Research Article - (2022) Volume 11, Issue 1

Received: 04-Jan-2022, Manuscript No. IJEMS-22-51232;

Editor assigned: 10-Jan-2022, Pre QC No. P-51232;

Reviewed: 31-Jan-2022, QC No. Q-51232;

Revised: 02-Feb-2022, Manuscript No. R-51232;

Published:

09-Feb-2022

, DOI: 10.37421/2162-6359.2022.11.620

Citation: Hitihamu H.M.S.J.M and H.A.C.B Karunarathna. “Identification of Value Chain Gaps and Suggestions for the Dairy Development.” Int J Econ Manag Sci 11 (2022): 620.

Copyright: © 2022 Hitihamu H.M.S.J.M, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

The main aim of this study was to identify key actors in inbound logistics, their positions in dairy value chain and asses the actors in primary and support activities according to Portor’s Value chain approach. The study was conducted in Nuwara- Eliya, Kandy, Gampaha, Anuradhapura Kurunagala and Jaffna district to represent six dairy farming systems of Hill country, Mid country, Low country wet, Low country dry, Coconut triangle and Jaffna Peninsula. Cost of production of one litre of milk including family labour cost was RS.59.63, whereas excluding family labour Rs.29.78. The labour cost accounts for 50% and feed cost account for 46% of total cost. The main value chain actors under the inbound logistics are input supply such as feed, water, labour, veterinary services and animal breeding. MILCO, NESTLE, YALCO, LIBCO, CIC, Pelwatta, Cargills and Rich Life dairies play a major role in milk collection, storage, processing and distribution. To enhance the dairy value chain efficiency, concentrate feed cost should be reducing and need to increase quality grass in diet. Further, increasing infrastructure, support services, promotion of local products and convert small scale produces in to economic units, establishing quality management system and introducing an appropriate milk distribution mechanism will enhance the dairy value chain efficiencies.

Value chain analysis • Dairy industry • Farming systems • Sri Lanka

Agriculture plays an integral role in Sri Lankan economy. Livestock is one of the main agricultural sub-sectors, which produce high quality protein, vitamin and minerals in the form of milk, meat and milk derived products. Archaeological evidences indicate that dairying had been an integral part of agriculture in Sri Lanka since 400 BC. Cattle and buffalo had been reared as sources of milk, draft power and manure as well as living banks to be used in times of need, while large herds had been an icon of wealth [1].

In the context of Sri Lankan economy, value chain development is significantly important in dairy development. A value chain describes “the full range of activities which are required to bring a product or service from conception, through the intermediary phases of production, delivery to final consumers and final disposal after use” [2]. According to Jayasuriya M [3], dairy industry should develop because it increases food security, reduces rural poverty, reduces import bills and prevents the rural to urban migration. Furthermore, several constraints were identified in developing the Sri Lankan dairy sector including difficulties to access credit facilities, finding the correct breeding stock, difficulties in getting advisory and veterinary service in an effective manner and finding proper markets. Achchuthans S and Kajanathan R [4], who conducted a value chain analysis in the Killinochchi district found that majority of the famers, engage in dairy as a small-scale industry and to obtain better income existing farms should be transformed into large-scale farms. However, the knowledge on entire dairy industry, which representing different dairy farming system and management systems of the country are not available based on the value chain approach and identifying different value chains which required address value chain gaps from milk production to consumption.

For many rural smallholder farmers, dairy animals are a ‘living bank’ that serves as a financial reserve for periods of economic distress [3]. The Department of Animal Production and Health (DAPH) estimates that the domestic milk production was sufficient to meet 40% of the milk requirement of the country during 2018, while the rest was met through imported milk powder. The total domestic milk production was estimated as 414.83 million liters in 2020 which consisted of 363.2 million liters of cow milk and 57.6 million liters of buffalo milk. The total importation of powdered milk in 2020 was 102,365,524 kg and the total import bill accounted more than Rs.54 billion in 2020 and it became a huge burden to the economy of Sri Lanka. Managing dairy cow is one of the most important investments a farmer can make to improve their socioeconomic condition because of the valuable nutritional milk produced and diversify farming activities [5].

Value chain analysis of the dairy industry provides an understanding of dairy markets, their relationships, contribution of different actors such as; input suppliers, producers, farmer organizations, dairy processors, distribution and critical constraints that limit the growth of dairy production and consequently the competitiveness of smallholder farmers. In the prevailing situation, dairy farmers receive only a small fraction of the ultimate value of their output [4,6-8]. Value chain analysis can be a useful tool as an industry seeks to achieve competitive advantage. The value chain is a way of conceptualization the activities that are needed in order to provide a product or service to a customer with increased value. It depicts the way a product gains value (reduced costs) as it moves along the path of design, production, marketing, delivery and service to the customers [9]. According to Jayasuriya M [3], dairy production is stagnant due to various constraints in the input supply sector such as the higher price of concentrate feed, finding correct breeding stock and constraints to access credit.

