quality, foreign direct investment, foreign aid, trade openness. Hence, we simplify and specify the functional model of globalization-manufacturing sector output growth nexus in Nigeria as:

MVA=f(GI,EG,FDI TOP EXR)

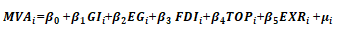

We transform the implicit function above to explicit econometrics model as follows:

Where MVAi is manufacturing sector value added to GDP, GIi is overall globalization index EGi is economic globalization FDIi is foreign direct investment, TOPi is trade openness and EXRi is exchange rate. β0 is a constant β1…β5 are model parameter estimators and μi is a white noise error term (Table 2).

| Variable | Measurement | Sources of data |

|---|---|---|

| Manufacturing Sector Output (MVA) | Manufacturing sector value added to GDP per annum. It is measured in billions of naira | Central bank of Nigeria statistical bulletin (various issues) |

| Globalization index | Composite index of economic, social and political dimensions of globalization | KOF index of globalization (2019) |

| Economic globalization | Composite index of trade flows portfolio investment and level of trade restrictions that applies to a country | KOF index of globalization (2019) |

| Foreign direct investment | FDI inward flow is the value of foreign investors equity in Nigeria and net loans to enterprises in Nigeria it is measured in US dollars | Central bank of Nigeria statistical bulletin (various issues), UNCTAD, OECD |

| Trade openness | Export plus import divided by GDP, it is an index ranging from 1 to 100 | World bank’s World Dev. Indicator (WDI)/CEIC global data base. OECD |

| Exchange rate | The amount of naira given up in exchange for one dollar | Central bank of Nigeria bulletin |

Table 2. survey of globalization.

All data are secondary in nature and were collected from 1990 to2019.

Method of data analysis

The study adopted the Auto-Regressive Distributed Lag (ARDL) regression techniques to developed by Pesaran, Shin and Smith to analyze the data. The ARDL/bound approach has some advantages over the traditional approaches such as the Engle-Ggranger ECM, Johansen and Johansen and Juselius and the Sim VAR/VECM approaches in time series analysis. One advantage of the ARDL/ bound test approach is that it can be applied in case of mixed order of integration, that is order 0 and 1. However, It breaks down in the presence I(2) series. It is efficient in small sample and requires just one equation set up for both long run and the short run. The ARDL/bound test approach does not need separate unit root test apart from guiding against I(2) series in the model. The ARDL regression approach o model analysis has the follows steps.

Unit root test

Maddala observed that time series data are fraught with unit root. Ignoring unit root and running regression with the time series data will lead to spurious regression. Therefore, it is advisable in empirical studies to examine the unit root properties of the data before applying them in regression analysis. The unit root test adopted in the study is the augmented dickey-fuller approach. The ADF has control for serial correlation in the model and performs well asymptotically. However, several studies have established that the ADF has low power in differentiating from unit root and alternatives close to 1. Therefore, a researcher who is interested in examining unit root should conduct more than one test. Based on this advice, the ADF would be complemented by Phillips-Perron test.

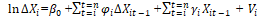

There are tree strands of the test. The study adopts the complete version with constant and trend. The ADF with constant and trend is stated thus:

The hypotheses for test are: H0: ρ=0 Y has unit root and H1; ρ<0 Y has no unit root. The test would be carried out at 0.05 levels of significance.

Co-integration test

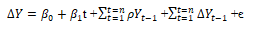

Co-integration is a necessary condition for stationarity among variables that are integrated. Co-integration test is a necessary step for checking if the relationship among the variables can be expressed and estimated as a meaningful empirical model. There are several co-integration analysis techniques. However, the cointegration bound approach technique developed by Pesaran et al. for examining co-integration among variables is the best test approach to examining co-integration among the variables in the model. The afore stated advantages and small sample size of our data, 1990 to 2019, that 29 points, the factors which made ARDL/ bound testing approach the most suitable approach for this study. The ARDL/bound testing model for the study can be specified compactly as follows:

Where ΔX is a vector of the first difference of dependent variables and ΔXit-1 is the lag values of the difference of the dependent variables, i=1…5. ΔXit-1 are the first lag of the independent variables φ short run coefficient; while ɣi are the long run coefficients. Σ is summation and Vi is the error term. The bound test provides information for both the short run and the long-run coefficients of variables in one equation. The bound test F-statistics test, which is generated by wald test, is compared with critical upper and lower bounds of Pesaran, et al. table at 5% probability level. The table provides lower I(0) and upper I(1) critical bounds. The null-hypothesis is rejected if the F-statistic is higher than the upper critical bound at the specified level of significance and it is accepted if the F-statistics is lower than the lower critical bound. The test will be inconclusive if the F-statistics falls between lower and upper critical bound.

