Research Article - (2021) Volume 0, Issue 0

Received: 03-Aug-2021

Published:

24-Aug-2021

, DOI: 10.37421/2375-4389.2021.s2.376

Citation: Khazaei, Mehdi. "The Impact of Global

Entrepreneurship Monitor Indicators on Corporate Profitability."

J Glob Econ 9 (2021) : 376.

Copyright: © 2021 Khazaei M. This is an open-access article distributed under the terms of the creative commons attribution license which permits unrestricted

use, distribution and reproduction in any medium, provided the original author and source are credited.

Given the role and importance of Global Entrepreneurship Monitor (GEM) indicators for businesses' performance and profitability, the question arises why no research has been undertaken internationally in this regard. Therefore, the main purpose of the present study is to investigate the impact of GEM indicators on the financial performance of top companies in the world. For this purpose, 176 top companies in the world from 2013 to 2018 that were profitable among the top 200 companies each year were selected as the statistical population. World Bank annual reports, GEM reports and Fortune reports were used to collect the data. Also the data analysis was done according to the panel data method using Eviews software. The results show that in general, there is a positive relationship between GEM index and financial performance of top companies in the world. On the other hand, the per capita income of the countries in which the top companies belonged was considered as a control variable and the results shows that the per capita income has a positive and significant relationship with the financial performance of the top companies in the world.

GEM • Performance • Profitability • Entrepreneurship • Per capita income

Every year a number of factors affecting the global economy, business policies andmergers, acquisitions and corporate growth influence the world's top 500 companies. Fortune reports that out of the top 200 companies in the world in terms of profitability in 2018, 61 are owned by the United States, which has the highest share in the world. On the other hand, in the Entrepreneurship Index, the United States has always been at the top of the ranking, and thus reflects the relationship between the financial performance of top companies and the Entrepreneurship Index. Of these 200 companies, 25 are Chinese, 21 are Japanese, 13 are German, 12 are French and 9 are UK. According to the World Bank, the total GDP of these six countries in 2018 was $ 48.673 trillion, and the world's total GDP was$ 85.791 trillion. Thus, more than 56 percent of the world's GDP belongs to these six countries, which also have the world's leading companies in profitability.

Factors affecting corporate performance include entrepreneurship, technology, marketing, product, management, finance, and environmental factors including turbulence, heterogeneity, environmental dynamics, competitiveness, and corporate exclusivity [1].

Economic, social and cultural, political, legal, technological and international environments influence entrepreneurship [2]. A weak contract and legal environment can increase business costs with the effects of employment, production, investment, productivity, and living standards [3].

Characteristics of the business environment are effective and predictive factors for entrepreneurial activities. In dynamic environments with growth, there is a greater desire for entrepreneurial activity, innovation and product development. While in static and unchanging environments, entrepreneurial activities and risky investments are less frequent[4]. The favorable business environment leads to increased entrepreneurial activities and consequently to increased employment, Knowledge production, economic growth and poverty reduction. Reforming the National Business Environment Improves Entrepreneurial Activities [5]. The level of public services and infrastructure development in an area is positively correlated with local entrepreneurial activities [4].

Theoretical foundations and research background

Found that entrepreneurial strategic orientation enables firms to take a more proactive stance towards environmental sustainability, which leads to successful corporate performance. In performance theory, the relationship between environmental, strategic and organizational factors on the one hand and the firm's financial performance on the other is examined. The performance of a company is measured using capital return, return on assets and return on capital employed (Ace Equity database).

The innovation theory of profits explains that economic profits arise because of successful innovations introduced by the entrepreneurs. It has been held by Joseph Schumpeter that the main function of the entrepreneur is to introduce innovations in the economy and profits are reward for his performing this function. Now, what is innovation? Innovation, as used by Schumpeter, has a very wide connotation. Any new measure or policy adopted by an entrepreneur to reduce his cost of production or to increase the demand for his product is an innovation.

High rates of new business formation are therefore expected to be a dynamic factor for economic development and employment growth. Entrepreneurship is referred to as the tendency of individuals to take up innovation, act to launch their own business, work for themselves and create employment for others.