Even though the dairy industry provides substantial benefits, in general, farmers are leaving the industry due to various reasons. Consequently, their livelihood is vulnerable to different natural and artificial shocks. Lack of appropriate marketing channels and limited degree of response from the respective government authorities that result in weak market integration are the impediments which affect the livelihood of these communities. Supporting such farmers to engage in different dairy related income generating activities, including marketing and processing could be a means to build their resilience against the shock they are facing. The study on value chain analysis of the dairy industry will help to understand different value additions and relevant value chains, which will be beneficial in identifying the most efficient value chains in the dairy industry to improve the competitiveness of the dairy sector. In addition, how value chain actors and stakeholders contribute to the value chain at different stages from producer to consumer could also be identified to understand the present context, problems and constrains along the value chains. By increasing the efficiency of different dairy value chains, more and more dairy farmers would be able to sustain their dairy farming systems.

This article mainly focusses to understand key actors and assess efficiency of actors involved in primary and support activities of dairy value chains and map the existing value chains. In addition, socio-economic standards of dairy farming also describe in detail. Further this article aimed to understand various value chain gaps in the areas of input management, productive and reproductive performance of cows, animal wellbeing, milk marketing, processing and final sale of the dairy products to consumers and provide possible solutions to enhance the dairy sector of the country.

The value chain concept can be divided into two main streams of literature: one is based on Porter’s Value Chain Model and other is known as Global Value Chains [7]. The concept of value was incorporated into the framework when researchers started to show where value is captured within a particular industry [7]. Value chain analyses are crucial importance for understanding the behaviour of the components of products flow from the producers to the end consumers. The value chain perspective provides an important means to understand the business-business relationships, mechanism for increasing efficiency and ways to enable a business to increase productivity and value addition [10]. Porter ME [11] claims that value chain analysis is a basic tool for diagnosis of competitive advantages and finding ways to create and sustain over it. Faida M [12] defines value chains as set linkages between actors who seek to support each other with the objective of increasing effectiveness and competitiveness. According to Jordan H, et al. [13] value chains analyse the links and information flows within the chain and reveals the strengths and weaknesses in the process. It also analyses the boundaries between national and international chains, takes buyers’ requirements and international standards into consideration. Porter ME [11] introduced the generic value chain model in (1985). Value chain (VC), represents all the internal activities of a firm engages in to produce goods and services. VC is formed of primary activities that add value to the final product directly and support activities that add value indirectly.

As shown by Tegegne A [14], land holding size, amount of income from sale of livestock and livestock products, the number of local and cross breed milking cows owned, access to market information and service contact frequency of extension, affected significantly the participation decision and level of participation of households in milk market supply. Rahman H, et al. [8] conclude that dairy farming provide means of livelihood for large number of small scale farmers and traders and also provide lion’s share of protein for the population of Bangladesh. Further, they explained that, dairy farming is profitable at small scale and value addition is profitable for the traders. Consumer price is the highest in different channels and milk packaging, transport costs are at higher level and need to be reduced to obtain better results from the industry. According to the study conducted in Ethiopia, Brhane G and Weldgegiorgis Y [15], identified different levels of value chain in input supply, production, marketing, processing and consumption. The major inputs are feed, veterinary service, artificial insemination, extension and labour. Further, dairy value chains are supported by public or private sector either directly or indirectly. Traditional milk production and processing shows low milk yield and hygiene. Achchuthan S and Kajunanthan R [4], in a study on milk value chain analysis in the Killinochchi district found that, dairy farmers of the district face financial difficulties and lacking the required knowledge to establish large scale farms. In addition, technical support, which required for milk preservation and value addition, was also unavailable in the district. However, the value chain information of different farming systems in Sri Lanka need to be study to understand the value chain gaps of the dairy industry.

Porter ME [16] concept of value chain analysis approach was utilized for this study. Accordingly, primary activities in the dairy value chain such as input delivery, processes or operations that input converted to output, outbound logistics, namely storage, transportation, processing, product distribution and marketing and sales, consumer services were analysed in detail. Furthermore, support activities such as farm infrastructure, human resource management, technology development and procurement and resources also discussed to understand the value chain gaps.

Study locations

Six main dairy production systems relate to agro climatic conditions, have been identified in Sri Lanka as up country, mid country, Coconut Triangle, wet lowlands, dry lowlands and the Jaffna peninsula. To represent the dairy production systems, six districts have been selected for the study and they are respectively Nuwara Eliya, Kandy, Gampaha, Anuradhapura, Kurunegala and Jaffna. From each district, 30 dairy farmers were randomly selected for the questionnaire survey and 53 randomly selected processors were interviewed. Among them, 12 processors were also engaged in dairy farming. The total sample size was 192. Some of the major collectors were also interviewed to gather information on value addition. The government representatives at district level in the dairy sector and the private sector service providers were also interviewed.