Post estimation tests

Testing the basic assumptions of the Ordinary Least Square (OLS) is important in empirical studies. The important assumptions that may affect the estimates include residual distribution, auto correlation and heteroskedasticity. Hence, the following diagnostic test would be conducted. All tests were carried out under 5% probability level. A summary of the proposed tests are presented below in Table 3.

| S/N | Test | Techniques | Maintain hypothesis |

|---|---|---|---|

| 1 | Residual normality | Jacque-Bera (JB) | H0: Estimated residuals have normal distribution |

| 2 | Autocorrelation | Breusch-Godfrey (BG) | H0: There is no auto-correlation among estimated residuals |

| 3 | Heteroskedasticity | ARCH | H0: Estimated residuals have constant variance over time |

| 4 | Model specification error | Ramsey RESET | H0: Empirical model is correctly specified |

Table 3. Proposed diagnostics tests.

This section of the study presents the empirical results and discussed the findings as follows:

Descriptive statistics

Descriptive statistics examines the statistical properties of regression data. It is, always, important to carry out examine the statistical properties of the variables data to see how they behave and detect any statistical problems before applying the data in regression model estimation. The results of the descriptive statistics of the variables in the model are presented in Table 4.

| MVA | GI | EG | FDI | TOP | EXR | |

|---|---|---|---|---|---|---|

| Mean | 5.7852 | 51.4833 | 53.5791 | 2.79E+09 | 54.6080 | 123.2397 |

| Median | 5.3353 | 52.6899 | 55.1066 | 1.92E+09 | 57.9004 | 128.0000 |

| Maximum | 9.7541 | 58.4472 | 81.2571 | 8.02E+09 | 81.8128 | 363.1700 |

| Minimum | 2.4101 | 40.0631 | 26.8555 | -9E+08 | 21.4469 | 9.000100 |

| Std. dev. | 2.5356 | 5.5553 | 13.8299 | 2.21E+09 | 15.0078 | 92.19591 |

| Skewness | 0.3124 | -0.7003 | -0.12184 | 0.850347 | -0.42946 | 0.842241 |

| Kurtosis | 1.7956 | 2.4222 | 2.400164 | 2.806939 | 2.56147 | 3.657732 |

| Jarque-Bera | 2.3013 | 2.8693 | 0.5239 | 3.662043 | 1.16259 | 4.087616 |

| Probability | 0.3164 | 0.2381 | 0.7695 | 0.160250 | 0.55917 | 0.129535 |

| Sum | 173.55 | 1544.5 | 1607.374 | 8.38E+10 | 1638.24 | 3697.192 |

| Sum sq. dev. | 186.45 | 894.99 | 5546.738 | 1.41E+20 | 6531.82 | 246502.5 |

| Observations | 30 | 30 | 30 | 30 | 30 | 30 |

Table 4. Descriptive statistics of variables in the model.

From the Table 4, there are thirty (30) observations. The manufacturing sector contribution to GDP had a mean of 5.78% during the period under review. The maximum value was 9.75%. While the minimum value during the same period was 5.33%. The maximum value of overall globalization index was 51.48 and the minimum value was 40.06. The average value during the period was 51.58. Economic globalization index had an average of 53.57. It was higher than the overall globalization index. The maximum and minimum values are 81.25 and 26.85 respectively. FDI had an average of 2.79E+09 as a ratio of the GDP between 1985 and 2019. The maximum and minimum values are 8.02E+9 and -8.97E+08. Trade openness and foreign exchange rate had maximum value of 81.81 and 363.17 respectively. The minimum values for both variables are 21.44 and 9.00 respectively.

