Research Article - (2025) Volume 14, Issue 2

Received: 13-Jul-2024, Manuscript No. JBFE-24-141622;

Editor assigned: 17-Jul-2024, Pre QC No. JBFE-24-141622 (PQ);

Reviewed: 31-Jul-2024, QC No. JBFE-24-141622;

Revised: 12-Apr-2025, Manuscript No. JBFE-24-141622 (R);

Published:

19-Apr-2025

, DOI: 10.37421/2167-0234.2025.14.519

Citation: Kibet, Kenneth. "Contribution of Manufacturing and Infrastructural Development on the Economic Growth in Kenya." J Bus Fin Aff 14 (2025): 519.

Copyright: © 2025 Kibet K. This is an open-access article distributed under the terms of the creative commons attribution license which permits unrestricted use,

distribution and reproduction in any medium, provided the original author and source are credited.

In Kenya, both infrastructural development and manufacturing are critical components of economic growth and development. Kenya has made significant investments in improving its energy accessibility, road network, railways, ports and airports and manufacturing. Despite all these improvement, infrastructural projects often face funding constraints. Budgetary limitations and reliance on external financing pose significant challenges. Existing infrastructure requires regular maintenance to ensure longevity and efficiency. However, maintenance efforts are often inadequate due to financial and logistical issues. Corruption and mismanagement can lead to delays, cost overruns and substandard work in infrastructure projects. This article empirically analyzed how this huge investment in energy sector, transport infrastructure and investment in manufacturing have had a significant to overall economic growth. From the findings, these components have positive and significant contributions to the growth of economy. The combined positive and significant effects of these factors suggest that a coordinated effort to improve electricity accessibility, transport infrastructure and manufacturing investment can have a synergistic impact on Kenya's economic growth. Each factor complements and strengthens the others, resulting in a more robust and resilient economy.

Investment • Economic growth • Kenya

The Kenyan construction industry is primarily driven by transportation and building/housing sectors. The ministry of transport and infrastructure oversees policy initiatives related to roads, aviation, maritime, rail, housing and urban development. According to the Kenya Economic Survey 2022, the construction industry in Kenya grew by 6.6% in 2021, down from 10.1% in 2020, indicating a shortterm slowdown. The sector is expected to maintain a growth rate of around 6% in the near future as it recovers from the COVID-19 pandemic. This growth was fueled by major infrastructure projects involving roads, ports and airports from 2022. Due to budgetary constraints, the Kenyan government aims to achieve more infrastructure developments through Public-Private Partnerships (PPPs) [1].

In 2018, the Government of Kenya (GOK) launched an ambitious development initiative called "The Big Four," focusing on affordable housing, universal healthcare, enhancing manufacturing and food security. Regarding affordable housing, the GOK aims to construct 500,000 homes. However, progress has been slow, with only 431 units completed by the end of 2021.

Kenya's economic growth is placing increasing pressure on the country's infrastructure, leading to a rising demand for improvements. To support the expansion of existing organizations and attract new companies, more effective logistics strategies and models are essential. There is a significant need for affordable and efficient urban mass transit systems, as well as the adoption of alternative transportation modes. Easing congestion and enhancing transit infrastructure could potentially open up the broader East Africa region, similar to how the railroads opened up the American West [2].

We found that governments face significant challenges in delivering utility projects due to budget shortfalls, prompting the need for private sector investment, which can provide reasonable returns. Major road construction projects often experience delays because of insufficient government budgets. However, the involvement of the private sector helps alleviate these delays. Additionally, the bureaucratic hurdles faced by the private sector in project implementation are mitigated as the government side of PPPs manages the details. The PPP strategy addresses issues of financial limitations, insufficient contractors, cost overruns, and delays by fostering collaboration between both parties, leading to a higher success rate for road projects.