Data collection

Data collection consisted of secondary data collection, focus group and key informant discussions, direct interviews and a questionnaire survey.

Data collection was performed using demography of the sample population, dairy management systems, socio-economic standards, herd composition, milk production characteristics, service providers in the milk collection, milk collecting, milk processing, and economic viability of dairy farming in different scales of operation.

Under the farm infrastructure, system of dairy management was considered as an indicator. Under human resources management, farmers’ level awareness was assessed by the number of training programmes they had attended and other extension services offered by the government and non-government sectors were also examined. The resource availability of dairy farming, such as concentrate feed availability, cost, grassland availability grass varieties, water availability, breed types, veterinary and medicine and other support services was also investigated.

The primary activities within the industry were identified as in-bound logistics, operations, out-bound logistics, marketing, sales and customer services. In Sri Lankan dairy sector, most of the dairy farmers produce raw milk within their farms and sell to the formal milk collectors. Therefore, according to the Porter’s Value Chain Framework, in-bound logistics and operations were undertaken. Indicators such as the concentrate feed cost, labour type, labour cost, cost of veterinary medicine, grassland availability; grass type, breed and availability of fixed resources were considered.

Statistical analysis

To measure the input - output relationship in milk production function, Cobb- Douglas production function was used [17].

Variables used in the analysis:

• Number of animals/herd, Milk production, Milk production/breed, Cost of production/litres of milk, Total cost/herd, Total expenditure, Profit and profitability

• Cobb-Douglas Production Function

• Cobb-Douglas Production Function is used in agricultural and livestock sectors to understand input - output relationship. It is linear in its logarithmic form.

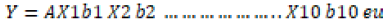

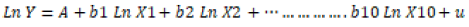

The following Cobb-Douglas function (1) fitted to the data in its log-linear form (2)

(1)

(1)

(2)

(2)

Where Y is the dependent variable and X1………….X10 represent the different independent variables and the b1…………b10 are the partial elasticities of different independent variables.

Dependent variable:

Y=Milk production (litres/herd/day)

Independent variables

X1=labour hours/herd/day

X2=Amount of concentrate feed=kg/herd/day

X3=Cost of veterinary and medicine (Rs/herd/day) (It was assumed that in study area, price of a particular medicine is considered as same price)

X4=Cost of Transport (Rs/herd/day)

X5=Cost of insurance and other maintenance (Rs/herd/day)

X6=Fixed cost (Rs/Farm/day); (Depreciation also considered as same values)

X7=Breed type (improved=1, local=0)

X8=Cost of Transport (Rs/herd/day)

X9=Years of experience in cattle rearing

X10=Management type (intensive=1, extensive=0)

Socio-economic state of the dairy farmers

Accordingly, to the analysis, the youth below 30 years of age, involvement in dairy farming were approximately 7% of the sample, elderly farmers in between 30 to 60 years of age represented 48% and senior farmers above 60 years consisted of 45% of the sample. Further, male female ratio of the dairy farmers in the study area is 84% to 16%. Land availability for the dairy farming explained that 55% of farmers owned less than 0.5 acres of land where as 25% of the farmers owned more than 2 acres of land for dairy farming. However, 33% of the farmers having more than 20 years of dairy farming experience and last five years 16% of dairy farmers initiated dairy farming as income generating activity. 2.6% of the farmers were university graduates and 4.7% had high school qualifications (G.C.E. Advanced Level), 15.63% had received primary education, 39.09% had secondary education and 38.53% had Passed G.C.E. (Ordinary Level). With respect to the income, 28.6% received less than Rs.20,000, 38% received in between Rs.20,000 to 40,000, 21.8% received Rs.40,000 to 60, 000 and 11.4% received more than Rs.60,000 from daily farming.

Characteristics of dairy farming

Figure 1 illustrates the dairy management systems in the study area and it is clear that majority of the farms practice the semi intensive system in all selected districts. In Jaffna and Nuwara-Eliya majority of the farmers follow semi intensive method. This study clearly shows that the extensive management system is diminishing even in the dry zone areas.

Figure 1. Dairy management systems in the study area.

Figure 2 explain the cattle breed distribution in different districts. The breed jersey was dominant in the districts of Gampaha, Kandy and Anuradhapura for its heat resistant characteristic and their high yield potential. The Kurunagala district represents the Coconut Triangle farming system and consists of breeds such as jersey Frisian crosses and jersey X Sahiwal crosses. However, in the Nuwara-Eliya district, has Frisian breed mainly that suits the cool climatic condition while showing higher production performance. Jersey breed represented 45% of the total cattle population of the sample. In Jaffna, jersey breed represents 35% while Frisian at minimum level. However, the other breeds, especially the number of crossbred are much higher than the pure improved breeds in the district.