The skewness value for all the variables are not much different from zero. It could be taken that they have central spread. The kurtosis values for MVA, GI, EG, FDI and TOP are less than 3.000. Thus, these variables have platykurtic distribution.

The peak of their distribution is flatter than the normal curve. The kurtosis value for EXR is 3.6577. It has leptokurtic distribution. This implies that it has more pointed peak than the normally distributed curve. The Jacque-Bera statistics for all the variables are insignificant. this evidence from their probability values which is greater 0.05. hence, all the variables have normal distribution.

Correlation matrix: Multicollinearity test

The correlation matrix is shown in Table 5. The correlation matrix is mainly used for examining the pairwise correlation coefficient among variables in multiple regression model. If the pairwise correlation coefficient between any pair of variables is greater than 0.9, then the inclusion of these variables in the model would give rise to the problem of multicollinearity in the model. Otherwise, there is no reason to suspect multicollinearity in the model (Table 5).

| MVA | GI | EG | FDI | TOP | EXR | |

|---|---|---|---|---|---|---|

| MVA | 1.000000 | |||||

| GI | 0.335345 | 1.000000 | ||||

| EG | -0.58734 | -0.20216 | 1.000000 | |||

| FDI | 0.069013 | 0.627148 | -0.21689 | 1.000000 | ||

| TOP | -0.7109 | -0.40769 | 0.545087 | -0.26784 | 1.000000 | |

| EXR | 0.496782 | 0.756190 | -0.62346 | 0.345749 | -0.37151 | 1.000000 |

Table 5. Correlation matrix test result-multicollinearity test.

From the Table 5, none of the pairwise correlation coefficient is greater than 0.9. Hence, there is no clue to suspect the problem of multicollinearity among the variables in the model. Therefore, the variables can be combined in a multi-regression model with any fear of multicollinearity.

Unit root test results

The results of the unit root tests are presented in Table 6. Both the Augmented Dickey-Fuller (ADF) and the Phillips-Perron (PP) tests are presented. The critical tau statistic at 5% probability level is 3.6220.

| Augmented Dickey Fuller (ADF) | Phillip Perron(PP) | |||||

|---|---|---|---|---|---|---|

| Variable | Level | First diff | Order | Level | First diff. | Order |

| MVA | -1.2144 | -5.0479 | I(1) | -1.3109 | -5.0466 | I(1) |

| GI | -1.541 | -5.9151 | I(1) | -1.3911 | -7.4911 | I(1) |

| EG | -2.4892 | -6.9929 | I(1) | -2.4353 | -7.5909 | I(1) |

| FDI | -4.3324 | - | I(1) | -2.1173 | -6.3986 | I(1) |

| TOP | -2.7721 | -6.4581 | I(1) | -2.7721 | -6.4679 | I(1) |

| EXR | -1.5153 | -3.8783 | I(1) | -0.6727 | -3.8942 | I(1) |

Table 6. Unit root test results.

The unit root test shows that all the variables, apart from FDI, have unit root at level for both the Augmented Dickey-Fuller (ADF) and the Phillips-Perron (PP) tests. Foreign Direct Investment (FDI) is stationary at level for the ADF test, shows sign of unit root for the Phillip-Perron test. Thus, all the variables, apart from FDI, are first difference stationary, that is, they are I(1) series, or integrated of order 1. FDI is integrated of order 0 and therefore is I(0) series. The next step is to examine the integrated variables for cointegration, to see if there is any stable long run relationship among the variables.

ARDL/Bound cointegration test

The ARDL/bound cointegration test approach was adopted to examine the integrated variables for cointegration. The result is presented in Table 7.

| F-Bound test | Null hypothesis: No levels relationship | Actual sample size: N=29 | ||

|---|---|---|---|---|

| Test statistic | Value | Signif. | I(0) | I(1) |

| F-statistics | 4.1340 | 0.1% | 2.331 | 3.417 |

| K | 5 | 0.05% | 2.804 | 4.013 |

| 0.01% | 3.9 | 5.419 | ||

Table 7. ARDL/Bound test result

The ARDL/bound test result in Table 7 shows that the variables are cointegrated. The empirical F-statistics is greater than the upper critical bound statistics at 5% probability level, thus, the null hypothesis which says there is no level relationship is rejected at 5% probability level. This implies that there is a fixed long run relationship among the variables of globalization and manufacturing sector performance in Nigerian economy. We proceed to presenting the long run impactcoefficients of the effect of globalization on Nigeria’s manufacturing sector during the period under review [8].