Another key component that enhances economic growth is energy accessibility. Energy plays a crucial role in the modern economy, despite not being traditionally considered as a direct input in conventional growth models. We focused on how energy contributes to economic growth and the potential limits imposed by our reliance on fossil fuels. They argued that the industrial revolution liberated economic growth constraints through the utilization of coal and the discovery of new fossil fuel resources. Their study also found that the elasticity of substitution between a capital-labor aggregate and energy is less than unity. This suggests that when energy services are scarce, they significantly restrict output growth, potentially leading to a low-income steady-state. Conversely, when energy services are abundant, the economy operates under what can be termed as the 'modern growth regime', with the Solow model serving as a limiting case. This underscores the critical relationship between energy availability and economic growth dynamics in contemporary economies [3].

Access to clean energy is a critical issue for many impoverished households who lack external assistance and must rely on traditional fuels for lighting and biomass for cooking. This reliance has detrimental effects on health, gender equality and the environment. Recognizing the importance of reliable electricity access for resilience, especially in healthcare facilities, some countries have prioritized energy access in their post-pandemic recovery plans under the 'building back better' framework. The COVID-19 pandemic heightened the demand for convenience and energy independence among middle-income households facing moderate affordability challenges. This has led to an increased transition towards clean cooking fuels such as biogas and electricity, which were less affected by COVID-19 restrictions. As countries continue to recover from the pandemic and reconstruct their economies, there is an opportunity for governments to prioritize access to clean energy, particularly clean cooking solutions, to improve overall societal well-being and sustainability [4].

In 2019, 66% of the global population had access to clean cooking services. However, access varies significantly across different regions and country groupings. In Least Developed Countries (LDCs), only 17% of the population has access to clean cooking, while in Landlocked Developing Countries (LLDCs) and Small Island Developing States (SIDS), the rates are 28% and 40%, respectively. Out of the 2.6 billion people worldwide who lack access to clean cooking solutions, the majority live in rural areas (58%). These individuals are fairly evenly distributed across the three main regions with the highest access deficits: Central Asia and Southern Asia (31%); sub-Saharan Africa (35%); and eastern Asia and southeastern Asia (29%), compared to access deficits for electricity.

Sub-Saharan Africa stands out as the region with the lowest access to clean cooking solutions, where over 85% of the population, including over 95% of rural residents and about 70% of urban dwellers, lacks access to clean cooking facilities. This disparity underscores the urgent need for concerted efforts to improve access to clean cooking solutions, particularly in rural and underserved regions, to promote health, gender equality and environmental sustainability [5].

From 2010 to 2019, the global number of individuals without access to clean cooking solutions decreased by a modest 9%, declining from 3 billion to 2.6 billion. This reduction has been limited by population growth, which outpaced the increase in individuals gaining access to clean cooking options over the previous two decades. Notably, significant progress was achieved in Eastern Asia and South-eastern Asia, where 232 million fewer individuals now lack access to clean cooking solutions. In contrast, sub-Saharan Africa experienced a concerning trend, with the population lacking access to clean cooking solutions increasing by nearly 50% since 2000. This disparity highlights regional challenges and the need for targeted interventions to improve access to clean cooking facilities, which are essential for promoting health, environmental sustainability and socioeconomic development.

Statement of the problem

Several studies conducted in Kenya that focus on economic growth have not fully explored the impact of investment levels on economic development. However, these studies have generally not addressed economic growth in relation to specific sectors such as electricity accessibility, transport infrastructure and manufacturing. These factors are crucial for Kenya's Big Four agenda and are integral to achieving Vision 2030. Therefore, there is a need for new insights and knowledge regarding the nexus between manufacturing and infrastructural development on economic growth. This article comprehensively examined the impact of investment in the electricity accessibility, transport infrastructure, and manufacturing on the economic growth rate in Kenya. The goal is to bridge the gap between the current economic growth rate and the targeted growth rate of 10% per annum as envisioned for Kenya's development trajectory [6].