Table 1 explains the average milk yield of the different breeds and minimum and maximum production potentials of these animals.

| Breed Type | Minimum litres/day | Maximum litres/day | Average litres/day |

|---|---|---|---|

| Sahiwal | 1 | 12 | 6.93 |

| AFS | 4 | 14 | 9.94 |

| Jersey | 2 | 14 | 8.35 |

| Frisian | 2 | 13 | 9.76 |

| Sahiwal-Jersey | 3 | 15 | 8.25 |

| Jersey-Frisian | 2 | 13 | 9.5 |

Milk value chains in the study area

1. Milk producer (Farmer) → Value Addition at farm (6%) → Consumers

Milk toffee, Curd,

2. Milk Producer Formal Collector+ milk transporting → Consumers + Milk processing + distributing

3. Milk Producer informal or Private Collector +milk transporting, processing Consumers + Distributing

4. Milk producer → Informal collector formal collector → Consumers Milk transport + processing + distribution

5. Milk producer Consumers

The study reveals that, there are five main value chains in the study area. The most dominant type is the second value chain, where farmers produce milk at their farms and sell to the main collectors. Then collectors process the milk in their factories and distributed to the sales centres and consumers. Within the second chain, there is a high competition for milk collection in lean periods of production. Further, the first value chain is practiced by only 6% of the sample population and they involved in valued addition, which do not require sophisticated technology and machineries. Small-scale and medium-scale milk producers practice third value chain and they involved in milk processing with limited resources. However, these processors obtain a smart income from iced milk packets, which is popular among children. Forth value chain is operating at very remote areas where villages do not have proper infrastructures. Due to absence of formal milk collectors, informal collectors collect milk and sell to the formal collectors. This includes several value points and ultimately farmers receive lower price to their milk. Limited number of farmers practices the fifth value chain. They sell their milk to neighbours, hotels, schools and sometimes they operate small milk bars.

Value chain actors

Porter’s value chain involved inbound logistics, operations, outbound logistics, marketing and sales and customer servicers. Accordingly, inbound logistics in the study area can be described as feed, water, labour, veterinary service and medicine and the supply of animal breeding.

Feed supply: Feed, are the most important aspects of input supply, are two types: as forage supply and concentrate feed supply. Forage supply in Sri Lanka consists of dry forage and fresh forage. In Sri Lanka most of the farmers depend on natural grasslands. The study showed that 65% of the farmers rely on natural grasslands whereas 35% of the farmers maintained own grasslands. However, 55% of the grass cultivators were having less than 60 purchases of grasslands and 45% of the grass cultivators were having more than 60 purchases of grasslands. Since land is a limiting factor; dairy farming is mainly relying on natural grasslands. Further, the majority of cultivated grass variety is CO-3 which was grown by 91% of the grass cultivators.

It is also reveals that two farmers who operate large-scale dairy farming maintain the grasslands of an extent of around four acres and have cultivated the improved grass types such as CO-3 and CO-4. These farmers prepare hay within their farms to feed the animals during the dry season of the year. However, silage-making farmers were not identified among the sample population. Furthermore, 20% of the sample farmers maintain more than an acre of grassland in the study area. It was observed that the improved grass variety of CO- 4 is becoming popular among the dairy farmers in study area. The Indian Council of Agriculture Research (2012) describes that CO-4 matures before CO–3 and management, leaf width and size of the plant was also better than that of CO-3. Further, it is more succulent, palatable and liked by cattle and feeding one bundle (15 kg) of CO-4 increases the yield by 200 ml per cow.

There are number of concentrate feeds available in the study area. Prima feed is the most famous among the dairy farmers. In addition to commercial concentrate feed, Coconut meal, rice bran, dhal husk, Omi are other types of concentrate feeds used in the study area. Generally, a kilogram of Prima feed costs above LKR. 60.00 Whereas coconut meal and dhal husk costs LKR. 55/=and LKR. 40/=per kg respectively. Rice polish and rice bran also have high demand in the dairy input market and the price of rice polish varies from Rs.LKR 25/=to LKR. 30/=per kg. When considering the relationship between concentration feeds and milk yield, it was observed that farmers provide less than 0.5 kg of concentrate feed obtain an average milk yield of 2.91 litres per day without considering the breed type. The farmers who supply 0.5 kg–1 kg of commercial feed yields 2-4 litres of milk and more than 2 kg of concentrate feed yields around seven litres of milk per day. However, these production capabilities are most likely to depend on the breed and the management practices.

Water supply: The amount of water lost from a cow’s body depends on the animal’s level of activity, Ambien temperature, relative humidity, respiratory rate, water intake; feed consumption, milk production and management factors. Michael and Dan, (2007) explained that, cows need 60 to 120 l of water per day depending on the body weight, climatic condition and the physiological status of the animal. Drinking water covers 80- 90% of the dairy daily water requirement and the rest are taken with feed. There are three main water sources identified in the study area. 52% of the dairy farmers in the sample rely on well water. Pipe borne water was utilized by 25.5% of the sample whereas river or lake water is used by 23% of the dairy farms. The farmers who practice extensive farming are more likely to use well water, river or lake water. Dairy farms managed under the intensive system mostly utilized the pipe borne water.

