Research Article - (2021) Volume 10, Issue 8

Received: 06-Aug-2021

Published:

27-Aug-2021

, DOI: 10.37421/2162-6359.2021.10.606

Citation: Akram, Muhammad Waseem ,Irfan Ahmad Khan,

Ansar Abbas and Mansoor Ahmad Khan Sanwal, et al."Measuring the Effects of Globalization on Public Purchasing with Mediating Role of

Research and Development:Empirical Evidencefrom Developing Economies.” Int J Econ Manag Sci 10(2021): 606.

Copyright: © 20201 Akram MW, et al. This is an open-access article distributed

under the terms of the Creative Commons Attribution License, which permits

unrestricted use, distribution, and reproduction in any medium, provided the

original author and source are credited..

While examining the effect of globalization on public purchasing, the role of research and development was neglected before. Globalization is concerned with growing inequality in most highly developed economies, but also with the gap found in the vast majority of emerging economies. In most emerging economies, technological and financial development has led to growing inequality, while its impact on developed economies has been mixed. Furthermore, our findings show that the effects of GDP, foreign direct investment and the supply of unskilled workers to the effects of technology, and the effects of globalization on the supply of skilled workers to the effects of financial growth and also acts as a transmission channel. This research also examines how much the globalization effects public purchasing when R & D plays a mediating role in Pakistan. Data was used from 2002 to 2018 by applying dynamic ARDL simulation model. Dynamic ARDL simulations model has ability to calculate the real positive and negative modification in the independent variables and its influence on the dependent variable. The studied outcomes of dynamic ARDL simulations shows that foreign direct investment, research and development, gross domestic product and economic global index have positive effect on public purchasing in Pakistan while inflation, interest rate have negative effect on public purchasing in Pakistan. Based on the results of this study policy implications are suggested for Pakistan.

Globalization • Foreign direct investment • Development • Dynamic ARDL simulations

Globalization means close integration of international trade systems and foreign exchange. Trade growth transforms the traditional economy into a modern economy, with massive production of goods, which is relatively beneficial to one country-to developing countries; these are goods used by many unskilled people, such as shoes, textiles, clothing and the light industry a large consumption of goods that the country cannot produce [1]. Large production facilities for export goods are located where most of the workers are, i.e. in cities. With economic globalization, such employment opportunities are attracting more and more people from rural areas [2]. Foreign investment inflows are concentrated in some urban areas and capitals with relatively good infrastructure. Multinational companies, which are the main source of foreign direct investment, may choose to invest directly in the country instead of exporting. Investments are usually directed to large manufacturing enterprises, thereby positively increasing the impact of economic activity on trade in urban areas [3]. It is characterized by an international flow of globalization, goods, services and finance, which contributes to the current trend of rural-to-urban migration [4]. Globalization was achieved through the "often necessary-inevitable" acceptance by global governments of the idea that a market economy works better than public administration. The ability of private market capital to move to different parts of a country puts significant pressure on the government's ability to intervene in the provision of public services [5]. In the race to attract foreign capital for economic growth, governments sometimes have to promise investors that they will avoid conditions and tax breaks [6].

That through different flows of people, information and ideas, the process of networking between different actors destroys national borders and increases the common domination of the state [7]. It has been widely achieved economically in many countries that are globalized. Decades of empirical research on globalization can be emphasized that globalization not only leads to economic growth, increased gender equality and also improved human rights [8]. That globalization has no negative effect on social agreements, worker protection and market liberalization [9]. Contrary to these positive factors, many pragmatic studies have also shown that globalization exacerbates domestic inequality and affects unfair economic activity [10]. Globalization is a program that targets countries with modern economies to expand the current economic hierarchy. From the era of decolonization, American-led developed countries continued their dominance over developing countries by promoting development projects until the 1970 s, and then through the spread of neoliberal entrepreneurial logic in the name of globalization from the 1980 s [11]. Although global economic amalgamation has led to economic growth, it has further degraded urban official sector employment and increased income inequality between and within cities. Trade growth, the most important indicator of globalization, is causing changes in the labor market. Especially in developing countries, unskilled workers are sent to the informal sector because traditional employment and professional skills are being pushed into the slums. In other words, some skilled workers enjoy the benefits of globalization, while many unskilled workers do not [7]. Also negative aspect of globalization is the growth of the informal sector and the gap in income between formal and non-formal workers due to economic globalization has led to the growth of slums [12].

