Review Article - (2022) Volume 11, Issue 4

Received: 24-Jan-2022, Manuscript No. IJEMS-22-46921;

Editor assigned: 27-Jan-2022, Pre QC No. IJEMS-22-46921(PQ);

Reviewed: 10-Feb-2022, QC No. IJEMS-22-46921;

Revised: 24-Mar-2022, Manuscript No. IJEMS-22-46921(R);

Published:

01-Apr-2022

, DOI: 10.37421/2162-6359.11.639

Citation: Ntu Louis , Nanyongo Wonganya Charlotte. "The Relative Effectiveness of Fiscal and Monetary Policy on Economic Growth in Cameroon: An Error Correction Model." Int J Econ Manag Sci 11 (2022): 639.

Copyright: © 2022 Sonkey LN, et al. This is an open-access article distributed under the terms of the creative commons attribution license which permits

unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

The aim of this research was to investigate the effectiveness of monetary and fiscal policy on economic growth in Cameroon. The Study make use of Error correction model and Johanson Cointegration using the St. Louis equation to examine the short run and long run effect of these policies on GDP in Cameroon. Data were collected from World Bank Development indicators from 1985 to 2018. Our findings reveal that fiscal policy has a positive and significant effect on economic growth in the short run while monetary policy has a positive and insignificant effect on economic growth in Cameroon in the short run. The result of cointegration using trace statistics shown a single cointegrating equation, meaning that there is a long run relationship. The error correction term estimation gave a negative and significant value of about 0.14 showing that about 14% of error deviation in the short run is corrected in the long run. The overall findings reveal that fiscal policy, monetary policy, and export has asymmetric effect on current GDP with fiscal policy having a greater short run effect on GDP while monetary policy have a greater long run effect on GDP. Since fiscal policy was found to be more effective than monetary policy in affecting real GDP growth in the short run, improving the quality of public spending should be part of the growthemployment strategy paper implemented in Cameroon through reduction of taxes and deviating government expenditures to productive activities rather than on buying of arms and other unproductive expenditures.

Monetary policy • Fiscal policy • Economic Growth • Error correction model St • Louis equation

The Classica l Economists like Jean Baptiste Say, David Ricardo and Adam Smith with his principle of the invisible hand rejected government interference in an econom y because such interventions could result in distortion in optimal resources allocation. This view was questioned in Europe between 1925 and 1936 when unemployment rose by 25 percent, stock market prices failed between 50 and 60 percent of their face values and inflation almost doubled for every quarter of a year. Since the years of independence of most developing countries such as Cameroon in the 1960’s, are still striving to achieve sustainable economic growth and development. The difficulties in their growth over the recent years may be attributed to the ineffectiveness of monetary and fiscal policy undertaken by most countries that belong to a single currency zone. Indeed, it has been argued in most literature on currency unions that inappropriate monetary policy and constraints on national fiscal policy can deteriorate the economy of the member countries belonging to a single currency zone. Cameroon has put in place measures to fine tune her economic situation. The measures, which have affected Cameroon directly include, the Structural Adjustment Programmes (SAP) of 1988/1989, the Austerity Programmes (AP) of 1987, the slashing of civil servants salaries by over 60 percent in 1992/1993, the Trade Liberalisation Programme (TLP) of 1990, the devaluation by more than 50 percent of the FCFA in 1994, the Poverty Alleviation Programmes of 2000, the National Good Governance Programme of 2000, the National Anti-Corruption Drive of 2006 and the Operation Declaration of Assets of 2006/2007 among others. These programmes were designed to reduce government expenditure in the unproductive sectors of the economy [1].

