Research Article - (2022) Volume 13, Issue 9

Received: 20-Sep-2022, Manuscript No. BEJ-22-75612;

Editor assigned: 22-Sep-2022, Pre QC No. P-75612;

Reviewed: 10-Oct-2022, QC No. Q-75612;

Revised: 15-Oct-2022, Manuscript No. R-75612;

Published:

20-Oct-2022

, DOI: 10.37421/2151-6219.2022.13.395

Citation: Adan Abdirahman Jimale, Abdiaziz Ahmed Ibrahim, Mohamed Hussein Abdi, Maryan Abdullahi Abdi and Bile Abdi Siyad. “The Role

of Financial Institutions on Employment in Mogadishu Somalia.” Bus Econ J 13 (2022): 395.

Copyright: © 2022 Adan AJ, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Financial institutions become much more effective, play a vital character in the Somali economy, which led to become a big part of the employment sector. So, in this study, we will Aim to investigate the role of financial institutions on employment in Mogadishu Somalia And the research design was descriptive research design and a questionnaire was used to collect research data from a sample size of 123 respondents from the target population and that date we collected from the respondents shows that in terms of occupation, 46 (37.4%) of our respondents was Financial Institution Clients, while 37 (30.1%) were Financial Institution staff, and, 40 (32.5%) were Financial Institution managers and reason we targeted those was to get valid data from someone who is involved or somehow linked to financial institution And for Data analysis we used the statistical package for social scientists (SPSS) version 23, and most of the respondents agreed that financial institutions have a significant and encouraging role on employment in Mogadishu.

Financial institutions • Banks • Employment sector • Microfinance- performance • Mogadishu

Financial Institutions (FIs) are companies whose main assets are financial assets such as claims, stocks, bonds, and loans rather than physical assets like real estate, machinery, and raw materials [1]. Given the numerous varieties of unemployment and the fact that some are inevitable or even required for a healthy labor market, full employment is not the same as zero unemployment. Jobs are constantly being created and destroyed as industries change, and the transition from one employment to another is not smooth. For instance, frictional unemployment develops when workers leave their jobs or get fired and often do not take the first new position that comes their way. Most people take the time to look for a job that fits their skills well unless they are under intense pressure to replace lost money. Due to this lag, a portion of the workforce is perpetually looking for work and is labeled as unemployed.

The employment-to-population ratio presents the percentage of a country's or region's working-age population that is employed. It gives information about an economy's ability to produce jobs. A low ratio indicates that a large proportion of a country's population is not participating in marketrelated activities due to unemployment or inactivity, whereas a high ratio indicates that a large proportion of the working-age population is employed. High employment to population ratios in developing regions/countries, such as Somalia, may not be predictive of a better outcome because many employed people may be engaged in informal or low-quality occupations. About 25.5 percent of the Federal Republic of Somalia's total population of 3.7 million people aged 15 and above were employed [2]. Financial institutions, in general, play an important part in Somali economic progress; hence it is one of the top goals. The phrase "financial institution" refers to the combination of banks, remittances "Hawala," and microfinance organizations, each of which plays a key role in the economic growth process [3].

Following the union of Italian Somaliland and British Somaliland, the Somali National Bank became the first financial institution in the nation on July 1, 1960. The National Bank initially had one office in Mogadishu and employed fourteen people, but by 1965, the Bank had succeeded in establishing nine branches. With 67 percent of Somali youth unemployed, high youth unemployment is one of the country's biggest problems. The plan was for the bank to replace two foreign banks (Somalcassa and the Bank d'Italia) operating in the country at the time [4].

Since the end of the civil war in 1991, the private sector has formed the backbone of Somalia's economy. Private financial investment by individuals and members of the diaspora is now more practical than relying on the government for assistance. The private sector employs a wide range of people in industries including telecommunications, finance and banking, hotels and restaurants, education and health services, manufacturing and construction, transportation, and small and medium-sized businesses [5].

In the past ten years, numerous financial organizations have formed and are now offering financial services including ATMs, debit cards, and savings accounts. Examples of these banks are Premier Bank and International Bank of Somalia (IBS). These new financial institutions have between 50 and 150 staff. In these two banks, individuals under the age of 35 hold more than 90% of the posts. Young individuals are more likely to be financially savvy and conversant with current banking technology, thus banks seek to recruit them. Women make up around 45% of employees and have the most opportunities at IBS. Interviews with stakeholders suggest that rising financial institutions provide direct loans to create jobs for young people in addition to formal employment.