Objective of the study

• To evaluate the contribution of electricity accessibility on economic growth in Kenya

• To determine the effect of transport infrastructure on economic growth.

• To investigate the effect of manufacturing investment on economic growth.

Research hypothesis

• H01: Electricity accessibility does not have an effect on economic growth in Kenya

• H02: Transport infrastructure has no significant effect on economic growth.

• H03: Manufacturing investment does not have a significant effect on economic growth.

Majanja conducted a study on the financing constraints of infrastructure projects in Kenya, involving 87 construction firms. Two variables were used to measure these constraints: The degree of financing constraints faced by firms and the use of bank credit. To assess perceived financing constraints, respondents rated access to financing as a constraint on project performance. The study revealed that financing constraints were a significant obstacle for construction firms. Local construction firms faced critical issues affecting the financing of their projects. Majanja suggested that the government should promote Public-Private Partnerships (PPPs) to raise adequate funds for road construction projects [7].

Kolisi analyzed the impact of Foreign Direct Investment (FDI) on economic development and growth, highlighting its significance in many economies. The study focused on determining the long-term relationship between FDI in the manufacturing sector and economic growth in South Africa from 2006 to 2018. Additional variables included trade openness, domestic investment, inflation and exchange rate. An autoregressive distributed lag model was employed to examine the long-term relationship between these variables. The results indicated that FDI in the manufacturing sector had a negative impact on economic growth in the long run. The study suggested that policy measures should be implemented to improve labor quality and infrastructure development to achieve higher growth rates in South Africa.

Ekpo examined the performance, challenges and prospects of Nigeria's manufacturing sector to provide a clearer understanding of its current state. Using a descriptive analysis approach and data from secondary sources, the study found that the sector's performance was unsatisfactory and significantly lower than the performance levels achieved in the 1970's. A notable feature of Nigeria's manufacturing sector is its high dependence on imports. As a result, the cost of production, output size, product competitiveness and returns on investments were closely tied to the availability of foreign exchange and the exchange rate in the country. The challenges which had impeded the performance of manufacturing sector identified in the study included inadequate foreign exchange and high exchange rate, infrastructural deficit, inadequate access to credit, high interest rate and inflation rate, multiple taxes and levies, insufficient demand and institutional inefficiency.

Saidi, Shahbaz, and Akhtar investigated the impact of transport energy consumption and transport infrastructure on economic growth using panel data from MENA countries (the Middle East and North Africa region) from 2000 to 2016. The study divided the MENA region into three sub-groups: GCC (Gulf Cooperation Council countries), NGCC (countries not in the Gulf Cooperation Council) and North African countries (MATE-Morocco, Algeria, Tunisia and Egypt). Utilizing the Generalized Method of Moments (GMM), the researchers found that transport energy consumption significantly contributed to economic growth in the MENA, N-GCC and MATE regions. Transport infrastructure also positively impacted economic growth across all regions. The Dumitrescu-Hurlin panel causality analysis revealed a feedback effect between transport energy consumption, transport infrastructure and economic growth. The empirical results highlighted the importance of investing in modern infrastructure that promotes the use of more energy-efficient modes and alternative technologies, which positively impact the economy while minimizing negative externalities.

Toader, Firtescu, Roman, and Anton analyzed the impact of the accelerated development of Information and Communication Technology (ICT) on economic growth over the past two decades. Their study aimed to assess the effect of ICT infrastructure on economic growth in European Union (EU) countries from 2000 to 2017. Using panel-data estimation techniques, they empirically investigated how various ICT infrastructure indicators influenced economic growth, incorporating several macroeconomic control variables in their estimates. The results indicated a positive and significant effect of ICT infrastructure on economic growth in EU member states, with the magnitude of the effect varying depending on the type of technology examined. Additionally, the estimates showed that macroeconomic factors such as inflation rate, unemployment rate, trade openness, government expenditures and foreign direct investments significantly affected GDP per capita at the EU level. The findings aligned with theoretical predictions and relevant empirical studies, revealing that ICT infrastructure, alongside other macroeconomic factors, was a crucial driver of economic growth in EU countries [8].

