Review Article - (2022) Volume 11, Issue 4

Received: 24-Jan-2022, Manuscript No. IJEMS-22-46700;

Editor assigned: 27-Jan-2022, Pre QC No. IJEMS-22-46700;

Reviewed: 10-Feb-2022, QC No. IJEMS-22-46700;

Revised: 24-Mar-2022, Manuscript No. IJEMS-22-46700;

Published:

01-Apr-2022

, DOI: 10.37421/ 2162-6359.11.638

Citation: Tano JilengaMoga. "Econometric Analysis of the

Impact of Economic Growth and Inflation on Unemployment rate in

Tanzania ." Int J Econ Manag11 (2022) : 638.

Copyright: © 2022 Jilenga MT, et al. This is an open-access article distributed under the terms of the creative commons attribution license which permits

unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.

Studies on the relationship between unemployment and economic growth both in developed and developing countries is still debatable. This study investigates the impact of economic growth and inflation on unemployment rate in Tanzania. We use time-series data for the period spanning from 1991 to 2020 and the Dynamic Ordinary Least Square (DOLS) technique to analyse the relationship of unemployment and economic growth for the case of Tanzania. The DOLS technique is used due to its superiority in estimating the long-run and short-run coefficients of co-integrated series. The results from the empirical analysis found that there is significant negative long-run relationship between economic growth and inflation with respect to unemployment rate in Tanzania. Thus, both the real Gross Domestic Product and inflation rate are statistically significant in influencing unemployment rate in the long-run. The study recommends that; first, in order to reduce unemployment rate, industrialization is highly encouraged if the country is to promote economic growth. Secondly, monetary and fiscal policies should be used in controlling the flow of money in the economy which results in the control of inflationary negative outcomes.

Unemployment • Inflation • Economic Growth • DOLS

Unemployment rate is one of the most conspicuous measures of how well an economy is performing. High rates of unemployment are a signal of economic distress, but extremely low rates of unemployment may signal an overheated economy. Scholars and researchers have identified that when the economy expands, it characterized by increasing investment opportunities, increasing employment level (low unemployment), as well as a high demand for goods and services. The economic growth in relation to unemployment rate in Tanzania is still a paradox on whether it has any contributions to the life of her citizens especially in employment perspectives. High unemployment rate affect the distribution of economic wellbeing among the citizens. People who cannot find work suffers from ability to acquire goods and services due to low disposable income, lowering their living standards compared to those employed [1].

A good measure used by economists to observe and analyze the problem is through unemployment rate, which is the proportions of the labor force that would like to work, but cannot find jobs. Plummeting unemployment and achieving high economic growth are important priorities for both developed and developing country economies. According to International Labour Organization (ILO), unemployment is defined as a situation whereby the people (adult with age of 16 or above) who are willing and able to work at an existing wage rate, cannot find a job. Therefore those people who are without work and not seeking for a job as well as those below the working-age like under-aged children, disabled people, full-time housewives and such others are not included in the labour force and therefore are not considered unemployed. The incidence of unemployment in Tanzania is considered as a foremost national developmental challenge both economically and socially [2].

Tanzania economic performance has continued to be stable and strong over the past decade. The economy continued to expand gradually with the real GDP growing by 7.0% in 2018, maintaining the high growth momentum over the past five years. According to African economic outlook, growth slowed to 2.1% in 2020 from 6.8% in 2019 because of COVID-19. Growth was driven mainly by construction and manufacturing on the supply side and investments on the demand side. The current population in Tanzania is about 55 million [3]. The population in Tanzania is growing at 2.7% per year, which is two times more than the global average of 1.2% per cent and average in Africa about 2.5%. The population is increasing very fast leading to an increase in the number of the labour force who in turn fail to find a job. As the consequences, the number of informal sector is enlarging over time. Pointed out that families have high expectation for their children to have jobs soon after graduating, although many youths are completing school and universities without stable employment, making youth unemployment to be among the major challenges in Tanzania has stated that, despite the county experiencing strong economic growth, the annual unemployment rate was rising from 2%in 2005 to 2.9% in 2013. Despite the government efforts in initiating the National employment policy, unemployment still remains a challenge [4].