Labour supply: The study showed that the majority of small-scale dairy farmers utilize family labour. Full time dairy farmers who engage dairy farming as their main income spend whole day for farm activities. The study indicated, a farmer of small-scale farm of 6 animals in a herd has to spend 7 hours per day for the dairy management activities. Large scale farms utilized hired labour and the labour at a cost of Rs.1500.00 per day.

Animal breeding: Dairy farmers practiced both natural breeding and artificial insemination in their herds to obtain new animals. This study reveals that 95% of the farmers opted for artificial insemination as a breeding method and 5% of the farmers practice natural breeding by borrowing a high quality bull. Natural breeding is mainly practiced in Jaffna district due to unavailability of Artificial Insemination services.

Veterinary services: The study explained that 74% of the sample farmers obtained advice from the Livestock Development officers whereas 26%of the farmers received advice from the Veterinary Surgeons. 90% of the farmers are capable of obtaining the AI service from the officials. However, 10%of the farmers stated that they were unable to obtain the service at the required time. In addition, the importance of having a mobile veterinary service unit in the dairy management dominant areas of the country was also stressed. Study showed that majority of the farmers and officers focus on the importance of 24- hour service and holiday service to the required dairy farmers, to enhance the productivity of the dairy industry. 60% of the sample receives good service from Livestock Development officers and most of the LDIs try to reach within the expected time for an artificial Insemination. In addition they provide required extension services to the farmers.

Out bound logistics: Farmers sell their milk in the form of raw milk to collectors in respective areas. Study found that 94% of the farmers sell milk to main collectors and 6% of farmers engage in value added production or milk processing.

Milk storage is primarily done by the collectors and processors in the value chain. Farmers usually involve in morning milking and they sell the milk to the collectors. However, in Kurunagala district evening milk collection was observed. Farmers who do not sell milk in the evening used to store the evening milk yield in their domestic refrigerator until the next morning.

Milk collectors: In Nuwara- Eliya district, 73% of the farmers sell to Milco and the rest of the farmers sell to Palawatta, other private collectors and to hotels. In Kandy district too Milco is the leading collector and Nestle and other private collectors also engage in milk collecting. In Kurunegala district, Milco is the main collector and Nestle, Cargill’s and other cooperative societies collect a significant amount of milk. In Anuradhapura district, Milco plays the leading role in collection. However, in the Gampaha district Cargill’s contributes to 49% of milk collection. In addition, Rich-Life, cooperative societies and Milco also collect milk in the district. In general, Milco acts as the main collector and even in high production seasons, farmers can sell their products to Milco. In certain areas in the Kurunegala district Milco collects milk in the evening as well (Figure 3).

Figure 3. Milk collectors in the study area. (Source- Survey data 2019-2020).

Milco: Milco private limited is the biggest state sector organization and the strongest milk-collecting network functioning all over the country. Principal activities of the company are collecting, value addition and distribution. MIlco has formed Dairy Farmer Managing Societies in the milk collecting centres and introduced welfare facilities to the dairy farmers. Milco collects 170,000 litres of milk daily and produce value added products under the trade name of Highland. Milco produces pasteurized milk, sterilized milk, yoghurt, curd, butter, ghee, processed cheese, ice cream, condensed milk and UHT milk. Being the largest milk collector, it is essential to improve the outbound logistics such as storage facilities by introducing mini coolers in the dairy organization level which helps strengthen the evening milk collection and improve value chain efficiency.

Nestle: Nestle is a multinational company and one of the world’s largest beverage companies. It is one of the largest private sector milk collectors operating all over the island. Nestle milk factory is located in Kurunegala district. Nestle milk collectors also have formed Farmer Managing Societies and provide welfare benefits to dairy farmers. In addition, they have introduced rules and regulations to maintain safe milk production and advise dairy farmers and collecting centre workers to ensure safe milk production. According to the volume of milk supplied the farmer centric benefits also change. Farmers who supply milk continuously for two years will receive benefits for incidences like: death of a family member, death of the parents of milk farmer, educational achievements of family members, critical illness or accident causing handicap condition to a farmer and for important life events However, if farmer does not supply milk continuously for two years their membership will be terminated. As described in the Porter’s Value Chain Concept under primary activities, production of quality products and ensuring customer satisfaction is important. Therefore, as Nestle practices, to develop the dairy value chain, production of clean milk and following standard operation procedures are important.

According to the quality of the milk, Nestle determines the price. In the case of disease of animals, Nestle provides free essential medicines to the farmers. In addition, Nestle provides support to build cattle sheds and loan facilities for large scale dairy farmers.