Yet not all of these efforts by the government of Cameroon has significantly stimulate it economic growth. Based on the fact that much have been put in place to pave the ways to growth and development in Cameroon through government expenditure as a poverty reduction policy. Poverty continues to prevail within the country. Base on these problems, Cameroon is face with a high level of unemployment, slow economic growth and a consistent balance of payment problems; for example, between 1984 and 2004 about 42percent of the rural labour forces in Cameroon were unemployed while about 26.4 percentof the urban dwellers were jobless. World Bank statistics 2006 reviews that in June 2005 rural, unemployment rate in Cameroon dropped to 20.42 percent while the urban rate equally dropped to 36.13 percent (giving a composite unemployment rate of 56.55 percent). This is large number giving the fact that more than 30 percent of the country’s population is within the labour force. Above all, Cameroon like other African countries particularly Ghana in terms of its per capita GDP in 1960. However, Cameroon’s level of economic growth between 1981 and date has been more disappointing. With a GDP of about 17 billion USD in 2006 and a per capita real GDP of about 150 USD, Cameroon has been listed among the poorest countries in the world based on its record on human development index. This explains why this research work is aim at examining the relative effectiveness of these two important economic policies as drivers of economic growth in Cameroon both in the short run and in the long run [2].

Economic growth

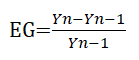

According to, views economic growth is merely increase in a country’s output of goods and services over a particular period of time. In other words, it is the increase in the GDP of a country within a short period of time. Also define economic growth as the rise in the real per capita income of a country over a long period of time. Meanwhile, defines economic growth as the annual increase in the real Per Capita Income (PCI) of a country over a foreseeable period of time. Have defined economic growth as an increase in a country’s productive capacity, identifiable by a sustained rise in real national income. Economic growth is an important issue in economics and is considered as one of the necessary conditions to achieve better outcomes on social welfare, which is the main objective of economic policy. It is thus an essential ingredient for sustainable development. Economic growth in a country is proxied by Gross Domestic Product (GDP). Thus, in this study, it is conceptualized as the monetary value of all goods and services produced in an economy over a specified period, usually one year. Numerically, we can determine whether there is an economic growth in a country using the traditional GDP (Y) dynamic or static analysis. For dynamic analysis we have [3].

Where EG=economic growth and Y1-Yn are the successive years in question. When the values gotten are positive and successive year’s values are greater than previous years’ values, then we say that there is an economic growth in such a country. The growth based on the approach is called dynamic growth since such growth takes into consideration time as a variable. The formula also takes into consideration the definition of economic growth from the classical views. Alternatively, economic growth could be viewed from a base year. That is the measurement of the growth from certain period of time. In this case the base year is fixed and growth is measured starting from that period of time [4].

Fiscal policy: involves the government changing the levels of taxation and government spending in order to influence aggregate demand and the level of economic activity. Aggregate demand is the total level of planned expenditure in an economy. Hence, the key instruments of fiscal policy is government expenditure and taxation. Fiscal policy as a means of promoting economic development aims at achieving the following objectives. The first reason is to increase the rate of investment. Fiscal policy aims at the promotion and acceleration of the rate of investment in the private and public sectors of the economy. This can be achieved by checking actual and potential consumption and by raising the incremental saving ratio. Fiscal policy should also be used to encourage some and discourage other forms of investment. In order to raise the rate of investment, government should undertake a policy of planned investment in the public sector. This will have the effect of increasing the volume of investment in the private sector. The second reason is to encourage socially optimal investment. Fiscal policy should encourage the flow of investment into those channels, which are considered socially desirable. This relates to the optimum pattern of investment and it is the responsibility of the state to promote investment in social and economic overheads. Investment in transport, communication, river and power development and soil conservation fall under economic overheads while that in education, public health and technical training facilitate come under social [5].

Another objective of fiscal policy is to increase employment opportunities. Fiscal policy should aim at increasing employment opportunities and reducing unemployment and under employment. For this, the state expenditure should be directed towards providing social and economic overheads-such expenditures create more employment and increase the productive efficiency of the economy in the long run. In under developed countries with a larger base of rural population like Cameroon, the state should undertake local public works of community development, involving more labour and less capita per head. The government should also encourage private investment through tax holidays, concessions, cheap loans, subsidies, etc. In the rural areas, efforts should be made to encourage domestic industries by providing training, finance and machines connected with them. Expenditure on all these short-term and long term measures will go a long way not only in eradicating unemployment and underemployment but also increasing employment opportunities. Fiscal policy is also aimed at promoting economic stability in the face of international instability. An underdeveloped country is prone to the effects of international cyclical fluctuations due to the very nature of its economy [6].