Global exchanges and capital inflows have increased the beneficial distribution of assets, achieving higher and wider growth, additional of more occupations, economic reconstruction and professional development. Intend of globalization is to provide benefit to the economy of the nations by making efficient markets, enhancing rivalry and the most important one by allocation of wealth equal [13]. Production has been increased due to globalization process and also financial development has gotten to be exceptionally viable on the method of economic development. However, energy consumption has been increased due to quick production and fiscal growth. Due to this aspect, in 2018 primary energy usage was increased at a rate of 2.9%. Secretion of greenhouse gases has been increased as a result of this heinous energy consumption. Statistics also shows that carbon Dioxide emission was increased by 2.0% in 2018 reached 33890 million tons [14]. Globalization has given rise two environmental effects, those are known as scale effect and the composition. The effect of global trade on production levels is referred as Scale effect. Under these circumstances, Demand for goods and services has been increased due to globalization. Interaction between business and production components in countries is referred as composition effect.

Pakistan's economy has been affected for various reasons. Terrorism and political instability are the biggest reasons. Foreign investors are reluctant to come to Pakistan because of terrorism and existing investors were limiting their business rather than expanding it. Investors were shifting their business out of Pakistan owing to which Pakistan's economy has been badly affected [15]. Due to this bad Economy, the value of the dollar continued to rise and the rupee lost its parity. Investors from Karachi and Faisalabad turned to Bangladesh and UAE. Lack of employment reduced people's purchasing power. Due to the lack of industry, Pakistan's exports have become less or non-existent, and Pakistan's imports have skyrocketed. As a result, foreign exchange reserves have shrunk dramatically. Pakistan couldn’t gain enough benefit from globalization as compare to other countries [16].

Research and Development is the widely used substitute for measuring the amount of innovation in organizations and countries [17]. By the evidence of International Research, real scientific and technological research involves capability to acquire new scientific or technological information, while applying research results or other knowledge in development to a project or design for a new or significantly improved product [18]. R & D can help in saving enough funds while purchasing materials, equipment, products, processes, systems, or services before starting profitable production or practice. R & D costs will lead entities (public and private) to growth and revenue and succeeding financial and calculated achievement [19]. Costs based on this knowledge are the origin of innovation, leading companies to financial gain. Many countries have gradually put more effort into research and development activities, implemented property ownership to encourage innovation and sought to create conducive modernization environment. The literature does not provide convincing confirmation of the bond between innovation and revenue at the microeconomic level. Researchers have found positive two-way relationship between R & D growth and enlarged sales for large companies those are constantly innovating. However, in small constant product novelties, the link is stronger than ever. In addition, in the random process and product innovation, a qualitative and important relationship was found between sales growth and successive research and development growth. The direct relationship between R & D costs and future profits, which is within the latitude of the stock market evaluation obtained from R & D costs isn’t supported by [20]. In fastmoving companies, the research and development benefits outweigh the internal benefits of firms that are steadfast in innovation costs. Despite the composite bond between R & D activities and the resulting financial gains, R & D can be an important resource for competitive use if used effectively and efficiently [21]. According to raising costs for research, development and innovation is not enough when countries have weak organizations, networks and poor communication systems. Creative needs to build and develop high performance [22]. This inventive culture mixes purchaser emphasis, risk acceptance, business shipping, strategy, innovation, virtual organization, networking and efficiency. Creating an Innovative One R & D philosophy involves standards, skills, short-term experience and effective approaches. Thus, as a driver of attraction to national culture, individuals, and organizations as a whole (at the macro and microeconomic level) under the influence of innovation and in economic variables such as GDP, human resources in science may be the most important driver of investment, Technology [23].

By recognizing globalization as a multifaceted phenomenon, we argue that globalization is multifaceted and that globalization has a positive impact on public purchasing. Globalization increases production and gives more positive results, as well as helping to solve other economic problems in the country. Although this concept is not new, based on the popular discourse on the various implications of globalization, we provide significant theoretical contributions by identifying more accurate ways in which globalization will affect the expansion of government procurement. We benefit from the current global data in developing countries compiled by the World Bank and the common data set on the subject of globalization. This study investigates the effects of globalization on purchasing power with facilitating role of research and development. This study adds to the related literature from numerous traits: First, in this study, globalization’s effects on social, political and economic factors, novelty and purchasing power in Pakistan are addressed. These traits were overlooked in previous investigations. Researchers merely analyzed the influence of few causes of the globalization and neglected the role of research and development. We believe that globalization will reduce inequalities between economies and that globalization will have a positive impact on the purchasing power of developing countries.