Risk and Uncertainty Bearing Theory of Profit explains that profits are a necessary reward of the entrepreneur for bearing risk and uncertainty in a changing economy. So this is functional theory of profits. Profits arise as a result of uncertainty of future. Entrepreneurs have to undertake the work of production under conditions of uncertainty. In advance they have to make estimates of the future conditions regarding demand for the product and other factors which affect price and costs. In view of their estimates and anticipations, they make contract with the suppliers of factors of production in advance at fixed rates of remuneration.

The global entrepreneurship monitor

The conceptual framework of the Global Entrepreneurship Monitor stems from the fundamental assumption that the growth of the national economy is the result of individuals' abilities to identify and exploit opportunities, and this process is influenced by environmental factors that influence people's decisions in the environment. The pursuit of entrepreneurial motivation affects. Global Entrepreneurship Monitor has divided the entrepreneurial process into important components and relationships, and also grouped entrepreneurs according to the level of development of their firm.

Product innovation strategy and process innovation have a positive relationship with business performance and environmental dynamics [6-7].Companies can enhance their innovation by adopting three interrelated policies: fostering internal knowledge, gaining knowledge from external partners, and combining internal and external knowledge [8].

On the other hand, the level of infrastructure development, government incubators and venture capital funds has a significant positive impact on entrepreneurial activities [9].

Opportunity perception

In recent years, various factors affecting the identification of entrepreneurial opportunities have been identified. These factors include human and social capital, individual characteristics, and different levels of consciousness [10].

Institutional theory has been one of the theoretical frameworks in the study of the environmental impact of the opportunity recognition process. Recent research has used institutional theory to study opportunity recognition in emerging or underdeveloped economies. Tang has examined opportunity recognition in China. Where there have been institutional failures including prudent government policies and ineffective laws. He suggests that the human and social capital of entrepreneurs and their skills can help address such inefficiencies.

Entrepreneurial intention

Intention is influenced by one's choice and leads to continuity and guidance of behavior. According, empirical analysis indicates that intention is to successfully predict behavior and attitudes provide the basis for intention prediction. From Shook and perspective, entrepreneurial intention represents the individual's intention to start a business, and is a conscious process of mind that prioritizes action and drives one's desire to start a new business. Entrepreneurial intention is defined as a pre-action conscious state and guided towards a goal such as job creation [11].

States that intention is the best predictor of planned individual behaviors including entrepreneurship [11]. Shane and argue that the impact of intention is particularly critical when launching an entrepreneurial process. In addition, entrepreneurial intent can also partially affect ongoing economic activity. In fact, entrepreneurial intention is the intention of people to start a new business in the near future.

Fear of failure

Although the ability to take risks and seize opportunities is one of the characteristics of entrepreneurs, entrepreneurs continue to fear luck because the timing and extent of the risk is unclear [12]. One of the reasons for avoiding risk is the fear of unknowns, because when people do not have the necessary knowledge, and information about different issues, they avoid making decisions about issues where there is uncertainty [13]. Researchers attribute fear to unknowns to the extent of negative predictions about the future, such as forecasts of events such as natural disasters, economic downturns, and etc [14]. Have conducted empirical research on the "relationship between perceived fear level and business performance"[14]. Conducted an empirical study on "the success of entrepreneurs, the impact of fear on human performance" in order to examine the impact of fear and performance [15].

Innovation

Innovation is the process of thinking and turning it into a new product, service or way of doing things. Creativity means the power to create new ideas and innovation means to apply those new ideas [16].

Innovative capability enables the company to become a growing organization and enriches the company that leads to growth in performance [17]. Stated that there is a positive relationship between firm innovation capability and firm performance and that innovation is a critical factor for companies that need to provide competitive advantage over their competitors and that innovation ensures the survival of such companies [18]. And today's business environment requires continued growth in order to stay competitive and sustain corporate growth. Implementation of innovation capabilities and abilities is used as the primary mechanism of the organization to sustain long-term growth. Innovation can be technology-related; adopting and applying technology will increase corporate profits [19].

Organizational entrepreneurship

Organizational entrepreneurship is a process within organizations that seeks opportunities with individuals and organizations regardless of available resources [20]. Organizational entrepreneurship is usually crystallized through product innovation, process innovation, new market entry, new business development, strategic modernization, and organizational structure sometimes in many organizations organizational entrepreneurship is an important strategy for improving the performance of the organization [21]. There is a positive and significant relationship between organizational entrepreneurship and the performance of active companies [3]. According to research by, three dimensions of risk taking, pioneer and innovation that are components of organizational entrepreneurship have a positive and significant relationship with corporate performance.