Studies conducted at the national level such as focused on youth unemployment. Most of these studies suffer from one or more of the following limitations; limited geographical coverage, methodological approach; mostly used qualitative, over and above they did not consider the rate of inflation and GDP growth together on how they affect the rate of unemployment. Although similar studies were conducted (at international level) outside the national borders, such as, these studies are not related to the economic environment and policies of Tanzania [5]. Basing on the limitations from previous studies, we use dynamic ordinary least square to investigate the impact of economic growth and inflation on unemployment rate in Tanzania. The remainder of this paper is organized as follows; section two of this study provides a survey of similar studies, section three presents the methodology used in this study, section four of this paper shows analysis and discussion of findings. Finally, section five provides conclusion and policy recommendations [6].

Theoretical review

The theory centered on the relationship between unemployment and economic growth. According to Arthur Okun, there is a negative relationship between unemployment and economic growth in any given economy. He estimated Beta (β) coefficient to be approximately 0.3 by employing US real growth rate data for 55 quarter observations from 1947- quarter II to 1960-quarter IV. That is when actual output is larger than 1 per cent of the potential output, then the actual unemployment rate less than 0.3%. The theory argues that a percentage decrease in the unemployment rate leads to 3 percentage increase in economic growth. In addition, when economic growth rises by 1% may result in a 0.3% decrease in unemployment [7]. The theoretical investigation conducted by Okun based on the fact that any increase in the labour force must produce more goods and services. He found unemployment declined in years when the real growth rate of the economy was high and also the unemployment rate increase in year’s as the growth rate of the economy at constant prices is low (Figure 1) [8].

Empirical literature

The study of analysed the determinants of unemployment in Palestine over the period from 1994 to 2017. This study used the OLS method to investigate the relationship between unemployment with other variables such as GDP, inflation, labour force, external trade and restriction on the labour movement. The result found that all the variables are the main determinants of unemployment in Palestine, where GDP is significantly affecting unemployment with a negative relationship while inflation and all other variables are significant with respect to unemployment with a positive relationship [9]. In addition, the empirical study conducted by Oniore, focusing on macroeconomic determinants of unemployment in Nigeria using time series data and employing Error Correction Mechanism. This study estimated the long-run relationship using the Johansen cointegration test. The result indicate that GDP growth rate, inflation, openness as well as private domestic investment are statistically significant in influencing unemployment in the short run during the study period. And both inflation and GDP are negatively related to the unemployment rate [10].

Studied the relationship between unemployment and inflation in Nigeria for the period of 1980 to 2015. Unemployment rate was treated as the function of total government expenditure as a percentage of GDP, money supply percentage of GDP as well as the inflation rate. The study adopted VECM, Causality test as well as co-integration test. The result was found to have a significant relationship between unemployment and inflation rate in Nigeria over the study period. Also, a causal relationship was found among the variables in the model [11]. Hence recommends government to apply discretionary policy that would reduce unemployment in Nigeria through boosting government expenditure and maintaining stability of money supply. The study of examined the impact of unemployment and inflation on the Nigerian economy for the period of 1981 to 2015. Using the ARDL approach in establishing the long-run relationship they found that unemployment has an insignificant impact on economic growth. However, the negative relationship exists between them [12]. They recommended that the government should regenerate ailing industries as well as establish new ones so as to encourage enormous industrialization which will create more jobs for crowded graduates and reduce the unemployment rate in Nigeria. Similar study was conducted in Tanzania concluding that there is a positive relationship between unemployment and economic growth in Tanzania but insignificant influence over the study period [13].