ARDL model parameter estimates

Having identified that the variables in the empirical model are cointegrated. We proceeded to estimate and present the model parameter estimates. First, the long run coefficients and second the short run coefficients. The long run and the short run coefficients are presented in Table 8.

| Variable | Coefficient | St. error | t-Statistics | Prob. |

|---|---|---|---|---|

| GI | -0.6424 | 0.2861 | -2.2456 | 0.0427 |

| EG | -0.2058 | 0.0861 | -2.3897 | 0.0327 |

| FDI | 0 | 0 | 0.2354 | 0.8175 |

| TOP | -0.1053 | 0.0442 | -2.3826 | 0.0331 |

| EXR | -0.0572 | 0.025 | -2.2873 | 0.0396 |

Table 8. Long run coefficients.

The long run coefficients presented in Table 8 above show the effect of globalization variables on Nigeria’s manufacturing sector performance in terms of output. The Table reveals that Globalization Index (GI) negative and significant impact on manufacturing sector output. This is in line with the a priori expectation for the variable and economic theory. This implies that increase in overall globalization had positive impact on the Nigerian manufacturing sector. Specifically, increase in Nigeria’s globalization index led to increase in Nigeria’s manufacturing sector output by 0.6424. The relationship between economic globalization and manufacturing sector output is negative, but significant [9]. This implies that increase in Nigeria’s economic Globalization Index (GI) had negative impact on Nigeria’s manufacturing sector output during the period under review.

The impact of FDI on the Nigerian manufacturing sector in the long run is positive. but insignificant. It implies that the inflow of FDI to Nigeria during the period under review has not been beneficial to the Nigerian manufacturing sector. The impact of Trade Openness (TOP) on Nigerian manufacturing sector out is negative and statistically significant. The implication is that the openness of Nigerian economy during the period under review had negative impact on the Nigerian manufacturing sector. This is contrary to the a priori expectation for the variable. The relationship between Naira’s Exchange Rate (NER) and the manufacturing sector output is negative, but significant. The sign of the variable coefficient conforms with the a priori expectation for the variable. The result implies that. during the period under review, variations of the value of the Nigerian currency had negative effect on the Nigerian manufacturing. In all, the impact of globalization on the Nigerian manufacturing sector in the long run is negative [10]. We proceed to examine the short run impact of globalization on manufacturing sector (Table 9).

| Variable | Coefficient | St. error | t-statistics | Prob. |

|---|---|---|---|---|

| D (EG (-1)) | 0.0487 | 0.0196 | 2.48192 | 0.028 |

| D (EXR (-1)) | 0.0329 | 0.0085 | 3.86137 | 0.002 |

| D (FDI (-2) | 0.0001 | 0.0542 | 0.00184 | 0.173 |

| D (TOP (-1) | 0 | 0.0251 | 0.0039 | 0.459 |

| Coint Eq (-1)* | -0.4171 | 0.0641 | -6.50339 | 0 |

Table 9. Short run coefficients.

The short run impact of globalization on manufacturing sector output as presented in Table 9 reveals that Economic Globalization (EG), Exchange Rate Variations (EXR), Trade Openness (TOP) and Foreign Direct Investment (FDI) had positive effect on manufacturing sector output. However, the impact of FDI and trade openness were statistically insignificant in the short run. Overall globalization index had no short run effect on manufacturing sector out. The insignificant impact of FDI and TOP is a direct consequence of the fact that FDI and trade openness have long and significant impact lags.

This will make their impact insignificant in the short run, but significant in the long run after adjustments. The coefficient of the error correction mechanism (CointEq (-1)*) is negative and statistically significant. The coefficient of the variable is appropriately signed and significant. The absolute value of the coefficient, -0.4171, implies that the speed of adjustment of the model to the long run equilibrium value is about 4% within one year [11].