We started with the bond between the conceptual definition of globalization and the purchasing power of individuals and how research development enhances the effect of globalization. The Literary Review section reviews existing studies on how globalization is evolving and the factors influencing such development. ARDL model was used by the current studies most times [24]. However, dynamic ARDL simulation was applied to measure the variations in dependent variable due to change in independent variables. This model Dynamic ARDL simulations model plot the predications of real alteration in the independent variable by holding constant the remaining variable sand can measure the change [25,26]. Conclusion discusses the scholarly contributions and policy suggestions of this study.

Literature review

Term globalization is used to define the linkage of culture, population and economy among countries. Investments, people, information and international trade of goods and services are brought through globalization [27]. To promote these activities, countries have made partnerships amongst them. In ancient times due to improvements in technology and transportation, human beings have been living in isolated places, manufacturing and trading goods. International integration began to arise in the 19th century. The first trend of globalization was promoted after many years of European foundations in which trade activities were increased that resulted in more economic cooperation among nations [28].

Globalization has far-reaching effects on different segments. Globalization’s main benefit is advancement in technology. While benefitting society as a whole, globalization has done something unfair with certain groups. Knowing the comparative costs and benefits can surface the way to improve the problem although keeping greater profits. Companies those decide to go global can earn huge shares in different sectors of business, including production, distribution, marketing and management [29]. By adopting this idea they can weed out opponents those quiet have prehistoric assumptions about how the world works. Multinational companies and global companies are not the same person. Multinational companies operate in multiple countries/regions and adjust the goods and services of every country/region on a relatively high comparative price [30].This global company resolutely maintains stability at low relative cost. The multinational and global companies sell products around the globe by adopting same techniques.

The exchange of information around the globe is abundant, constantly spreading new potentials to ease by improving living values and efforts. The countries those want its identity of culture should be recognized and respected by the world also proclaim the transfer of modern technology, goods and services to them. Innovation is a mutual practice among people, but not for those who insist on early approaches and inheritance with indomitable interest or religious enthusiasm [31].

Globalization has become a means to ensure personal economic and cultural growth. The rise of urbanization and the close integration of the world economy have promoted global interconnections. However, trade and travel are important components of globalization.

FDI: Purchasing power of individuals has been increased due to positive inflow of FDI. While due to heinous involvement of FDI in recent years, statistics shows a rapid increased in emission of CO2. REF found both national and external investments stimulate purchasing power [32]. Developing Stock market and FDI inflows has positive effects on economic conditions of developing countries like Pakistan but carbon emission must be controlled. FDI in the renewable energy ventures are beneficial for economic and environment [33].

Pakistan needs to significantly raise its utilization of external capitals and vital need to lift trade production due to its insubstantial balance of payments position; however, due to Pakistan's weak and contracted capital market long lasting authorized support will become gradually unusual and it’s not a proper policy option to endorse outsized portfolio investments. Significant increases in viable borrowings are also not desirable. It is therefore vital to accord high priority to FDI [34].

Previous inflows of FDI in Pakistan were meager and stats show Pakistan each year in the 1990 s gain only 0.2% of the world overall and not more than one percent of the Asia. Unpredictable economic plans, political conditions, terrorism, discrimination in justice system and bureaucracy are among the major obstacles. Curative policy activities are vital. FDI results in large foreign exchange costs and transfers due to focus on the power sector which increased the implications in Balance of payments [35].

Due to political stability and control over terrorism FDI is increased in Pakistan in recent years. China Pak Economic Corridor (CPEC) a project of about 46 billion has paved the road for development. Due to CPEC many industries of Pakistan got boom including cement, iron and unemployment ratio was decreased. Purchasing power of the people is increased [36].

Research and development: Companies frequently employ resources on definite research activities in a struggle to make findings those can help to improve products and also the method of performing task towards encouraging existing yields or methods. Such actions come under the umbrella of R & D [37].