Based on the empirical literatures cited above, most of the studies were focusing on how unemployment and inflation could have an impact on economic growth. They did not trigger directly on how the real growth rate of the economy and inflation impact the rate of unemployment of the respective economy. However some of the studies have tried to cover that, but still there is a need for conducting the study again in Tanzania due to the following reasons; first is the existence of controversies among the studies, as one study found the existence of the significant relationship, or positive relationship say between unemployment and inflation, other studies prove the other way round. Second, most of these studies were conducted outside Tanzania, as proposed by that “each economy must be viewed and analyzed independently” hence a researcher conducted the study following Tanzania context. And lastly, most of these studies used OLS while the variables used in the study are likely to be non-stationary, due to this OLS cannot provide accurate results. Therefore this study aimed at investigating the impact of economic growth and inflation on unemployment rate using a Dynamic OLS [14].

This study uses time series data to analyze the impact of economic growth and inflation on unemployment rate in Tanzania. The annual data for all three variables were sourced from the World Development Indicators (WDI) database for the period from 1991 to 2017. Annual unemployment rate is measured by a percentage of the labour force in a country that is out of work and is treated as a dependent variable. Annual real GDP rate measured in percentage is a proxy for Economic growth and annual percentage inflation rate is treated as independent variables in this study [15]. We apply a Dynamic Ordinary Least Square (DOLS) technique proposed by to estimate the long-run elasticities of parameters. This method was selected because it takes care of endogeneity bias and corrects the problem of autocorrelation by incorporating leads and lags of the first differenced regressors. The Ordinary Least Squares is considered a biased estimator and does not handle clearly endogeneity of regressors when there is cointegration. Based on this reason, DOLS is a more robust method and appropriate for small sample used in estimating the long-run coefficient of an integrated series of higher-order. The Dynamic OLS procedure which essentially involves regressing any I(1) variable on other I(1) variables with leads and lags of first differencing regressors of any I(1) variables [16].

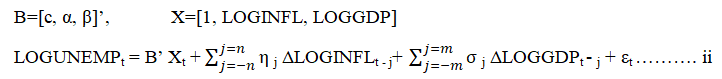

According to DOLS, the estimates model will be;

For t=1, 2…………….z

Model specification

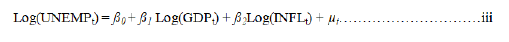

In order to empirically analyse the impact, the unemployment rate was identified by the researchers as the dependent variable while real GDP rate and Inflation was treated as explanatory variables. In order to estimate the model, the researcher applied double-log form as postulated by economic theories and also the results would be interpreted as elasticities. The following econometric model was specified [17].

Whereby;

Log (UNEMPt)=is natural logarithms of annual unemployment rate

Log (RGDPt)=is the natural logarithms of the annual real GDP rate

Log (INFLt)=is natural logarithms of annual inflation rate

μt=is the error term

t=(1, 2, 3 ……..n)

Descriptive statistics

The results in the table below portray the descriptive statistics of the variables. The Jarque-Bera statistics fail to reject the null hypothesis that the variables are normally distributed at 5% level. Therefore we can declare that all variables are normally distributed. In addition, the standard deviation shows small dispersion of the variables from the mean (Table 1) [18].

| Unemployment rate | Real GDP Growth | Inflation Rate | |

|---|---|---|---|

| Mean | 3.66937 | 5.382941 | 12.1565 |

| Median | 3.864 | 5.566596 | 7.870724 |

| Maximum | 5.1 | 8.464381 | 34.08336 |

| Minimum | 2.118 | 0.584322 | 4.735801 |

| Std. Dev. | 0.878696 | 2.216444 | 8.661941 |

| Skewness | -0.467567 | -0.640908 | 1.134606 |

| Kurtosis | 2.186396 | 2.451714 | 3.052369 |

| Jarque-Bera | 1.728482 | 2.186627 | 5.796077 |

| Probability | 0.421371 | 0.335104 | 0.055131 |

| Sum | 99.073 | 145.3394 | 328.2255 |

| Sum Sq Dev | 20.07477 | 127.7283 | 1950.76 |

| Observations | 29 | 29 | 29 |

Source: Author's computation

Tests for univariate integration

Since the estimation of time series data may produce a spurious regression. The authors had to test for unit root to verify to whether the data series is stationary or non-stationary. For that case, both Augmented Dickey-Fuller and Phillip-Perron unit root test were employed. The test results for each method were provided below. The test was performed by including trend and constant in a model.