Business performance

The measurement of business performance by financial and nonfinancial subjective indicators is adequate and this measurement can be used to measure business performance. According to, as well as research, the financial system has an impact on corporate performance and economic growth. On the other hand, there is a positive and significant relationship between competitiveness and profit management, according to research by and Rotemberg and.

Dynamic business capabilities generally include innovation, information capability and communication capability. Innovation capabilities include product design, new product development, and business process innovation. Information capability is one of the corporate processes for employing information technology to obtain process and transfer information to improve business operations, support decision-making and facilitate communication and coordination with external partners. According to the above, the research hypotheses are as follows:

Hypothesis 1: The innovation index has a positive relationship with the profitability of the world's top companies.

Hypothesis 2: The Organizational entrepreneurship index has a positive relationship with the profitability of the world's top companies.

Hypothesis 3: The Fear of failure index has a negative relationship with the profitability of the world's top companies.

Hypothesis 4: The Entrepreneurial intention index has a positive relationship with profitability of the world's top companies.

Hypothetical research model

Based on the hypotheses presented, the hypothetical models of the present study are shown in Figure 1.

This study is practical and in terms of data collection method this is secondary data. It is also a quantitative research method because it seeks to distribute the characteristics of a statistical population. The dependent variable of the research is the profitability of the world's top companies (Profit). The independent variables of the research are elements of GEM index including innovation (Inn), organizational entrepreneurship (EEA), fear of failure (Fea) and Entrepreneurial intention (Int) and per capita income (GDPPC) is considered as a control variable.

Every year, Fortune site a report on revenue, profitability, industry type, number of employees, and more from the top 500 companies in the world. Given that the dependent variable in this study is the profitability of the top companies and the profitability difference between the top companies and the down companies is high, out of 500 companies, 200 companies that have profitably ranged from 1 to 200 Statistical population is considered. As the present study attempts to investigate the impact of entrepreneurship indices on the profitability of top companies, the statistical population of the study is the countries whose company or companies were among the top 200 companies in the world for profitability from 2013 to 2018. In the present study, from 2013 to 2018, data on the top 200 companies in the world were extracted for profitability from 32 countries. Of these, 176 companies over the past six years have been among the top 200 profitable companies in 23 countries. Therefore, the world's top 176 companies are considered as sample size in terms of profitability of 23 countries in the statistical community. Data on the dependent variables, profitability of top companies, are extracted from Fortune's annual reports and data on independent research variables from the Global Competitiveness Index annual reports between 2013 and 2018.

Data analysis

Descriptive statistics and inferential statistics were used to analyze the collected data. The descriptive statistics of the graphs, Central indicators (mean) and dispersion (standard deviation) indices and SPSS software is used for this purpose. In the inferential statistics section, since the nature of the data is cross-sectional and time series, the panel data technique is used.

Panel data is a combination of cross-sectional data and time series, meaning that we observe cross-sectional data over time. It is clear that such data have two dimensions, one dimension being related to different units at each specific time point and the other dimension being time. The use of panel data methods over crosssectional and time series methods has two major advantages: First, it allows the researcher to consider the relationship between variables and even units (companies) over time, and The second advantage is the ability of this method to control the individual effects of companies (as cross-cutting units) that are not observable and measurable.

If one observes autocorrelation or variance heterogeneity, the generalized least squares (GLS) method can be used to estimate the coefficients. However, using this method requires some guesses about the variance-covariance matrix of the disturbance statements that the use of the variance-covariance matrix of the estimated OLS model as a starting point and the use of iterative methods can be helpful in this regard.

The minimum, maximum, mean, standard deviation, Kurtosis and skewness of the research variables are listed in Table 1. Because the distribution of the research variables is not normal by logarithmizing the data, their distribution is normalized. It should be noted that due to the large amount of corporate profits, these values are scaled between 0 and 100 to allow for comparison with other variables. For example, the highest profit is $ 53394 million, which is scaled to 99.8.