Jaffna District Development Co-operative (JDDC)

YALCO is the common name for the Jaffna District Development Co-operative and main milk collector in Jaffna district. Nine hundred farmers supply milk to the YALCO. There are 27 milk collecting centres operated in the district. Around 6000 litres of milk are collected daily. YALCO consists of 61 employees. The Board of Directors of YALCO consists of six farmers and three officials. Among six farmers, two should be younger than 35 years. Farmers in the board of directors are being selected by an election. Out of three officers, the district government argent selects two officers. The Ministry of Agriculture selects the other.

From total collection, 75% of the milk is sold as raw milk to the identified customers. The remaining 25% is utilized for value added products such as yoghurt, ice-cream, ghee, paneer, curd, lollipop, iced milk packets and pasteurized milk. YALCO collects milk two times a day. Milk price is determined by the fat and SNF content of the milk.

Table 2 explains the cost of production of dairy products produced by YALCO. According to the cost of production, YALCO determines the selling price to maintain the profit margins.

| Product Type | Unit | Cost of Production |

|---|---|---|

| Ice-cream | 1 cup | 20.00 |

| Yogurt | 1 cup | 20.00 |

| Milk lolly | 80 ml | 7.50 |

| Curd | 1 L | 70.00 |

| Milk toffee | 1 piece | 6.00 |

| Paneer (fat) | 1 kg | 1000.00 |

| Paneer (non-fat) | 1 kg | 500.00 |

| Pasteurized milk | 500 ml | 46.00 |

| Ghee | 750 ml | 1025.00 |

YALCO also provides animal feed to the farmers on loan basis. It includes dhal husk and mineral mixture. Gingerly poonac and coconut poonac are usually provided on request. The feed costs are deducted from the milk earning. UNDP provides Rs.5 to YALCO for every litre of milk and under this agreement the dairy farmers automatically contribute to raise the fund in the YALCO. Farmers are eligible to receive loans from the raised fund. 90% of the fund is available for loan facilities for dairy farmers and it should be repaid within a year.

LIBCO (Livestock Breeders’ Cooperative Society)

LIBCO milk collecting and processing centre is situated in the Jaffna Karaveddy GS division. There are six branches and it is running as a milk cooperative. At present, there are 18 employees and they produce value added products. They collect 400 litres of milk per day and sell 300 litres of milk in the form of raw milk and 100 litres of milk are used for producing value added products. Evening milk collection does not function properly due labour shortage. Lack of evening milk collection decreases the efficiency of the value chain and it is important to provide mini coolers at village level or for Farmer Managed Societies. LIBCO pay Rs.67/=per litre of milk and deducts one rupee as compulsory saving to the farmers and company contributes 50 cents per litre to the fund.

Table 3 illustrates the cost of production and selling prices of different processed products produced by LIBCO.

| Product | Unit | Cost of Production (Rs.) per unit | Wholesale Price (Rs.) | Retail Price (Rs.) | |

|---|---|---|---|---|---|

| Product cost | Label Cost | ||||

| Curd | 150 ml 250 ml 500 ml 1 l |

20/- 30/- 56/- 100/- |

4.00 6.90 14 16 |

30/- 40/- 70/- 130/- |

|

| Yoghurt | 11/- | 4.13/- | 20/- | 25/- | |

| Paneer | 850/= Per kg | 950 Kg | 1200/- Per Kg | ||

| Ghee | 1 bottle ¼ bottle ½ bottle |

700/- 175/- 350/- |

900/- 225/- 450/- |

1000/- 250/- 500/- |

|

| Milk toffee | 1 Piece | 3.50/- | 5/- | 4/- | |

| Milk lolly | 1 Packet | 6.50/- | 8/- | 10/- | |

| Non Fat Paneer | 1 Kg | 570/- | 750/- | 850/- | |

CIC dairies

CIC Dairies milk factory is situated at Dambulla and there are 550 registered farmers. There are six main routes that CIC collects milk.

During the peak production, CIC Diaries collect an average of 4500 litres of milk per day. However, in the lean period their collection drops to 2900 – 3500 litres of milk per day. CIC pays Rs.63.00 to Rs.67.00 per litre depending on the quality of milk. The company maintains the quality of milk by rigorous quality checks. If the quality is not up to the company accepted level, they reject the milk and provide a detailed report stating the reasons for rejection.

As per other collectors, CIC has also provided financial benefits to the farmers on their special life events. Further they provide dairy inputs at a subsidized rate and provide welfare facility to farmers. CIC add LKR 0.20 per every litre of milk for the welfare fund. Company provide training facilities to the new farmers on milking, feeding, feed preservation, prevention of diseases etc. in addition CIC is working with NGOs and provide facilities to the regional milk collecting centres to upgrade the quality of milk.