The null hypothesis for each test is that the variable has a unit root (non-stationary). The results of all variables at their levels and first difference were as follows (Tables 2 and 3) [19].

| Level | First Difference | |||||

|---|---|---|---|---|---|---|

| Variables | T-Statistic | Critical Value 5% | Probability | T-Statistic | Critical Value 5% | Probability |

| Logunemp | -2.225 | -3.595 | 0.457 | -4.691 | -3.603 | 0.005 |

| Loggdp | -2.449 | -3.595 | 0.3482 | -9.77 | -3.603 | 0 |

| Loginfl | -1.743 | -3.595 | 0.7022 | -4.765 | -3.603 | 0.0042 |

Source: Author's Computation

| Level | First Difference | |||||

|---|---|---|---|---|---|---|

| Variables | T-Statistic | Critical Value 5% | Probability | T-Statistic | Critical Value 5% | Probability |

| Logunep | -2.225 | -3.595 | 0.457 | -4.691 | -3.603 | 0.005 |

| Loggdp | -2.449 | -3.595 | 0.3482 | -9.77 | -3.603 | 0 |

| Loginfl | -1.743 | -3.595 | 0.7022 | -4.765 | -3.603 | 0.0042 |

Source: Author's Computation

The test results presented above show that all the variables are non-stationary at level meaning we fail to reject the null hypothesis of having unit root at 5% level. However, after taking the first difference they became stationary. The probability value for Log (unemployment), Log (GDP), and Log (Inflation) were 0.005, 0.000 and 0.0042 respectively for both ADF and PP which are less than 5% level of significance, leading to the rejection of null hypothesis of a unit root and hence all the variables in the model are stationary after first difference [20].

Multivariate co-integration

Given that the variables share the common integration properties, the researcher then proceeded to test for the presence of cointegration by using Johansen and Juselius Maximum Likelihood procedure. Before estimation, the researcher obtained the optimal lag length to be included in the test. The number of Information Criterion (IC) employed, including the Final Prediction Error (FPE), the Akaike Information Criterion (AIC), the sequential modified Likelihood Ratio (LR) test, the Bayesian Information Criterion (BIC), and the Hannan-Quinn Information Criterion (HQ). All of these criteria select one lag (Table 4) [21].

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | -12.05151 | NA | 0.000743 | 1.308827 | 1.456935 | 1.346075 |

| 1 | 19.71500 | 52.48380* | 0.000104* | 0.670870* | -0.078438* | 0.521875* |

| 2 | 24.57569 | 6.762700 | 0.000156 | -0.31093 | 0.725826 | -0.050189 |

| 3 | 30.65160 | 6.868411 | 0.000228 | -0.056661 | 1.424419 | 0.315827 |

| 4 | 41.00358 | 9.001729 | 0.000265 | -0.174225 | 1.751178 | 0.310009 |

Note: * Indicates lag order selected by the criterion; LR: sequential modified LR test statistic (each test at 5% level); FPE: Final prediction error; AIC: Akaike information criterion; SC: Schwarz information criterion; HQ: Hannan-Quinn information criterion