| Variable | Skewness | Kurtosis | St. Deviation | Mean | Max. | Min. |

|---|---|---|---|---|---|---|

| Profit | 2.833 | 12.657 | 13.621 | 14.751 | 99.8 | 1.8 |

| Inn | -0.237 | 5.282 | 8.091 | 30.702 | 60.530 | 0.760 |

| EEA | -0.407 | 1.667 | 22.851 | 42.414 | 77.850 | 0.870 |

| Fea | 0.861 | 3.552 | 6.089 | 37.064 | 57.460 | 26.750 |

| Int | 0.603 | 4.121 | 5.351 | 11.861 | 34.030 | 0.980 |

| GDPPC | -0.927 | 2.737 | 15.817 | 43.524 | 74.852 | 15.388 |

In order to analyze the data using the panel data method, a number of tests must be performed in the first step to determine the method of analysis. These tests are:

Unit root test

Before estimating the model, it is necessary to Durability test all variables used in the research model. Because the inaccuracy of the variables causes the problem of false regression. In this study, the Levin, Lin, and Chu (LLC) Unit Test were used to investigate the variables maneuverability. The basic assumption of the LLC test is the existence of a single root process between sections. Based on the results of Table 2, all the research variables are either at a stable level or in other words zero degree of accumulation.

| Degree of accumulation | Prob. | Statistic | Var. |

|---|---|---|---|

| I(0) | 0 | -43.631 | lnprofit |

| I(0) | 0 | -5127.2 | lngdppc |

| I(0) | 0 | -29.412 | lneea |

| I(0) | 0 | -18.894 | lninn |

| I(0) | 0 | -41.987 | lnint |

| I(0) | 0 | -15.764 | lnfea |

Research model analysis

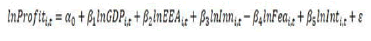

The first model: The purpose of this study is to investigate the effects of organizational entrepreneurship, innovation, fear of failure and entrepreneurial intention from GEM index on profitability of top companies in the world. In this regard, per capita income index is considered as a control variable.

Where α_0 is the width of the origin and ε is the estimated error. In order to estimate the above model, the F-Limer test and then the Hausman test for the type of estimation model should be performed. After confirming the results of these tests, the final model is estimated.

F-limer test

In order to investigate the type of model in panel data method, FLimer test was used. In this test, the null hypothesis of the existence of a pool method is tested against the hypothesis of a panel data method. If the null hypothesis is rejected, the model is panel data type and then fixed and random effects tests should be performed in the next step. If the null hypothesis is confirmed, the pool model should be used. Based on the results in Table 3, the null hypothesis is rejected. Therefore, panel data method should be used to estimate the model.

| Test | Statistic | d.f. | Prob. |

|---|---|---|---|

| F | 25.008 | -175,877 | 0 |

| Chi-square | 1421.32 | 175 | 0 |

Hausman test

Once the type of data has been determined, it is now clear which model should be used Fixed effects model or random effects model. In this study, the Hausman test was used to determine the type of model. If the null hypothesis of this test is rejected, the fixed effects model should be used; otherwise the random effects model should be used. Based on the results in Table 4, the null hypothesis is rejected. Therefore, the fixed effects model should be used to estimate the model.

| Test | Statistic | d.f. | Prob. |

|---|---|---|---|

| Chi-square | 1.805 | 3 | 0.663 |

Test of homoscedastic of likelihood ratio

Homoscedastic is a phenomenon in which the variance of disruption components changes over time or between sections. The existence of variance heterogeneity in the model results in estimates that, despite being consistent, is inefficient. Therefore, to ensure that there is no homogeneity variance problem, an homogeneity variance test should be performed. In this study, the likelihood ratio test was used to investigate the presence or absence of heterogeneity variance. The null hypothesis of this test is the homogeneity variance. Therefore, if the null hypothesis is rejected, it means that there is heterogeneity in the research model. In such circumstances, the GLS method should be used (Hawkins, 1981).

Based on the results in Table 5, the null hypothesis of the homogeneity variance test is rejected, meaning that the research model faces the problem of heterogeneity variance.

| Test | Statistic | d.f. | Prob. |

|---|---|---|---|

| likelihood ratio | 239.52 | 175 | 0 |

Wooldridge test for autocorrelation

Another test to be taken in panel models is the autocorrelation test. In this study, Wooldridge autocorrelation test was used. The null hypothesis of this test is the absence of autocorrelation with the disorder. If this assumption is rejected, the research model should estimate the model with AR (1). Based on the results of Table 6, the null hypothesis of the Wooldridge test has not been rejected, meaning that the research model has not encountered any autocorrelation problem (Wooldridge, 2002).