For achieving future growth, R & D provides opportunities for new business and enhancing capabilities of existing business. Keeping a relevant product in the market is easy now due to R & D. R & D isn’t confined to high technology firms or the multinational companies. In fact, a significant part of resources of most conventional consumer goods corporations dedicate towards developing new improved products [38]. Industries must focus on research and development if these want to survive in competitive market as their competitors are spending major portion of revenue on R & D. These industries include fashion, technology as well as software industry. R & D plays vital role in economic progress of the country by providing jobs and enhancing production capacity. Due to innovations life of a common man is changed [39].

Purchasing power: How much volume of products a single unit of money can purchase is referred as currency value. Also in terms of services, how much service can be obtained with each unit of money? Inflation has direct effect on purchasing power of individuals living in a specific country as rise in inflation will lead to decrease in purchasing power. People will unable to purchase more goods and avail fewer services due to rise in price [40].

Currency’s buying power may also be known as purchasing power. From consumers buying goods and services, investors buying stocks to a country’s economic prosperity, purchasing power affects every aspect of economics. An economic crisis rises when there is rise in inflation, cost of living and interest rate which leads to decline in credit ratings in global market. These factors play their effective role in making a country’s economy unstable [41].

For maintaining economic health, government’s institutes formulate policies to keep purchasing power of individuals strong. Consumer price index (CPI) is an effective tool to monitor purchasing power of citizens. We can measure CPI by averaging price changes and is very effective tool for measuring the changes in cost of living. Inflation and deflation rates are determined by CPI as well. In Pakistan, weighted average prices of consumer goods and services like food, transportation and medical care are measured by Pakistan Bureau of Statistics (PBS) [42].

Economic theory that assesses the quantity that is essential to be adjusted to the price of single item by comparing two countries exchange rate is known as purchasing price parity. We can use PPP for making comparison among countries in terms of income levels and other financial statistics related to the cost of living and to determine possible inflation and deflation rates [43].

Data

This study examines the data of Pakistan covering the period from 2002 to 2018. Our paper includes the globalization’s effects on purchasing power of people of Pakistan. Purchasing Power (PP) is dependent variable with foreign direct investment; Inflation, Interest rate, Research and Development, Gross domestic product and Economic globalization index are taken as primary independent variables. These variables are named as FDI, INF, IR, R & D, GDP and ECGI respectively. The data for FDI, INF, IR, R & D and GDP is obtained from the dataset of World development Indicators (World Bank) (Table 1).

| Symbol | Variables description | Units of measurement | Data source |

|---|---|---|---|

| FDI | Foreign direct investment | Foreign direct investment, net inflows (Bop, current US$) | WDI (2018) |

| INF | Inflation | Inflation, consumer prices (annual %) | |

| IR | Interest rate | Real interest rate | |

| RD | Research & development | Gross domestic expenditures on research and development (R & D) | |

| GDP | Gross domestic product | GDP per capita (constant 2010 US $) | |

| ECGI | Economic global index | Measured by the trade flow with other countries, FDI and portfolio investment and restrictions on these inflows and outflows | KOF Index |

Bound testing approach

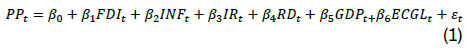

Co-integration can be examined by using Bound testing approach. At 5% significance level of F statistics, the relationship is determined in the long run. There will be Co-integration among variables if upper bound value is less than F statistics calculated value. When F statistics value is less than the lower bound value then there will be no relationship between variables. For undecidable decision it is necessary that calculated the F statistics value should be among the UBV and LBV. For examining the long run relationship, two hypotheses are examined follows.

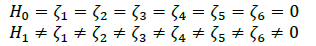

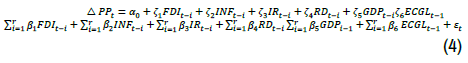

For Bounds testing approach, the equation is as follows.

Δ represents the change operator, t–I in equation (1) is showing the optimal lag number while 1 to 6 and 1 to 6 in equation (2) are indicating estimated elements.

ARDL: Developed Auto Regressive Distributed Lag model. When we compared ARDL model with other different co-integration “models’’ we came to know that ARDL has many advantages over others [44,45]. Different lag lengths can be used in ARDL co-integration for the dependent and independent variables whereas other models require identical lag length. We can use ARDL co-integration in different cases like I (0) and I (I). It can be also used for blend of both orders. Another interesting feature is that we can easily analyze small size data in ARDL model [46]. Due to the examined outcomes of bounds test we came to know about the long run relationship which exists among study variables.