Monetary policy: Monetary policy is the deliberate use of monetary instruments (direct and indirect) at the disposal of monetary authorities such as central bank to achieve macroeconomic stability. Monetary policy is essentially the tool for executing the mandate of monetary and price stability. Monetary policy is essentially a programme of action undertaken by the monetary authorities, generally the central bank, to control and regulate the supply of money with the public and the flow of credit with a view to achieving predetermined macroeconomic goals (Figure 1) [7].

The figure above shows the framework linking monetary and fiscal policies to economic growth. Monetary and fiscal policies influences economic growth through broad money supply and government expenditure respectively.

Wagner’s Law of Increasing State Activity

Adolf Wagner founded the law of increasing state activity in nineteenth century to explain the growth of the share of public expenditure on GNP. He divides government expenditure into three categories namely administration and defiance, cultural and welfare functions, and provision of direct services in cases of market failure. Wagner’s law states therefore that as per capita incomes in an economy grow, the relative size of the public sector will grow. That is, as an economy becomes industrialized, urbanisation and high density living result. This in turns leads to externalities and congestion, which require government intervention and regulation. Legal services and the police emerge to address problems of law and order, peace and security. Banking service by the state arises to link surplus funds with those who had the best investment opportunities. The growth in public expenditure on education, recreational facilities, health, and welfare service is explained in terms of their income-elastic and want. Wagner submits that as real income increases, public expenditure would also increase. This explains the rising ratio of government expenditure to gross national product. The implication of this in an economy is sustainable growth via employment creation hence, poverty reduction [8].

Wagner’s theory of increasing state activity has many defects. First, it is not a well-articulated theory of public want. Rather it is an organism theory of the state where the state behaves as if it were an individual and takes decisions independent of members of the society. Secondly, the predictive power of the theory is very much in doubt. It is not always true that as per capita income grows, shares of public expenditure in GNP increase. The share of public expenditure may actually shrink as the economy grows particularly when the private sector is strong and dynamic. Thirdly, Wagner’s based his theory on the experience of the United State, Japan and a number of European countries including Germany during the nineteenth century. But the experience of Western Europe and other industrialized countries may not be the same for other countries. Consequently, the theory has limited applicability. The social, political and economic factors which govern the behaviour of government expenditure in those countries may not be replicated in developing countries [9].

The Monetarist theory

Monetarist theory came to the fore in the 1950s, drawing its cornerstone from the QTM and if velocity in the quantity theory of money is generally stable, which implies that nominal income is largely a function of the money supply. Monetarist upheld the principle of trade-off between inflation and output but reformulated the Philips curve in terms of real wage and not nominal wages. Equilibrium in labour market is obtained at natural rate and assumptions of sticky wages prevail. The nominal rigidities in wages and prices imply that monetary policy affects real income in the short run (stabilisation); an increase in money stock would have temporary increase in real output (GDP) and employment in the short run, but no impact in long run due to countervailing effect of an increase in the general price [10]. Money supply in the long run is inflationary, thus theory assumed long-run monetary neutrality. There is substantial evidence found in even recent literature to support this. According to the monetarist theory, money supply is the most important determinant of the rate of economic growth. Therefore, if a nation's supply of money increases, economic activity will increase; the reverse is also true. Monetarist theory is governed by a simple formula;

MV=PQ

Where M is the money supply, V is the velocity (number of times per year the average dollar is spent), P is the price of goods and services and Q is the quantity of goods and services.