Palwatta dairies

It is a leading manufacturer of the locally produced dairy products in private sector. According to 2017 statistics, they support 25,000 to 30,000 farm families. Palwatta collects 150,000-200,000 litres of milk per day. Depending on the fat and solid non-fat content, price of the milk is determined. The company manufacture value added products including powdered milk. They also have formed Famer Managing Societies at the milk collection centres and provide welfare services and farm inputs on credit. This situation indicates that the company has formed an efficient milk collection network.

Cargills dairies

It was established in 1967 at Bogahawatta, Pathyana and Upper Kothmale. The Cargill’s Dairies expected to become the most trusted dairy brand in Sri Lanka and their Vision is to become the largest contributor to the national dairy industry. At present, Cargill’s collects 170,000 litres of milk daily. Cargill’s Dairies also maintain Famer Managing Societies at the collection centres and have introduced welfare facilities to the dairy farmers. The farmers are entitled to benefits after continuously supplying milk for six months. Farmers receive benefits for educational achievements of the family members, in the event of death or permanent disability.

Rich-life dairies

Rich-life Dairies Ltd. member of Renuka Shaw Wallace PLC, is a premier private sector milk collector, food and beverage company. They also maintain Famer Managing Societies in the milk collecting centres. Depending on the quality of the fresh milk, Rich life determines the price of milk. The primary focus of Rich life is to strengthen the milk collection network throughout the country and extend support to the rural dairy farmers to uplift their economy.

Economics of milk production

The cost of production of a litre of raw milk was calculated. In addition, the cost of production of value added products were calculated at the small and medium scale. Further, Cobb- Douglas Regression Model is utilized to understand the input-output relationship of milk production.

According to the Cobb-Douglas analysis of the data collected from the study the following regression model is derived. (Table 4).

| Coefficients | ||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | .837 | .100 | - | 8.381 | .000 |

| LN_X1 | .414 | .037 | .490 | 11.036 | .000 | |

| LN_X2 | .073 | .014 | .202 | 5.089 | .000 | |

| LN_X3 | .040 | .019 | .085 | 2.114 | .036 | |

| LN_X6 | .085 | .010 | .391 | 8.892 | .000 | |

| LN_X7 | -.047 | .059 | -.031 | -.795 | .428 | |

| LN_X10 | .042 | .060 | .027 | .691 | .490 | |

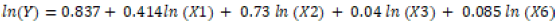

Estimated Regression model is

As shown in the model summary, 73.8% of the variance in the data can be explained by predictor variables. This indicates that the model explains 73% of the variance of the data (Table 5).

| Model Summary | ||||

|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .860a | .739 | .731 | .37342 |

The model helps to understand the effect of each variable to increase the milk production. Accordingly, above regression model explained that, amount of labour, amount of concentrate feed, cost of veterinary and medicine and fixed cost significantly affected the milk production. However, breed type and management type did not significantly influence the milk production according to the model. In general, breed type and the management type should have a significant influence on the milk production. However, in the study area, there is no significant effect of breed type on improved and local breeds. Further, the herd management type should have a significant effect. However, it may be due to lack of practice of better management practices. Even though the study identified the system as intensive, semi intensive or extensive, the feeding of nutrient rich feed may be restricted. This problem was investigated in the field level and it was observed that correct feeding was not being practiced. As a result of limitations in concentrate feed feeding, breed type might not have a significant influence on the milk production.

Cost of production of milk

Cost of production of milk was calculated inclusive and exclusive of family labour. The cost of production per litre of milk was LKR 59.63 and the labour cost accounts for 50% of the total cost of production whereas feed costs account for 46%. Other than the above main cost categories, medicine, operational cost, breeding cost also account for 4% which is illustrated in Table 6.

| Cost | Mean (Rs) | Percentage (%) |

|---|---|---|

| Cost of Feed | 27.45 | 46 |

| Labour Cost | 29.85 | 50 |

| Medicine Cost | 0.57 | 1 |

| Operational Cost | 0.93 | 2 |

| Breeding Cost | 0.83 | 1 |

| Cost of Production with Labour | 59.63 | 100 |

Table 7 illustrate the average cost of production without labour. The calculated feed cost was 92% whereas the medicine cost, operational cost and breeding costs account for 8% of the total cost.

| Cost | Mean (Rs) | Percentage (%) |

|---|---|---|

| Cost of Feed | 27.45 | 92 |

| Medicine Cost | 0.57 | 2 |

| Operational Cost | 0.93 | 3 |

| Breeding Cost | 0.83 | 3 |

| Cost of Production without Labour | 29.78 | 100 |

Table 8 illustrates the cost of production inclusive and exclusive of family labour according to the number of milking animals in the herd. This indicates that to obtain the maximum benefit out of the labour it is appropriate to rear six animals in a farm unit.

| Number of Milking Cows | COP without Labour (Rs) | COP with Labour (Rs) |

|---|---|---|

| 1 – 3 | 26.3 | 65.09 |

| 3 – 6 | 27.59 | 53.4 |

| 6< | 32.25 | 60.9 |

Cost of production of value added products

Curd production: Curd is a popular milk product in Sri Lanka. Traditional curd production systems are practiced, especially in the low country dry zone of Sri Lanka. In addition, in districts Gampaha, Colombo, Kurunagala that practice buffalo rearing is also famous for curd production. At present, both cow’s milk and buffalo milk are utilized for curd production. Curd production can be introduced as a household industry since it does not require sophisticated equipment and knowledge. It is noted that several families are engaged in curd producing industries at small and medium scales with milk being collected from surrounding farms.