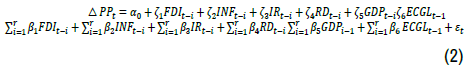

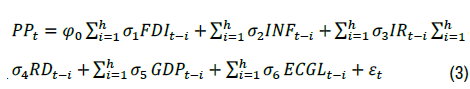

Equation for Auto Regressive Distribution lag in the long run for examined variables is as follows:

σ1 to σ6 in equation (3) show the Long run relationship among the study variables. ECM (error correction model)is described in following equation.

φ1 to φ7 in equation (4) show the short run relationship between variables. ECT in above equation is error correction term. ECT actually determined the speed of correction to balance after tremor. ADF and PP were used to check Stationary of each variable for both constant, constant and without constant trends. The serial correlation was checked through Breusch Godfrey LM test and to observe practical form, Ramsey RESET test were used Heteroscedasticity was checked through Breusch–Pagan– Godfreytest.

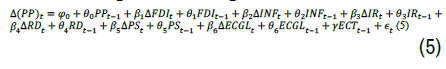

Dynamic ARDL simulations: Sometimes we have to face many problems while examining short and long run connection among variables through ARDL model. A new model with the name Dynamic Auto Regressive Distributed Lag simulations was given to examine the time series data. The dynamic ARDL simulation model has ability of stimulation and estimation [25]. It can automatically plot the graphs for an independent variable and also for its consequences on the dependent variable while to know actual change; other examined variables are kept constant in the equation [47]. When we are applying dynamic Auto Regressive Distributed Lag stimulations model, the series must be stationary I (I) and I (0) and also the variables have co-integrated bond among them

ADF and PP were used to observe the stationary of variables and results are shown in below tables. By assessing the outcomes we came to know that at I (2), the studied series are not stationary. The studied outcomes of ADF show that PP, FDI, GDP, IR, R & D, ECGL are not stationary at level nevertheless these series become stationary at first difference. The outcomes clearly indicate that ARDL model can be used with I (0) and I (I) order. The studied outcomes show that ARDL model can be applied with I (0) and I (I) order. The outcomes of AIC, SC and HQ with other test for the selection of lag created on VAR model (Tables 1 and 2).

| Test | P-value of X2 | Decision based on P-value |

|---|---|---|

| Ramsey reset test | 0.9745 | Model is properly specified |

| LM | 0.2153 | No serial correlation problem |

| Breusch-pagan-godfrey | 0.7461 | No heteroscedasticity problem |

The outcome of diagnostic statistics, to know that assessed ARDL model is suitably specified or not, Ramsey reset test were used. These tests show that estimated ARDL is correctly specified. Lagrange multipliers were used to observe the serial correlation problem in selected model whose results show that no serial correlation problem occurs in selected model. Breusch Pagan Godfrey test were used to inspect heteroscedasticity problem in the assessed model. The observed outcomes of Breusch Pagan Godfrey show that our predictable model has no problem of heteroscedasticity (Table 3).

| Variables | Constant | Constant and trend | Without constant and trend | Constant | Constant and trend | Without constant and trend |