Still, in order to make sure that appropriate lags with significant information content were not excluded from the VAR, various diagnostic tests were performed in the VAR system. First, we used AIC because it performs better with small samples to compare the value of AIC in the total VAR system and select the lag which has smallest AIC in total VAR system of which was found to be lag 2. Second, the residue was not normally distributed at lag 1; hence employing lag 2 the residue became normally distributed. It is also suggested by that “with annual data, the number of lags is typically small, 1 or 2 lags in order not to lose degrees of freedom”. Hence lag 2 was selected and used in testing for co-integration. Results for Johansen and Juselius's multivariate co-integration with Trace statistic and the Maximum Eigen statistic were presented below. The results show presence of at most a single co-integrating vector among the set of the variables in the study. This was concluded due to the evidence that the null hypothesis of no co-integrating vector (r=0), by both tests, was rejected at the 95% critical values (Table 5) [22].

| Hypothesized No. of CE(s) | Trace | Maximum Eigen Value | ||||

|---|---|---|---|---|---|---|

| Trace Statistic | Critical Value | Prob. | Statistic | Critical Value | Prob. | |

| None * | 36.18911* | 29.79707 | 0.0080* | 29.05156* | 21.13162 | 0.0031* |

| At most 1 | 7.137552 | 15.49471 | 0.5617 | 6.652082 | 14.2646 | 0.5311 |

| At most 2 | 0.48547 | 3.841466 | 0.486 | 0.48547 | 3.841466 | 0.486 |

Source: Author’s Computation

Note: Trace test and Max-Eigen value test t indicates 1 cointegrating eqn (s) at the 0.05 level and Where; * denotes rejection of the hypothesis at the 0.05 level

The results presented above show that trace statistics and maximum Eigen-value statistics are greater than critical values at (r=0). Thus, we reject the null hypothesis of no cointegration relationship among the variables and concluding that all variables unemployment, real GDP and inflation are cointegrated. Since the cointegration exists among the variables, then the long-run equilibrium exists between the variables. The Dynamic OLS technique was employed to estimate the long-run coefficients of an integrated series [23].

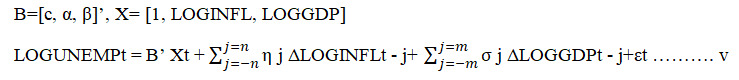

Long-run Elasticities Dynamic OLS: Given that the variables are co-integrated, we apply the Dynamic Ordinary Least Square (DOLS) technique proposed by to carry out long-run elasticity. The model was estimated by including up to j variables= ±3 leads and lags of the first differenced regressors as shown below;

The equation in (v) above is the specification for DOLS, where n and m stands for the lengths of leads and lags of the regressors, and εt is the error term assumed to be white-noise and normally distributed. LOG stand for natural logarithms and c, α, β are the longrun coefficient estimates. The results indicated that, both the inflation rate and real GDP (Economic Growth) significantly influence the unemployment rate in Tanzania. Interestingly, despite being significant their sign underlie to what has been suggested in economic theories and. The results for DOLS with all variables appearing in levels are shown below (Table 6) [24].

| Variable | Coefficient | Std. Error | TStatistic | Prob |

|---|---|---|---|---|

| Constant | 6.257601 | 1.747504 | 3.58088 | 0.0116 |

| LOGINFL | -0.937457 | 0.422138 | -2.220739 | 0.0681** |

| LOGGDP | -1.656075 | 0.530248 | -3.123206 | 0.0205* |

| R-squared | 0.790531 | |||

| Adjusted R-squared | 0.301769 | |||

| Durbin-Watson stat | 1.975204 | |||

Source: Authors Computation

Notes: * and ** Indicate significance at 5% and 10% per cent level respectively.

The analysis from the above table indicate that, a one per cent increase in the inflation rate, unemployment will fall by 0.937457 per cent keeping other variable(s) constant. Conferring to Phillips, when the inflation rate is high is due to increased aggregate demand, therefore firms need to increase production and therefore more employment will be available. Therefore the same case observed in Tanzania such that unemployment rate decreases with the increasing rate of inflation. Hence, in the long-run the Phillips curve hold in Tanzania. The estimated coefficient of GDP is also in line with the economic theory of, that is in Tanzania, a 1% per cent increase in real GDP will lead to 1.656075 percentage decrease in unemployment rate keeping other factors constant. Illustrating that, in the long-run, the Okun theory holds in Tanzania [25].