Assuming constant V, when M is increased, either P,Q, or both P and Q rise. General Price levels tend to rise more than the production of goods and services when the economy is closer to full employment. When there is slack in the economy, Q will increase at a faster rate than P under monetarist theory. Monetarism, however, has since been challenged on grounds of technological developments and the instability of the money demand function. Monetarism also assumed exogenous money supply which has been contested theoretically and empirically. The assumption of constant velocity of money has been equally challenged. Long-run neutrality has also been challenged in empirical literature: Evans finds that money is not neutral in the long run if it is not in the short run, in particular, if growth is endogenous. If growth is exogenous, long-run neutrality is found. Post-monetarism has also been largely dominated by real business cycle models, the New Classical Model, New Keynesian Models and the New Consensus Model. The difference between these theories is actually slim and relates to the treatment of nominal rigidities of wages and prices as well the treatment of demand [11].

Since the failure of fiscal policy after the great depression, which gave rise to the great debate in monetary theory, and policy, it has provoked many studies on the effectiveness of these two policies in influencing economic performance and stability. In the 1960’s in the United States, Friedman and Meiselman initiated the debate concerning the potency of two macroeconomic policy tools namely monetary policy and fiscal policy. In their work published in 1963, they concluded that fiscal policy is ineffective in affecting output in the United States. After this finding, which contradicted the existing conventional wisdom of that time where fiscal policy considered as the most effective policy tool to stimulate, researchers have been interested in contributing to the debate. Anderson and Jordan did the first empirical investigation on this change of policy effectiveness. In 1968, Anderson and Jordan published the St Louis equation also known as the A-J equation in the United States. The model is a monetarist model in which a change in monetary policy, directly affect output as opposed to the Keynesian model where monetary policy affects output indirectly through interest rate. It established a relationship between change in Nominal GNP, monetary and fiscal policy, where fiscal and monetary actions are the explanatory variables. As proxies for fiscal actions, they used nominal high-employment government expenditures and receipts, and high employment budget surplus. Money stock and changes in monetary base was the proxies for monetary policy [12].

The original A-J equation is in first difference form, which provides estimates for multipliers. In their estimations, Anderson and Jordan regressed quarter-to quarter changes in GNP on quarter-to-quarter changes in fiscal and monetary variables. They concluded that only monetary policy is significant and has a more predictable, permanent and lasting effect on the US’s nominal GNP; fiscal policy however was statistically insignificant. Since its publication, the reduced form A-J model has been subject to many criticisms. explored the impact of key monetary policy variables on the economic growth in the CEMAC zone from the period of 1981 to 2015, they made use of the Ex post facto research design based on the principal components selection approach. The study interacts money supply, interest rate, economic growth, and inflation rate, among themselves and their lagged values using the Vector Autoregressive (VAR) analytical technique. The Classical quantity theory of money, the Cambridge Cash Balanced, the liquidity preference theory and the Monetarists as theoretical frameworks were explored to appreciate the time trends of the selected variables on the economic growth of the CEMAC zone [13]. Based on the (VAR) methodology, the study revealed that key monetary policy variables influence economic growth of the CEMAC zone in different ways with inflation rate as the impact factor.

Similarly, estimated the effects of fiscal and monetary policies on economic growth in case of Bangladesh. The estimated variables of both the policies shown a significant impact on Bangladesh’s economic growth which implies that both policies were balanced and correspondingly contribute in the economic growth of Bangladesh economy. In the same economy, investigated the effectiveness of monetary policy and fiscal policy in Bangladesh. The results of Engle Granger test, Trace Statistics and Maximum Eigen value test shown that there was a positive and significant relationship among fiscal policy, monetary policy and economic growth in Bangladesh. Did a study in the Franc zone: the study aimed at assessing the effect of monetary policy on economic growth for the fourteen countries of the Franc zone over the period 1985-2012 using a dynamic panel model. The system estimator of the generalized method of moments allowed them to demonstrate a significant and negative effect of domestic credit provided by banking sector on economic growth. The analysis revealed that money supply had a significant positive effect on economic growth, while total reserves and inflation had a negative effect [14].