Table 9 illustrates the cost of production of a litre of curd pot by an external producer (who buy milk from outside).

| Cost Item | Cost (Rupees) |

|---|---|

| Milk | 81.59 |

| Labour | 08.03 |

| Pot/Label | 19.82 |

| Operational cost | 1.47 |

| COP /Curd | 110.91 |

Yoghurt production: Yoghurt production is not very common among Sri Lankan dairy farmers. A few farmers engaging in value added production are involved in yoghurt production. The cost of production of a cup of yoghurt is illustrated in Table 8. The selling price per cup is Rs.35/-. However, small scale manufacturers complain that production of yoghurt is not profitable as they have to compete with multinational companies (Table 10).

| Cost Item | Cost (Rupees) |

|---|---|

| Milk | 6.40 |

| Labour | 0.07 |

| Pot/Label | 7.10 |

| Operational cost | 0.41 |

| COP / Yoghurt | 13.98 |

Based on the interviews had with yoghurt producers, it is possible to produce 10-12 cups of yoghurt from a litre of milk. The cost of production per 1 yoghurt is Rs.13.98. However, producer sells the one yoghurt for Rs.20.00-22.00. Therefore, the yoghurt industry is profitable to the producer. However, traders sell a cup of yoghurt for Rs.35.00 the profit is distributed in the market chain (Table 11).

| Cost Item | Cost (Rupees) |

|---|---|

| Milk | 35.00 |

| Labour | 5.78 |

| Pot/Label | 41.80 |

| Operational cost / electricity | 0.9 |

| COP / Ice-cream(1litre) | 83.48 |

Milk toffee – milk based candy: Milk toffee production is popular among rural women. In Kandy district, there is a well-established milk toffee producer and she has become the best entrepreneur in the small-scale processing sector. The cost of production of a piece of milk toffee was Rs.1.97. However, the wholesale price is Rs.4.00 per piece and in the retail market it is Rs.6.00. Milk toffee has a high demand in small teashops

There are five main dairy value chains are identified in the study area and only 6% of the dairy producers involve in value addition. Most of the dairy farmers produce the milk in their farms and sell to the formal collectors. Formal collectors engage in milk transport, milk processing and milk distribution to the consumers as processed products.

According to the economic analysis, labour cost accounts for half of the total cost of production and concentrate feed cost accounted for 46% of the total COP. The cost of production of small scale dairy farms with 3-6 milking animals in a herd accounts for Rs.53.40 per litre. The analysis proved that the small scale milking farms with 3-6 milking animals in the herd is the ideal number to increase the profitability of dairying. Cobb-Douglas Production Function illustrates the input - output relationship of milk yield. Variables such as labour hours per day, amount of concentrate feed kg/day, cost of veterinary and medicine per day and fixed cost per day are significant for the milk production. However, breed type and the management systems did not significantly relate to the milk production. Ice-cream production shows the highest profit margins and all other products return higher benefits and higher demand in the market. The small scale yoghurt producers face difficulties when competing with the multinational companies. Therefore, promotion of local products and small scale producers is essential and the testing the quality of all the products are important.

As revealed by the study, Milco is the leading collector and distributor all over the country. In addition, Nestle, Richlife, Palawatta, Cargills are the top collectors, processors and distributors. Furthermore, some private collectors also actively involved in the milk collection and processing. The well-established state and private dairy companies create a competitive milk collecting network and depending on the fat and solid non-fat content the milk pricing is determined. LIBCO and YALCO are the milk collectors that operate in the Jaffna district. All the private companies and other private collectors complain that there is no sufficient and stable milk production around the year and they are also engaged in enhancing the quality and the quantity of milk and dairy farmers’ wellbeing.

From the selected sample, more than half of the farmers practiced semi intensive type of management of cattle farming. The extensive systems are threatened in low country dry zone due to absence of natural grass lands and deterioration of existing grasslands specially the traditional curd industry. Therefore, it is important to educate farmers and support them to shift from extensive to semi intensive systems for enhancing the milk production and protect the environment. The input gaps such as feed cost, knowledge gap of farmers, veterinary services and medicine, breed availability, quality grass production, grass preservation and other social problems should be addressed to increase the milk production of the country.