Model stability and diagnostic tests

The stability of the model is necessary for prediction as well as econometric inferences. This is because a parametric econometric model is entirely described by its parameters, hence model stability is equivalent to parameter stability. Also, the estimated parameters of the time series may possibly vary over time, therefore, it is important to conduct parameters stability test as model misspecification may arise due to unstable parameters. Model instability also makes it difficult to interpret the regression results. The Hansen parameter stability test results for longrun relationship between the unemployment rate, inflation and real GDP are presented below (Table 7).

| Stochastic | Deterministic | Excluded | ||

|---|---|---|---|---|

| Lc statistic | Trends (m) | Trends (k) | Trends (p2) | Prob.* |

| 0.045926 | 2 | 0 | 0 | > 0.2 |

Source: Author's Computation

*Hansen (1992b) Lc (m2=2, k=0) p-values, where m2=m-p2 is the number of stochastic trends in the asymptotic distribution Cointegration Test - Hansen Parameter Instability.

The results indicate that the test statistic is insignificant at all conventional significance level; therefore, there is no enough evidence to reject the null hypothesis of stability in the model. Hence parameters are stable in the long-run equation. Other model diagnostic tests were carried out and the results are indicated in the tables below for normality assumptions of the residue using Jarque-Bera and multicollinearity using Variance Inflation Factor (VIF) respectively. The results shows that, the residue was normally distributed since the probability value for JB is 0.5 which is greater than 0.05 level of significant leading to failure to reject the null hypothesis and concluding that residue are normally distributed (Figure 2).

Moreover, the test for multicollinearity in the model was carried out and the result shows that there is no multicollinearity since the centred VIF is less than 5. Also, the model has no autocorrelation problem using the Durbin-Watson statistic (Table 8).

| Variable | Coefficient Variance | Uncentered VIF | Centered VIF |

|---|---|---|---|

| LOGINFL | 0.178200 | 349.1856 | 2.906002 |

| LOGGDP | 0.281163 | 508.0109 | 2.906002 |

| C | 3.053769 | 1529.789 | NA |

Source: Author's Computation

Correspondingly, given the basic assumption of stationary time series, that is white noise stochastic process, the error term of the model must be normally distributed with mean zero and variance (σ2) (Figure 3).

The residue is white noise, with zero mean and constant variance as shown below.

The objective of the study was to investigate the impact of economic growth and inflation on unemployment rate in Tanzania. In order to model the impact of economic growth on inflation and unemployment, we apply a dynamic ordinary least square. This modelling approach provided by the most recent developments in the econometric time-series literature were adopted in estimating the long-run relationship between unemployment rate, inflation rate and real GDP of Tanzania economy. From the empirical analysis, the result indicated that the long-run real GDP coefficient is -1.656 and that of the inflation rate is -0.937 with the expected signs accentuated by the theories, both being statistically significant at 5% level and 10% respectively. Meaning, the real GDP and inflation rate both are statistically significant in influencing unemployment in the long run particularly under the period consideration.

This study investigates the impact of economic growth and inflation on unemployment rate in Tanzania. The Dynamic Ordinary Least Square (DOLS) technique to analyse the relationship of unemployment and economic growth were used. The results from the empirical analysis found that there is significant negative long-run relationship between economic growth and inflation with respect to unemployment rate. Thus, both the real Gross Domestic Product and inflation rate are statistically significant in influencing unemployment rate in the long-run. The long-run estimates of both economic growth and inflation elasticity found to be significant and influence unemployment in Tanzania. These results are supported by economic theories, showing that the unemployment rate is negatively related to inflation and economic growth. This might be due to strong industrialization policy undertaken in the country on sectorial reforms, Infrastructures developments as well as Revenue collection reforms which are believed to create more employment opportunities in the long-run.

[Crossref] [Indexing In].

[Crossref] [Google Scholar].

[Google Scholar] .