|---|---|---|---|---|---|---|

| At level (ADF) | PP | |||||

| PPP | -0.7233 | -0.8877 | 0.9818 | -0.8503 | -1.5316 | -1.6124 |

| FDI | -1.7789 | -2.3787 | 0.6774 | -1.0445 | -4.6209 | 1.1353 |

| INF | -1.3023 | -0.9708 | -1.3367 | -2.5868 | -2.8578 | -1.5811 |

| IR | -1.2087 | -2.9751 | -0.2846 | -4.7928 | -4.5501 | 0.2498 |

| R & D | -0.2538 | -5.2720 | 2.4315 | -1.2125 | -1.5439 | 2.082 |

| GDP | -2.3390 | -4.5475 | -4.1930 | 0.0892 | -5.2858 | -4.2261 |

| ECGI | -5.3868 | -5.2520 | 1.4442 | -5.3609 | -2.7723 | -2.7723 |

| At level (ADF) | PP | |||||

| PPP | -3.6211 | -7.5629 | -2.8105 | -7.1415 | -7.3355 | -6.2677 |

| FDI | -5.3918 | -13.7448 | -12.7423 | -13.2533 | -13.3243 | -11.4844 |

| INF | -2.8733 | -3.9976 | -2.5685 | -5.2629 | -5.5405 | -5.3566 |

| IR | -7.9556 | -8.1648 | -8.0998 | -6.2620 | -6.3512 | -5.6329 |

| R&D | -6.1439 | -8.2612 | -6.2183 | -8.4339 | -11.3509 | -6.3281 |

| GDP | -7.4085 | -7.3793 | -7.5284 | -14.0819 | -13.9820 | -14.2566 |

| ECGI | -6.5495 | 6.5933 | -6.6140 | -6.6665 | -6.8481 | -6.6140 |

The results of SC and HQ show that lag one are appropriate for model however the AIC goes in favor of lag two. For lag selection, SC data standard was used to show suitability of lag one for our model. The long run relationship between the examined variables was determined by Bounds test. The outcomes of bounds test are shown in table. It was determined by assessed outcomes that, at 5% level of significance long run relationship occur between the examined variables as the evaluated F-statistic value at 5% and 10% correspondingly is greater than the upper bound (Table 4).

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 568.0935 | NA | 2.79e-25 | -25.32243 | -24.87638 | -25.15702 |

| 1 | 991.3802 | 615.6898a | 3.51e-31 α | -39.06274 | 33.71017 α | -36.08775 α |

| 2 | 1129.001 | 131.3654 | 4.99e-31 | 38.82823 α | -29.55914 | -36.01367 |

The examined results for dynamic ARDL simulations model is shown in below table. The result of dynamic ARDL simulations show positive effect of financial growth and statistically key influences on the purchasing power in Pakistan not only in the short run but also has positive impacts in the long run for financial development (Table 5).

| Test statistic | Value | K |

|---|---|---|

| F-statistic | 3.418083 | 10 |

| Bounds critical value | ||

| Significance | Lower bound | Upper bound |

| 10% | 1.81 | 2.93 |

| 5% | 2.05 | 3.23 |

| 2.50% | 2.27 | 3.5 |

| 1% | 2.53 | 3.87 |

The examined results of foreign direct investment indicate positive and significant effect on the purchasing power in Pakistan in the short run. The examined results indicate that 1% increase in FDI has positive impacts on the Purchasing power in Pakistan and purchasing power increase about 0.0023% while FDI also indicate positive effect on the purchasing power Parity in the long run about 0.0065%. The examined results of FDI are similar with previous researchers and indicated that flow of foreign direct investment to developing economies from developed economies are primarily financed in industrial, mining and power generation that positively boost economic condition in emerging economies. The observed results of INF show negative effect on public purchasing in Pakistan in the short run and long run. The examined outcomes show that 1% growth in INF decrease the public purchasing in Pakistan about -0.0015% and-0.1170% in the short run and long run respectively. In the short run, the studied outcomes show that interest rate has negative and significant impact on public purchasing in Pakistan while also in the long run interest rate has negative effect on public purchasing. The examined results indicate that 1% growth in interest in the short run causes-0.1081% decrease the public purchasing in Pakistan. Due to increase in interest rate there is decline of -0.0560% in public purchasing in the long run (Table 6).

| Variable | Coefficient | Std. error | t-Statistic | Prob. |

|---|---|---|---|---|

| Cons | -2.8055 | 0.8322 | -3.3600 | 0.0031 |

| FDIt | 0.0023 | 0.0056 | 0.38 | 0.701 |

| ΔFDIt-1 | 0.0065 | 0.0082 | 0.8 | 0.4302 |

| INFt | -0.0015 | 0.0452 | -0.0400 | 0.975 |

| ΔINFt-1 | -0.1170 | 0.0595 | 1.98 | 0.0591 |

| GDPt | 0.272 | 0.1813 | 1.49 | 0.149 |

| Δ GDPt-1 | 0.0001 | 0.1454 | -0.0000 | 0.998 |

| IRt | -0.1081 | 0.0494 | 2.19 | 0.038 |

| ΔIRt-1 | -0.0560 | 0.058 | 0.97 | 0.346 |

| RDt | 0.0353 | 0.0253 | -1.3800 | 0.175 |

| Δ RDt-1 | 0.0398 | 0.0314 | -1.2800 | 0.216 |

| ECGIt | 0.1839 | 0.0778 | 2.35 | 0.029 |

| Δ ECGIt | 0.143 | 0.0935 | 1.501 | 0.148 |

| ECT(-1) | 0.6835 | 0.1682 | -4.0690 | 0 |

| R2 | 0.8543 | - | - | - |

| - | 44 | - | - | - |

| N | 5000 | - | - | - |

| Simulations | 0 | - | - | - |

| Prob(F-statistic value) | - | - | - | - |

| Durbin Watson statistic | 2.1713 | - | - | - |

The observed outcomes of R & D show positive and substantial effect on public purchasing. The examined results demonstrate that 1% increase in R & D roots to enhance public purchasing in Pakistan nearby 0.0353% in the short run while 0.039% in the long run. Novelties in R & D result in good quality products. Due to better quality products demand is increased.