Shi, Guo, and Sun explored the relationship between infrastructure capital and regional economic growth in China from 1990 to 2013, focusing on four types of infrastructure: Electricity generating capacity, roadways, railways and telecommunications. Using a vector error correction model, they found varied support across different time periods and regions for the impact of infrastructure investment on economic development. Specifically, in lagging regions, increased road construction efforts appeared to have a negative impact. These results align with the theoretical literature suggesting an inverse Ushaped relationship between infrastructure investment and growth, where excessive infrastructure investment can lead to a "crowdingout effect" on private capital.

Zichu and Masih investigated the rapid development of infrastructure in China over the past decade and its economic impact. While the economic contribution of infrastructure investment has been extensively studied, the results in the literature have been inconclusive. Using Nonlinear ARDL models, their study tested the effects of infrastructure investment on both GDP and domestic private credit levels. They found that an increase in infrastructure investment positively influenced GDP but also led to higher levels of domestic private credit. The study highlighted the importance of stable infrastructure investment and efficient management. It emphasized the need for governments to manage debt levels carefully and reduce debt leverage, as excessive debt could potentially slow down economic growth over time. This underscores the importance of balancing infrastructure investment with fiscal responsibility for sustainable economic development.

Description and measurement of variables

The dependent variable is economic growth. Economic growth refers to the increase in the production and consumption of goods and services in an economy over time. It is typically measured by the increase in a country's Gross Domestic Product (GDP). GDP measures the total monetary value of all goods and services produced within a country's borders in a specific period, typically annually.

The independent variables are electricity accessibility, transport infrastructure and manufacturing investment. Electricity accessibility refers to the extent to which households, businesses and other entities have reliable access to electrical power. This concept encompasses not only the availability of electricity but also its affordability, reliability and quality. Access to electricity is a critical factor for economic development, improving living standards and enabling various activities that require power.

Transport infrastructure refers to the framework that supports the movement of people, goods and services. It includes the physical networks and facilities such as roads, bridges, railways, airports, seaports and public transit systems. Effective transport infrastructure is crucial for economic development, social integration and environmental sustainability [9].

Manufacturing investment refers to the allocation of capital resources towards the establishment, expansion and maintenance of manufacturing facilities and processes. This includes investments in machinery, technology, infrastructure, workforce training and Research and Development (R and D). Manufacturing investment is crucial for economic growth, job creation and industrial development (Table 1).

| Variable | Measurement |

| Economic growth | Gross Domestic Product (GDP) (% annual growth) |

| Electricity accessibility | The percentage of the population with access to electricity. This is a common metric used by international organizations such as the International Energy Agency (IEA) and the World Bank |

| Transport Infrastructure | Accessibility of transport infrastructure to rural and remote areas |

| Manufacturing investment | Growth in manufacturing output measured by value-added or gross output |

Table 1. Measurement of variables.

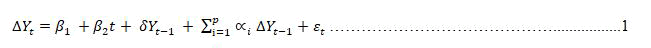

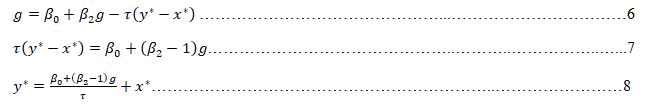

Stationarity augmented dickey fuller test was used. This test was carried out on nested time series model to accommodate serial autocorrelation, auto covariance and covariance. The model estimated was as follows:

Where ΔYt: Represents first difference of each variable β1: Represents the intercept β2t: Represents the time trend; δ: Represents the co-efficient of the lagged variable. The P represents the optimum lag length and are selected by; AIC selection criteria and SBIC selection criteria. If δ > δt, null hypothesis is rejected.