In his work Monetary Policy Effectiveness under the CEMAC Region: An Empirical Evaluation; used quarterly data from 1990 to 2007 and employed a gradual methodology based on Vector Auto Regressive (VAR) approach. He began by estimating usual three variable model including real GDP, consumer price index and interest rate. This author was able to find out that, there are too many differences among the CEMAC countries on effecting a common monetary policy. This outcome reflects the difficulties encountered by the central bank in implementing a common monetary policy in the region. His results also shown that traditional interest rate channel was not effective enough in the CEMAC area. Furthermore, Abdu-Bader and Abdu-Qarn investigated the relationship between government expenditure and economic growth in Egypt, Israel and Syria. The paper tested for causality within a bivariate system of government expenditure and economic growth; and within trivariate system of share of government civilian expenditures in GDP, military burden and economic growth. According to the authors, by separating government spending into productive and unproductive spending their findings provide adequate empirical basis for policy analysis. From the bivariate system of government spending and growth, the results showed a bi-directional causality from government spending to growth for Israel and Syria and a unidirectional short-run causality from economic growth to government spending for Egypt. Within the trivariate framework, it found that military expenditure negatively affects economic growth in all the countries. The government expenditures have positive effect on economic growth in Israel and Egypt but negatively affect growth in Syria. The results from the variance decomposition and the impulse response functions supported the findings from the Granger causality analysis [15].

In the context of developing countries, many studies confirm the monetarist view by concluding monetary policy is more effective than fiscal policy. This is the case of who examined empirically the relative importance of fiscal and monetary policy in the context of five African countries; Ghana, Kenya, Nigeria, Sierra Leone and Tanzania using the St Louis-type reduced-form equation used by. The annual time series data taken from the period 1965-1990. Monetary policy found to be relatively more effective in all the five countries. Rather than estimating the conventional St Louis single equation model used a modified St Louis cointegration four-equation vector-autoregressive system in the context of three Caribbean economies. The data used in the study, ranged from 1963 to 1997. Government expenditure and net domestic assets used as proxies for fiscal and monetary policy respectively. From the results, Government expenditure as opposed to the monetary policy revealed more significant for Barbados and Trinidad and Tobago. However, in Guyana, neither fiscal nor monetary policy was significant. Base on literature reviewed in this work, most of the studies that has been done in this area has been the effect or relationship between each of the single policy on economic growth for example “assessing the impact of monetary policy on economic growth in Cameroon”. To the best of this research work, on the literature review, little or no study have been done in Cameroon using the modify St. Louis equation to investigate the relative effectiveness of monetary and fiscal policy on economic growth. This study is one of the few study to apply this model to investigate the impact of these policies on economic growth as well as the effect of innovations on economic growth in Cameroon [16].

Methodology and model specification

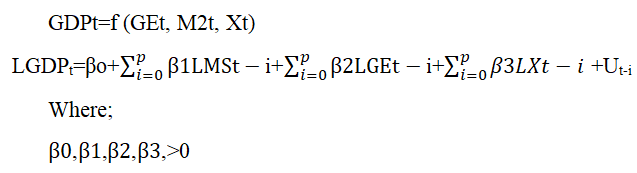

The St. Louis equation, developed by Anderson and Jordan in 1968 to test the effectiveness of monetary and fiscal policy in the US economy is commonly use in determining this model. However, Batten and Haffer (1983) in their work on other developed countries argued that in open economies, the conceptual misspecification of the St Louis equation poses a statistical problem in open economies since monetary and fiscal policies in these countries affect foreign sector. They therefore suggested the inclusion of external influences in the St Louis model by adding another variable to control for the foreign trade effect. Therefore, in line with Batten and Haffer, because Cameroon is an open economy, highly dependent on exportof commodities and raw materials; monetary and fiscal actions in the Cameroon is mainly determined by the level of internal economic activity andexternal influences [17]. Total exports are included as explanatory variable in the original St Louis equation. Thus, modified version of St Louis equation will be use in this study as seen below.