So Financial institutions become much more effective, play a vital character in the Somali economy, and become a big part of the employment sector. So, in this study, we Aim to investigate the role of financial institutions on employment in Mogadishu Somalia and there is a literature gap in the study area. Therefore, this study is designed to bridge this knowledge gap, the objective of the study is to identify the role of banks on employment in Mogadishu Somalia, and data was conducted from February to April 2022.

Research instruments

This study has used a questionnaire, a research instrument consisting of a series of questions to gather information from respondents. Questionnaires can be thought of as a kind of written interview. They can be carried out face to face, by telephone, by computer, or by post.

Data collection procedure

The questionnaire was used to collect research data from the target population. Study a participant will be briefed about the study and its objectives. They will also be requested to answer the questions as honestly as possible.

Data analysis

After data is rationally studied, scrutinized, edited, and summarized qualitatively and quantitatively, Data will analyze and process electronically using a statistical package for social scientists (SPSS) version 23, to analyze the effect of the service sector on economic growth in Somalia. Descriptive analysis will be done and then frequency tables and charts will be used to present the study results.

Population of the study

The study’s target population will be the managers, workers, and clients of Financial Institutions in Mogadishu in Somalia.

According to the Somalia National Bureau of Statistics Labour Force Survey Report in 2019, they find out that the Financial and insurance activities sector Employed 7,528 0.8% compared to the overall branches of economic activity sectors.

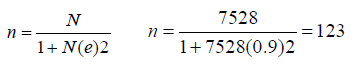

According to the nature of the target population where the number of the target population is many, to determine the required sample size n will use the Slovenes’ formula for sample size determination.

Where:

n = sample size

N = population and e2= standard error.

e2 =standard error.

Therefore, the sample size is 123 respondents.

Data analyses

The above table shows that 88 (71.5%) of the respondents are male while 35 (28.5%) of the respondents are female. And in terms of age, most of the respondents 53 (43.1%) were aged between 15- 25 years old, 23 (18.7%) were aged between 25-34 years old, 44 (35.8%) were the aged between 35-44years old, 3 (2.4%) were in the age 45 and above years old. Whale all of our respondents were University/tertiary in terms of Educational level. And in terms of occupation, 46 (37.4%) of our respondents were financial Institution Clients, while 37 (30.1%) were Financial Institution staff, and, 40 (32.5%) were Financial Institution managers (Tables 1,2).

| Variable | Frequency | Percentage | |

|---|---|---|---|

| Gender | Male | 88 | 71.5 |

| Female | 35 | 28.5 | |

| Total | 123 | 100 | |

| AGE | 15-24 | 53 | 43.1 |

| 25-34 | 23 | 18.7 | |

| 35-44 | 44 | 35.8 | |

| Above 45 | 3 | 2.4 | |

| Total | 123 | 100 | |

| Educational level | Primary | 0 | 0 |

| Secondary | 0 | 0 | |

| University/tertiary | 123 | 100 | |

| No formal education | 0 | 0 | |

| Total | 123 | 100 | |

| occupation | Financial institution managers | 40 | 32.5 |

| Financial institution staff | 37 | 30.1 | |

| Financial Institution Client | 46 | 37.4 | |

| Total | 123 | 100 | |

| Question | Strongly Disagree | Disagree | Neutral | Agree | Strongly Agree | Total | |

|---|---|---|---|---|---|---|---|

| Financial institutions participate in employment opportunities in Mogadishu | Frequency | 21 | 7 | 17 | 34 | 44 | 123 |

| Percentage | 17.1 % | 5.7 % | 13.8 % | 27.6 % | 35.8 % | 100 % | |

| Financial institutions facilitate business Transactions in Mogadishu. |

Frequency | 14 | 2 | 13 | 51 | 43 | 123 |

| Percentage | 11.4 % | 1.6 % | 10.6 % | 41.5 % | 35.0 % | 100 % | |

| Some of My colleagues work at financial institutions | Frequency | 21 | 5 | 13 | 54 | 30 | 123 |

| Percentage | 17.1 % | 4.1 % | 10.6 % | 43.6 % | 24.4 % | 100 % | |

| Most financial institutions offer fair employment opportunities |

Frequency | 20 | 21 | 13 | 33 | 36 | 123 |

| Percentage | 16.3 % | 17.1 % | 10.6 % | 26.8 % | 29.3 % | 100 % | |

| Financial institutions are the main source of income for many households in Mogadishu |