Economic model a Vector Error Correction Model (VECM) was employed. Sincé the variables under study were stationary and cointegrated, it required fitting, estimation and interpretation of the vector error correction to investigate the magnitude of short-term and long-run relationship. The vector error correction model is also referred to as restricted VAR. They are normally expressed in first difference.

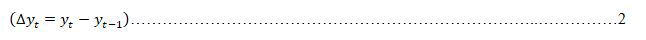

To produce the error correction mode, there is an assumption that the coefficient of yt-1 is equal to less the coefficient of xit-1. This implies that:

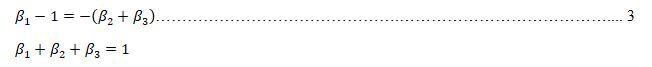

Usually, the ECM is written with τ as the coefficient on the error correction term.

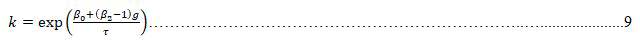

The above ECM is the representation of the short-run relationship between dependent variable y and each of the independent variable x. The long-run relationship was formed, it is assumed that the variables grow at a constant rate g instead of assuming all differenced terms equal 0. This gives

If the original model is: yt*=kxt* which in logs form is logyt*=logk +logxt* . Thus, anti-logging the above long-run expression becomes:

The k term is interpreted as the long-run relationship between dependent variable y and some independent variable x. i.e., y in this study is economic growth and x is the independent variable (electricity accessibility, transport infrastructure and manufacturing investment), k would be the average propensity for economic growth to grow.

The study employed the Augmented Dickey-Fuller (ADF) test, devised by Dickey and Fuller in 1979. The ADF test's null hypothesis posits that the series contains a unit root, whereas the alternative hypothesis suggests that the series is stationary. The Table 2 displays results both at levels and at first difference. The findings indicated all the variables were not stationary at levels, indicating the presence of a unit root. This is because their probabilities were greater than 0.05 level of significance to reject the null hypothesis.

| At levels | |||

| Variable | z | p-value | Remarks |

| ln GDP | 0.864 | 0.993 | Non-stationary |

| Electricity accessibility | 0.296 | 0.977 | Non-stationary |

| Transport infrastructure | -2.109 | 0.241 | Non-stationary |

| Manufacturing investment | -1.778 | 0.391 | Non-stationary |

| At first difference | |||

| D_lnGDP | -4.995 | 0 | Stationary |

| D_Electricity accessibility | -4.733 | 0 | Stationary |

| D_Transport infrastructure | -6.186 | 0 | Stationary |

| D_Manufacturing investment | -4.163 | 0 | Stationary |

Table 2. ADF stationarity results.

Upon differencing they attained stationarity property. This is indicated by its p-values which were less than 5 percent, this implies rejection of the null hypothesis of unit root and hence, I (1). If variables have unit roots, they are differenced to any order. In this study, all the non-stationary variables become stationary after first difference. Figure 1 provides graphical representation of data at levels. Figure 2 represents trends after first difference (they are stationary). Identifying unit roots and addressing non-stationarity is vital for reliable economic modeling. For instance, in analyzing the impact of electricity accessibility, manufacturing and infrastructural development on economic growth, ensuring that the data series used are stationary can lead to more accurate and meaningful results.

Figure 1. Trend of variables at levels.

Figure 2. Trend of variables at first difference.

Table 3 is regression results showing significant positive effects of electricity accessibility, transport infrastructure and manufacturing on economic growth in Kenya. This means the null hypotheses were rejected in favor of alternative hypotheses.