Where GDP is Gross domestic product (proxy for economic growth), MS is broad money supply (proxy for monetary policy), GE represents government expenditure (proxy for fiscal policy), X represents export and Ut is the error term.

βo=intercept

(i=1,2 and 3)=short run dynamics coefficients of the model adjustment to long run equilibrium.

p=optimal lag

length t=Time period

L=Natural log

VAR approach was used in the estimation of the model after carrying test of stationarity. By considering all the variables as endogenous, the VAR model solves the issue of endogeneity and controls for the feedback from the economy to the policy variables. Therefore, VAR estimation gives better results as compared to the OLS estimation [18].

Stationarity test of variables

The Table 1 shows ADF and PP test for all the variables at levels and at first difference. At levels all the variables have unit root since the probability value is insignificant and above 0.05 hence accepting the null hypothesis of unit root. While at 1st difference with intercept and without trend, all the variables are stationary with no unit root since the probability value is highly significant that is less than 0.05. In conclusion, the results of the ADF and PP tests showed that all the variables are stationary after first difference, thus integrated of order one [19].

| ADF | PP | |||||

|---|---|---|---|---|---|---|

| Variable | Without Trend | Prob | Decision | Without Trend | Prob | Decision |

| LGDP | -0.689709 | 0.8379 | NS | -0.546111 | 0.8712 | NS |

| LGE | -2.295942 | 0.1782 | NS | -2.374683 | 0.1551 | NS |

| LX | -1.765422 | 0.3916 | NS | -1.954039 | 0.3052 | NS |

| LMS | -1.189537 | 0.6696 | NS | -1.161021 | 0.6817 | NS |

| DLGDP | -5.78265 | 0 | S*** | -5.891876 | 0 | S*** |

| DLGE | -6.000525 | 0 | S*** | -6.000205 | 0 | S*** |

| DLX | -10.66237 | 0 | S*** | -22.01453 | 0.0001 | S** |

| DLMS | -7324908 | 0 | S*** | -7.226866 | 0 | S*** |

Note: NS denotes the variable is Non-Stationary and S means that the variable is stationary. ***denotes decision at 1%, ** denotes decision at 5% and *denotes decision at 10%, ADF=Augmented Dicky Fuller and PP=Phillip Perron

From the Table 2, the result shows that monetary and fiscal policy has a long run effect on GDP, since the Error Correction Term (ECT) is negative and significant at 5% level of significant. The result shows that any short run deviation of the various variables in the model will lead to a 14.94% error adjustment in the long run. Hence, there is a long run convergent relationship between GDP the dependent variable and government final consumption expenditure, broad money supply and export (independent variables) in Cameroon. LGDP(-1), LGE(-1), LMS(-1), and LX(-1), are the individual short run effect of GDP, government final expenditure(GE), broad Money Supply (MS) and export(X) respectively. The coefficients shows that only GDP has a significant individual short run effect at 5% level of significant with current GDP. From the result, a percentage increase in GDP (-1) will lead to a 0.282913 increase in current GDP in Cameroon. While government expenditure and current GDP has a significant short run effect at 10% level of significant. The result shows that a percentage increase in government expenditure in the short run will lead to a 1.557056 percent increase in current GDP [20].