The results of dynamic ARDL simulations show that GDP has positive and substantial effect public purchasing in Pakistan in the short run and long run. The observed outcomes specify that 1% increase in GDP increases the public purchasing in Pakistan nearby 0.2720% and 0.001% in the short run and long run respectively.

According to examined results of ECGI, public purchasing of Pakistan is positively affected by ECGI. ECGI shows that due to globalization Pakistan's bond with developed states is increased which resulted in form of economic correlation that stimulates the developed countries to spend in Pakistan. Industries those pollutes environment are being shifted to developing nations like Pakistan those boost economy and also play a major role in polluting the environment.

The value of Error Correlation Term is negative and the level of significance is 5%. ECT states that the rate of change to prior equilibrium is around 0.68% [48]. Squared value is analyzed by R which shows that 85% dependent’s variance is clarified by independent variables those are in analysis. The F-statistics observed P value indicates the fitness of the model. The model has not autocorrelation problem as determined by the Durbin Watson Statistics.

Since purchasing is an integral part of economic activity, the results of this study provide important insights into the relationship between globalization and public purchasing. According to our research, economic globalization mobilizes people economic activities due to flow of wealth. Consequently, developing countries that await or are currently experiencing economic globalization must be actively prepared for economic growth and strive to promote political and social globalization. Finally, as already mentioned, there is hope that the impact of sustainable economic globalization as a driving force of globalization will diminish. Our research enables countries to report sustainable performance while facing the positive effects of globalization. Other aspects of globalization include the economic situation; Promote social equity and ultimately sustainable development. The study examined the effect of globalization on public purchasing in Pakistan. Panel data (2002-2018) which was taken from World Bank was used to examine the short run and the long run relationship between the examined variables by using dynamic ARDL simulations model. Dynamic ARDL simulations model have ability to predict the real change in the independent variables and its effect on the dependent variable. After applying different statistical tests it was observed that globalization has significant effect on public purchasing in Pakistan.

Policy implication

Because the function of R & D has been overlooked in the past, developing nations like Pakistan may gain more from globalization by concentrating on R & D, since R & D is critical in achieving the greatest output from the least amount of input. Future study will concentrate on the multi-level impact of globalization using data from provinces to understand the larger impact of globalization and the usage of multi-level models. A long-term dependency on the degree of globalization is another aim for future study. Numerous studies have shown that socioeconomic situations are interrelated, and that nations with high rates of globalization may vary from those with high rates of economic growth.

From a policy standpoint, we believe that rising countries must depend on international trade and capital flows to grow their local economies. Developing nations must build a robust regulatory and supervisory structure to limit the risks of economic instability in order to grow their local economies. In this context, macroeconomic policies such as monetary, economic, and exchange rate management are critical in addressing the dangers of globalisation to economic stability. Micro-prudential measures that are appropriate may also be employed to boost vitality. Furthermore, to limit risks, the stability of foreign capital inflows needs significant international policy collaboration and border surveillance. Furthermore, the development of domestic markets is aided by the expansion of institutional infrastructure, particularly the rule of law, government influence, and property ownership. Emerging economies may achieve high growth rates in the long term with the establishment of quality institutions and the expansion of the economy. We think that our findings will be useful to policymakers in the developing economy in reducing global integration and ensuring that developing country economies achieve optimum growth and development in a timely manner, as well as qualitative development of institutional quality, banking, and stock market economic activities.

We look forward to the support of agencies those bring together international organizations and civil society. This study confirms important implications for theoretical and policy. Most importantly, Policymakers should try to normalize trade, external aid, policies of capital account and contracts in developing countries to pave the way for justifiable growth. It should be noted that the implementation of this approach does not fully open the boundaries of the foreign economy. In addition, developing countries should try to strengthen their trade agencies in the region.