| Ln GDP | Coef. | Std. err. | t-value | p | (95% Conf Interval) | Sig | |

| Electricity accessibility | 0.017 | 0.001 | 13.22 | 0 | 0.014 | 0.02 | *** |

| Transport infrastructure | 0.016 | 0.007 | 2.2 | 0.04 | 0.001 | 0.03 | ** |

| Manufacturing investment | 0.027 | 0.013 | 2.12 | 0.047 | 0 | 0.053 | ** |

| Constant | 23.25 | 0.33 | 70.46 | 0 | 22.56 | 23.937 | *** |

| Mean ln GDP | 24.765 | SD ln GDP | 0.312 | ||||

| R-squared | 0.929 | Number of observation | 24 | ||||

| F-test | 87.785 | Prob>F | 0 | ||||

| Akaike crit. (AIC) | -44.461 | Bayesian crit. (BIC) | -39.748 | ||||

| Note: ***p<0.01, **p<0.05, *p<0.1 | |||||||

Table 3. Model estimation results.

A positive coefficient for electricity accessibility implies that as more people and industries gain access to reliable electricity, the country economic output increases. The significant effect (with a very low p-value) suggests that electricity accessibility is a critical driver of economic growth in Kenya. Reliable electricity enables businesses to operate more efficiently, increase production hours and reduce downtime, thereby boosting overall productivity. Access to electricity is essential for the functioning and expansion of manufacturing and service industries, which contribute significantly to GDP. Enhanced electricity access improves living conditions, health and education, which in turn fosters a more productive workforce.

The positive coefficient for transport infrastructure indicates that improvements in roads, railways, ports and airports lead to higher economic growth. Improved transport infrastructure reduces transportation costs, facilitates the movement of goods and services and enhances market accessibility. Good transport networks attract both domestic and foreign investments, as they provide easier access to markets and resources. Better transport infrastructure enhances regional connectivity, promoting trade within and beyond Kenya's borders.

A positive coefficient for manufacturing investment suggests that increased investment in the manufacturing sector correlates with higher economic growth. Investment in manufacturing leads to job creation, which boosts income levels and aggregate demand in the economy. Enhanced manufacturing capabilities lead to increased production of goods for export, improving the trade balance and generating foreign exchange. Manufacturing investments often include advancements in technology and innovation, which can lead to higher productivity and economic efficiency.

Electricity accessibility, transport infrastructure, and manufacturing investment play pivotal roles in driving Kenya's economic growth. By focusing on these areas, Kenya can achieve sustainable and inclusive economic development, improve living standards and enhance its global competitiveness. The combined positive and significant effects of these factors indicate that an integrated approach to developing electricity accessibility, transport infrastructure and manufacturing investment can create a synergistic impact on Kenya's economic growth. Each factor supports and enhances the others, leading to a more robust and resilient economy.

From the findings, Kenya can enhance the positive impacts of electricity accessibility, transport infrastructure, and manufacturing investment on its economic growth by implementing these policy suggestions. These policies will help create a more robust, inclusive and sustainable economy, contributing to the overall development and well-being of the country.

Kenya may invest in expanding the national electricity grid to reach more rural and underserved areas. It need to encourage the development and use of renewable energy sources, such as solar, wind and geothermal, to increase energy availability and sustainability and provide subsidies or financing options to lower the cost of connecting to the electricity grid for households and small businesses.

Kenya should invest in infrastructure to reduce power outages and improve the reliability of electricity supply, which is crucial for industrial operations and economic activities. Allocate funds to upgrade and maintain existing roads, railways, ports, and airports to improve efficiency and reduce transportation costs. Invest in constructing new transport infrastructure to enhance regional connectivity and access to markets. Promote Public-Private Partnerships (PPPs) to leverage private sector investment and expertise in developing and managing transport infrastructure projects.

Kenya may provide tax incentives, grants and low-interest loans to attract both local and foreign investors to the manufacturing sector. Develop and promote industrial parks with ready infrastructure and services to reduce the initial setup costs for manufacturing businesses. Kenya should also invest in vocational and technical training programs to equip the workforce with skills required by the manufacturing sector and encourage the adoption of advanced manufacturing technologies and innovation through grants, subsidies and collaboration with research institutions.

Journal of Business & Financial Affairs received 1726 citations as per Google Scholar report