| Coefficient | Std. Error | t-Statistic | Prob. | |

|---|---|---|---|---|

| ECT | -0.149413 | 0.065221 | -2.290864 | 0.0289 |

| LGDP(-1) | 0.282913 | 0.125621 | -2.252114 | 0.0315 |

| LGE(-1) | 1.557056 | 0.779549 | -1.997381 | 0.0546 |

| LMS(-1) | 0.120259 | 0.377594 | 0.318488 | 0.7523 |

| LX(-1) | -0.136289 | 0.167145 | -0.815397 | 0.4211 |

| Constant | 0.281867 | 0.507 | -0.55595 | 0.5822 |

| R-squared | 0.622402 | Mean dependent var | -0.357373 | |

| Adjusted R-squared | 0.513113 | S.D. dependent var | 3.464888 | |

| S.E. of regression | 3.073587 | Akaike info criterion | 5.230962 | |

| Sum squared resid | 292.8551 | Schwarz criterion | 5.492191 | |

| Log likelihood | -90.77279 | Hannan-Quinn criter. | 5.323057 | |

| F-statistic | 2.949974 | Durbin-Watson stat | 2.264842 | |

| Prob(F-statistic) | 0.002216 | |||

Above all, Money supply has a positive but insignificant effect on current GDP in the short run. From the results, a percentage increase in money supply in the short run will lead to a 0.120259 increase in current GDP everything being equal. Therefore, in the short run, monetary policy has an insignificant positive short run effect on economic growth while fiscal policy has a significant short run effect on economic growth [21]. This is in line with the Keynesian transmission mechanism, which state that, an increase in money supply can have a significant effect of GDP only in the long run through a fall in interest rate and subsequently an increase in investment. The signs are in conformity with our expectation signs. Thus, we reject our null hypotheses, which state that, money supply and government expenditure does not have any effect on GDP in Cameroon. Furthermore, the results reveal that, in the short run, export has an insignificant negative effect on current GDP in the short run [22].

It shows that, a percentage increase in export in the short run will lead to a -0.136289 percent decrease in current GDP. This is in line with the J-curve effect, which state that, revenue from export can reduce in the short run. After devaluation, because of a fall in the export prices without a corresponding increase in the supply of export goods in the world market in the short run, export revenue will be bound to fall. Hence, it is contrary to our expectation sign. In addition, the constant term is positive but insignificant. Meaning that, without government expenditure, money supply and export, GDP is expected to be 0.281867 [23]. Finally, the F-test is significant, meaning that the model is globally significant or the model is consistent over time. Meanwhile the R-square adjusted reveals that about 51.3% variation in current GDP is explain by changes in LGDP (-1), LGE (-1), LMS (-1) and LX (-1). To determine the overall short run relationship and effect of the variables on GDP, we made use of the Wald test estimation. The results are as follow test for overall short run effect (Table 3) [24].

| Test Statistic | Value | df | Probability |

|---|---|---|---|

| F-statistic | 1.632489 | (5, 31) | 0.1808 |

| Chi-square | 8.162443 | 5 | 0.1475 |

Null Hypothesis: C(2)=C(3)=C(4)=C(5)=C(6)=0

The null hypothesis of this test state that there is no combine short run relationship between GDP lag (1) [C2], GE lag (1) [C3], MS lag (1) [C4], Export lag (1) [C5] and the constant (C6). From the probability value of F-statistics and Chi-square for the Wald test, it shows that the null hypothesis cannot be rejected at 5% level of significant since the test is insignificant. Therefore, there is no combine short run effect of government expenditure, broad money supply and export on economic growth in Cameroon in the short run [25].

The study revealed that in the short run, a change in government expenditure has a positive effect on economic growth in Cameroon; therefore, fiscal policy has an effect on economic growth in Cameroon. Meanwhile changes in monetary policy has no significant impact on economic growth in the short run. This is in line with Keynesian transmission mechanism, which states that monetary policy influences economic growth through many channels, and this impact can only be felt in the long-run. In the long -run, the joint effect of the policy has a convergent equilibrium on GDP with about 14% of deviation of variables in the short run corrected in the long run. From the overall analysis, it can be concluded that fiscal and monetary policies have different effect on economic.

[Crossref] [Google Scholar] .

[Crossref] [Google Scholar] [Pubmed].

[Crossref] [Google Scholar] .

[Crossref] [Google Scholar] .

[Crossref] [Google Scholar] [Indexing in].

[Crossref] [Google Scholar] .

[Crossref] [Google Scholar] .

[Crossref] [Google Scholar] .

[Crossref] .

[Crossref] [Google Scholar] .