| Test | Statistic | d.f. | Prob. |

|---|---|---|---|

| Wooldridge | 0.002 | 175 | 0.96 |

Research model estimation

According to the results, innovation has the greatest impact on profitability. The estimated coefficient for per capita income is 0.044 which is significant at 99% level. This means that with a one percent increase in per capita income, corporate profits increase by 0.044 percent. The estimated coefficient for innovation is 0.081 which is significant at 99% level. That is to say, with a 1% increase in innovation, corporate profits increase by 0.081%. The estimated coefficient for organizational entrepreneurship is 0.046 which is significant at 95% level. That is to say, by increasing one percent of organizational entrepreneurship, corporate profits increase by 0.046 percent. The estimated coefficient for fear of failure is 0.076 which is significant at 95% level. That is to say, by reducing one percent of fear of failure, corporate profits increase by 0.076 percent. The estimated coefficient for entrepreneurial intention is 0.055 which is significant at 95% level. This means that by increasing entrepreneurial intention by one percent, corporate profits will increase by 0.055 percent.

At the end of Table 7, the coefficient of determination, the adjusted coefficient and the Durbin-Watson statistic are presented. The coefficient of determination is 0.972, indicating that the independent variables were able to explain 97.2% of the dependent variable changes. Also the adjusted coefficient of determination is 0.966 which due to the small difference of this coefficient with the coefficient of determination it can be said that there is no surplus variable model and the model is well fitted. Durbin-Watson statistic is also 1.489, so there is no correlation between the residuals.

| Var. | Coefficient | Std.error | t-Statistic | Prob. |

|---|---|---|---|---|

| lnGDPPC | 0.04436 | 0.01065 | 4.16549 | 0 |

| lnEEA | 0.04682 | 0.01701 | 2.75236 | 0.0001 |

| lnInn | 0.08104 | 0.02224 | 3.6443 | 0 |

| lnFea | 0.07663 | 0.03225 | 2.37662 | 0.0003 |

| lnInt | 0.05556 | 0.02712 | 2.04903 | 0.0008 |

| C | 1.82492 | 0.08478 | 21.5266 | 0 |

| R2=0.972 | R2adjusted =0.966 | D.W=1.489 | ||

In the present study, the impact of some elements of Global Entrepreneurship Monitor on financial performance of top companies in the world was studied. In this regard, the statistical population of this study was considered 200 profitable companies in the world and out of this, 176 companies that were included in this list from 2013 to 2018 were considered as sample. The results are therefore generalizable to the world's top companies, which generally belong to developed countries with high economic stability and high per capita income and have a favorable environment for entrepreneurship.

The result of this study confirms the research of [22].which showed that entrepreneurial orientation leads to success in business performance. On the other hand, the findings of the present study confirm research that sometimes in many organizations organizational entrepreneurship is an important strategy for improving the performance of the organization. As well as [3]. research, there is a positive and significant relationship between organizational entrepreneurship and performance of active companies.

The result of this study therefore confirms research that product innovation strategy and process innovation have a positive relationship with business performance and environmental dynamics. On the other hand, the findings of the present study confirm the research of that innovation capability enables the company to become a growing organization and enriches the company which leads to growth of its performance. As well as confirm Li and research stating that there is a positive relationship between firm innovation capability and firm performance and that innovation is a critical factor for companies that need to provide competitive advantage over their competitors.

Has shown in a study that fear of failure affects the performance of businesses, which the results of this study confirm this [13].

The result of this study confirms the view of Shook and that entrepreneurial intention represents the individual's intention to start a business and believe that entrepreneurial intention is a mental process that is prior to action and one's desire Directs you to start a new business.

Research limitations

In addition to the original findings, this study has some limitations that could be an opportunity for future research. The first limitation is that we only considered the macro factors affecting corporate financial performance. However, many factors at lower levels such as industry and firm also influence the financial performance of the company. Therefore, multilevel studies of corporate performance are a good opportunity for research. The second limitation concerns the financial performance of a company studied in this study. While nonfinancial factors are both important and essential for companies and may provide the basis for successful financial performance, this study ignored the corporate nonfinancial performance. The third limitation relates to the nature of data comparisons in secondary data, whose quality and conditions may vary across industries, companies and countries.

Journal of Global Economics received 2175 citations as per Google Scholar report