Frequency | 15 | 34 | 18 | 31 | 25 | 123 |

| Percentage | 12.2 % | 27.6 % | 14.6 % | 25.2 % | 20.3 % | 100 % | |

| Bankers have a better standard of living compared to other jobs |

Frequency | 16 | 23 | 28 | 41 | 15 | 123 |

| Percentage | 13.0 % | 18.7 % | 22.8 % | 33.3 % | 12.2 % | 100 % | |

| I prefer to work for local banks | Frequency | 16 | 10 | 17 | 53 | 27 | 100 |

| Percentage | 13.0 % | 8.1 % | 13.8 % | 43.1 % | 22. %0 | 100 % | |

| Microfinance performance is determined by the number of running backs. | Frequency | 25 | 15 | 24 | 37 | 22 | 123 |

| Percentage | 20.3 % | 12.2 % | 19.5 % | 30.1 % | 17.9 % | 100 % |

The first question we asked respondents about the role of Financial Institutions on Employment in Mogadishu was “Financial institutions participate in employment opportunities in Mogadishu” the majority of the respondents 44 (35.8% ) Strongly Agreed, and 34 (27.6% ) agreed, and 17 (13.8%) where responded Neutral and 7 (5.7%) where disagree while 21 (17.1%) Strongly Disagree. And the second question was “Financial institutions facilitate business transactions in Mogadishu” the majority of the respondents 51 (41.5%) Agreed, 43 (35.0%) where strongly agreed, and 13 (10.6%) where responded Neutral and 2 (1.6%) were disagree while 14 (11.4%) Strongly Disagree, and the third question was “Some of My colleagues work at financial institutions” the majority of the respondents 54 (43.6% ) were Agreed and 30 (24.4% ) where strongly Agreed and 13 (10.6%) where responded Neutral and 5 (4.1%) where disagree while 21 (17.1%) Strongly Disagree, and the fourth question was “Most financial institutions offer fair employment opportunities” the majorityo f the respondents 36 (29.3%) were Strongly Agreed, and 33 (26.8%) where agreed and 13 (10.6%) where responded Neutral and 21 (17.1%) where disagree while 20 (16.3%) Strongly Disagree, and the 5th question was “Financial institutions are the main source of income for many households in Mogadishu” the majority of the respondents 34 (27.6% ) where disagree and 31 (25.2) were agreed and 25 (20.3) strongly agreed and 18 (14.6) were neutral and 15 (12.2) where responded strongly disagreed, and the sixth question we asked the respondents was “Bankers have a better standard of living compared to other jobs” the majority of the respondents 41 (33.3% ) agreed and 28 (22.8%) were neutral and 23 (18.7% ) Where disagreed and 16 (13.0%) strongly disagreed and 15 (12.2).

Where responded strongly agreed, and the 7th question was “I prefer to work for local banks” ” the majority of the respondents 53 (41.5%) Agreed, 27 (22.0% ) where strongly agreed, and 17 (13.8% ) were responded Neutral and 10 (8.1%) where disagree while 13 (13.0%) where responded Strongly Disagree, and the final question we asked respondents was “Microfinance performance is determined by the number of running backs.” the majority of the respondents 37 (30.1%) where agreed and 25(20.3%) where responded strongly disagreed while 24 (19.5%) where responded Neutral and 22 (17.9) where responded strongly agreed and 15(12.2%) where responded disagreed (Table 3).

| Variables | Cronbach’s Alpha |

|---|---|

| Financial Institutions | 0.656* |

| Employment | 0.774 |

The study attempted to build mainly primary data to identify The Role of Financial Institutions on Employment in Mogadishu. It employs cross-sectional data from 2022 and used SPPS as an analysis tool since it is the most informative and reliable estimated data one can get. And questionnaire was used for data collection It presents the research method adopted to achieve the stated research objectives. And most of the respondents agreed that financial institutions have a significant and encouraging role in employment in Mogadishu. And based on the findings and conclusions of this study, the following recommendations were made: financial institutions should increase microfinance programs, and to establish and implement legal financial systems and strategies for foreign investors and international financial institutions.

Google Scholar, Crossref, Indexed at

Business and Economics Journal received 6451 citations as per Google Scholar report