Post estimation tests

Post estimation tests examine the model employed for the empirical analysis and the parameter estimates whether they meet the basic assumptions of the Ordinary Least Square (OLS) regression techniques. The diagnostic test carried out on the model and the parameter estimates are the residual normality test, autocorrelation test, heteroskedasticity and model specification error tests. All tests were conducted at 0.05 level of significance. The summary of the results of the tests are presented in Table 10.

| Test | Method | Empirical statistics | Prob. | Remarks |

|---|---|---|---|---|

| Residual normality | Jacque-Bera (JB) | 1.438 | 0.4871 | Accepted |

| Autocorrelation | Breusch-Godfrey test | 1.914 | 0.1666 | Accepted |

| Heteroskedasticity | ARCH test | 0.093 | 0.7602 | Accepted |

| Model specification | Ramsey RESET | 0.048 | 0.8303 | Accepted |

Table 10. Diagnostic test results.

The Jacque-Bera (JB) test of residual normality shows that the estimated residuals have normal distribution. Thus, the null hypothesis is accepted at 0.05 level of significance. The autocorrelation test shows no evidence of autocorrelation among the estimated error terms. The Bresuch-Godfrey test statistic value is far much lower than the critical value at 0.05 levels. Thus, the null hypothesis of the test is accepted. The Autoregressive Conditional Heteroskedasticity (ARCH) test of heteroskedasticity supports the acceptance of the null hypothesis at 0.05 levels of significance. It therefore implies that there is no evidence of heteroskedasticity in the estimated error terms. The test of model specification error using the Ramsey Regression Specification Error Test (RESET) indicates that the model employed for the analysis was correctly specified [12]. Based on the results of the model diagnostic test, we can confidently declare that the model parameter estimates are the best linear unbiased and efficient estimator.

The study examined how globalization affects the performance of the Nigerian manufacturing sector between the period 1990 and 2019. The objective of the study was to estimate the effect of globalization on the Nigerian manufacturing sector output contribution to the GDP during the period under review. The study adopted ex-post research design approach using secondary data collected from various sources and a multiple regression model which has Nigerian manufacturing sector output contribution to GDP as the dependent variable, while overall globalization index, economic globalization, foreign direct investment, and trade openness were the independent variables.

The empirical model was estimated using the Pesaran, Smith and Shin autoregressive distributed lag/bound test cointegration analysis techniques. The ARDL/bound cointegration test shows that the variables in the model have stable long run relationship. Estimates of the long run coefficients revealed that the overall globalization index has positive and significant impact on the manufacturing sector out during the period under review. However, economic globalization index and foreign exchange variations, have negative, but significant effect on the manufacturing sector output in the long run. Trade openness and foreign direct investment had negligible and insignificant impact on manufacturing sector out in the long run. The short run impact of economic globalization and exchange rate were found to be positive and significant, while FDI and trade openness were not significant.

Based on the findings from the study, it is evident that globalization had negative effect on the Nigerian manufacturing sector. The annual output of the sector declined heavily under the influence financial and trade liberalization. The sector lost it market in the West African region and the domestic market in the face of cheaper and more sophiscated products from European and Asian manufacturers. The problem has been compounded by huge infrastructure deficit and macroeconomic instability, in particular, exchange rate instability, galloping inflation, and negative real interest rate, price instability, and sluggish economic growth. The manufacturing sector is important for job creation, industrial sector development, and economic growth, reserves conservation and foreign exchange earnings. The dwindling fortune of the Nigerian manufacturing sector has to be mitigated policy responses that protect critical the sectors from the raving influence of globalization and competitions from developed economies, while at the same time, not restricting international trade and consumers choices and variety space.

To achieve this, the government should adopt proactive trade policies, especially, policies that protect the domestic manufacturers and give competitive advantage to the manufacturers in the regional and domestic markets. Trade policies such as most rules of origin, most favoured nations clauses, local content requirement, high tariff on non-essential goods should be pursued to local manufacturers afloat.

[Crossref]

Business and Economics Journal received 6451 citations as per Google Scholar report